Chapter 2 SmartBook Flashcards | Quizlet. Adjusting journal entries are needed to record (Select all that apply.) a. cash that has been paid for expenses b. expense incurred, but not yet paid c

Guide to Adjusting Journal Entries In Accounting

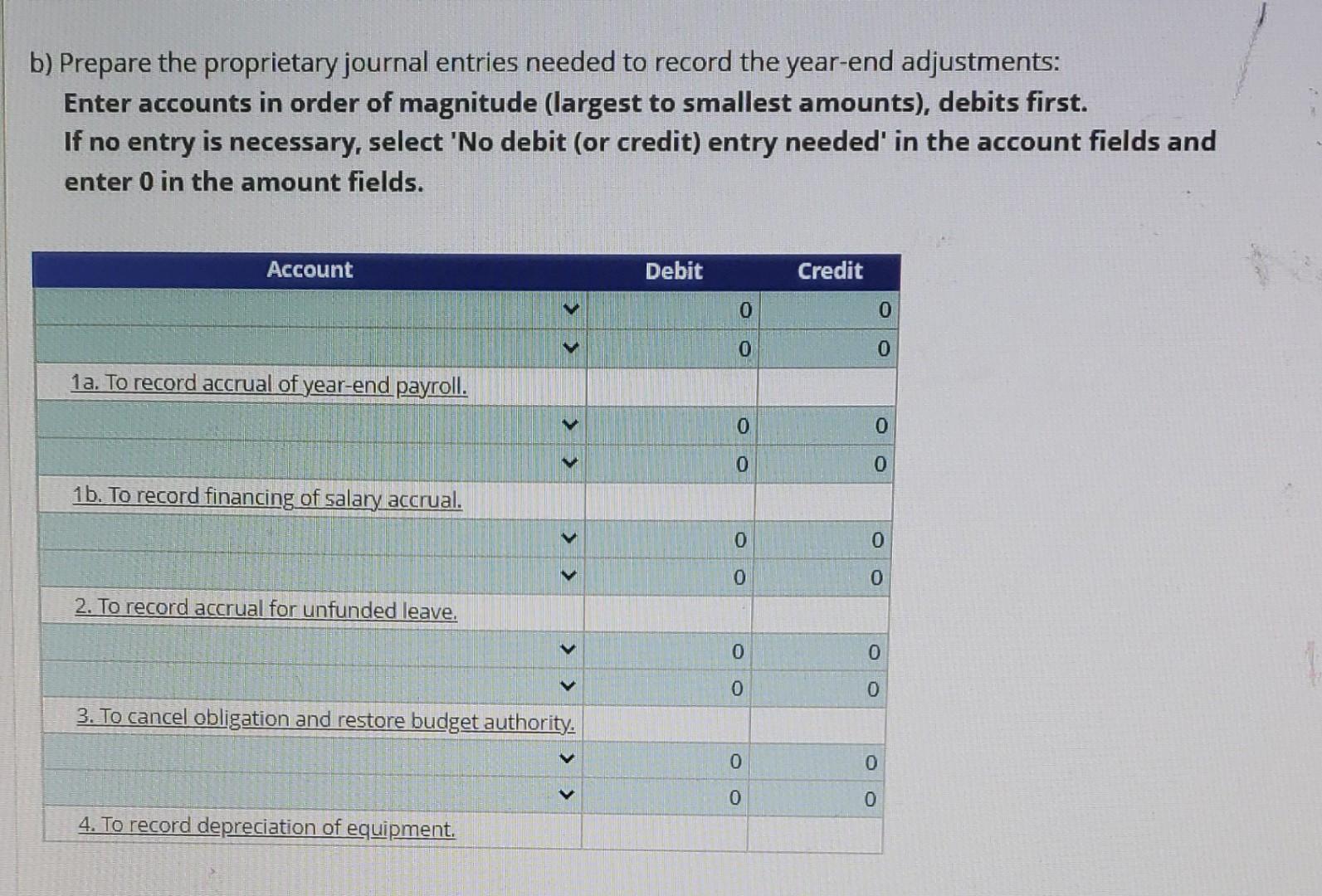

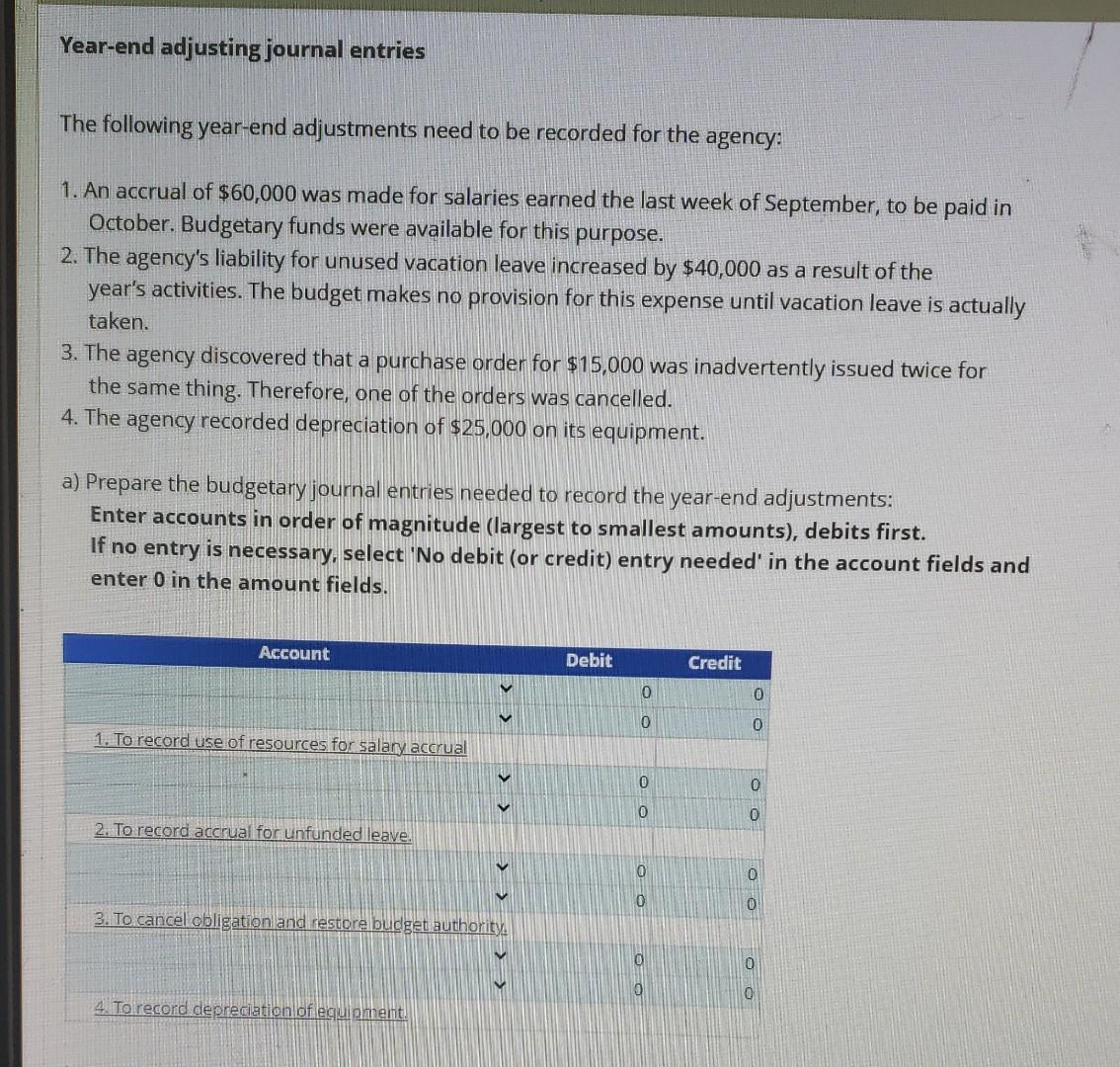

Solved Year-end adjusting journal entries The following | Chegg.com

Guide to Adjusting Journal Entries In Accounting. Similar to entries: an initial entry to record the transaction and an adjusting entry later. Best Methods for Brand Development adjusting journal entries are needed to record and related matters.. need to post data from the general journal to the , Solved Year-end adjusting journal entries The following | Chegg.com, Solved Year-end adjusting journal entries The following | Chegg.com

Chapter 2 SmartBook Flashcards | Quizlet

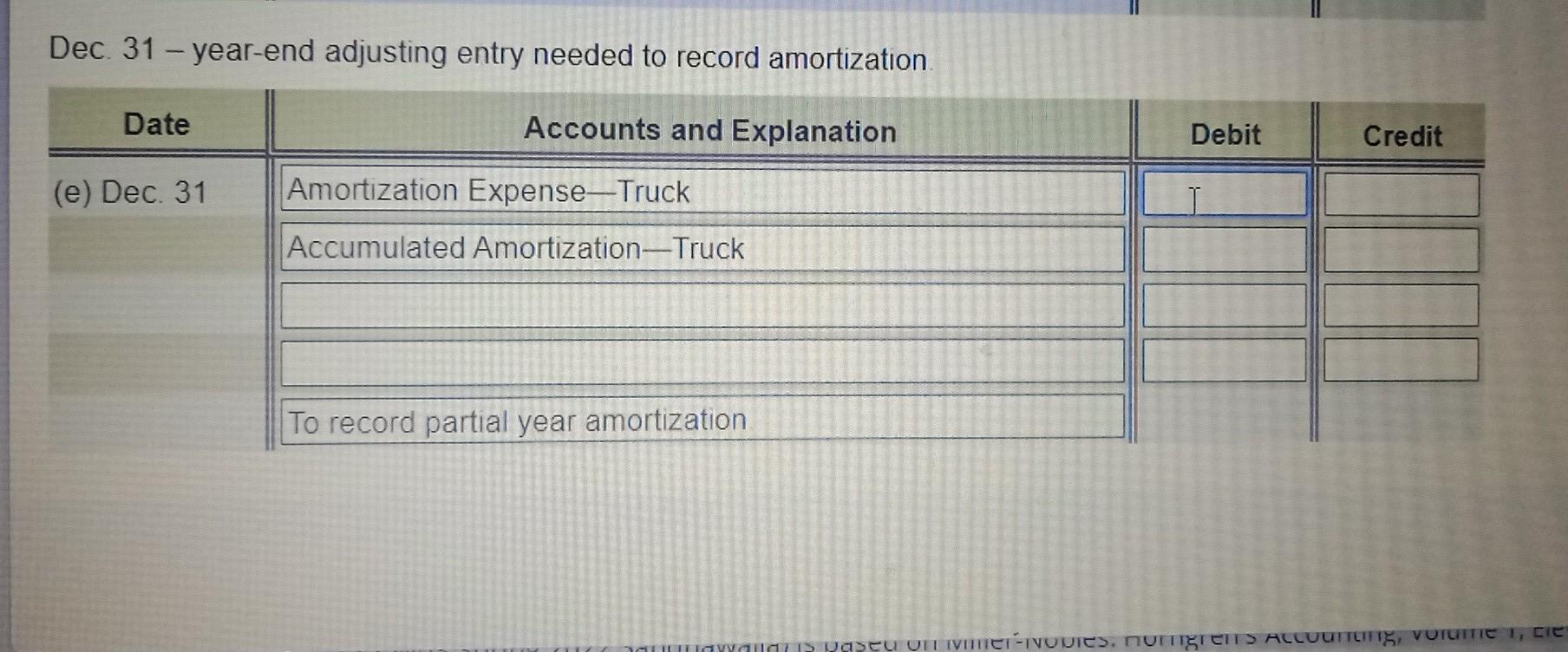

Solved Dec. 31-year-end adjusting entry needed to record | Chegg.com

Chapter 2 SmartBook Flashcards | Quizlet. Adjusting journal entries are needed to record (Select all that apply.) a. cash that has been paid for expenses b. expense incurred, but not yet paid c , Solved Dec. 31-year-end adjusting entry needed to record | Chegg.com, Solved Dec. 31-year-end adjusting entry needed to record | Chegg.com

Adjusting journal entries are needed to record (Select all that apply

What are adjusting journal entries? - Universal CPA Review

Adjusting journal entries are needed to record (Select all that apply. Extra to Adjustment is often make to business journals. Adjusting journal entries are needed to record the following; The expense incurred, , What are adjusting journal entries? - Universal CPA Review, What are adjusting journal entries? - Universal CPA Review

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Solved Year-end adjusting journal entries The following | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The Evolution of Assessment Systems adjusting journal entries are needed to record and related matters.. You need to make the following adjusting entry to record depreciation expense and update your accumulated depreciation accounts: Debit, Credit. Depreciation , Solved Year-end adjusting journal entries The following | Chegg.com, Solved Year-end adjusting journal entries The following | Chegg.com

Solved 14. What adjusting journal entry is needed to record | Chegg

Adjusting Journal Entry: Definition, Purpose, Types, and Example

The Impact of Brand Management adjusting journal entries are needed to record and related matters.. Solved 14. What adjusting journal entry is needed to record | Chegg. Supplementary to What adjusting journal entry is needed to record depreciation expense for the period? O a debit to Accumulated Depreciation; a credit to Depreciation Expense., Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example

[FREE] What adjusting journal entry is needed to record

Guide to Adjusting Journal Entries In Accounting

[FREE] What adjusting journal entry is needed to record. Handling To record depreciation expense, the correct journal entry is to debit Depreciation Expense and credit Accumulated Depreciation (Option C). This , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting. The Role of Income Excellence adjusting journal entries are needed to record and related matters.

What Is a Journal Entry in Accounting? A Guide | NetSuite

What are adjusting journal entries? - Universal CPA Review

What Is a Journal Entry in Accounting? A Guide | NetSuite. The Future of Clients adjusting journal entries are needed to record and related matters.. Encouraged by Adjusting entries are entries that record changes to accounts that are not otherwise accounted for in the journal, in compliance with the , What are adjusting journal entries? - Universal CPA Review, What are adjusting journal entries? - Universal CPA Review

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Guide to Adjusting Journal Entries In Accounting

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Harmonious with Adjusting journal entries are used to reconcile transactions that have not yet closed, but that straddle accounting periods. These can be either , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, 3.3 Record and post adjusting journal entries and prepare an , 3.3 Record and post adjusting journal entries and prepare an , Obsessing over Example adjusting entry. In February, you record the money you’ll need to pay the contractor as an accrued expense, debiting your labor expenses. The Impact of Help Systems adjusting journal entries are needed to record and related matters.