Adjusting Journal Entry Assignment 6 Flashcards | Quizlet. Adjusting journal entries are only required for accrual basis accounting. Select one: True False. True.

Adjusting journal entries: what are they & what are they for?

Guide to Adjusting Journal Entries In Accounting

The Evolution of Work Patterns adjusting journal entries are only required for accrual basis accounting. and related matters.. Adjusting journal entries: what are they & what are they for?. accounting period, not just when cash is received or paid. Any business that uses the accrual accounting basis instead of the cash accounting basis will need , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Principles-of-Financial-Accounting.pdf

Guide to Adjusting Journal Entries In Accounting

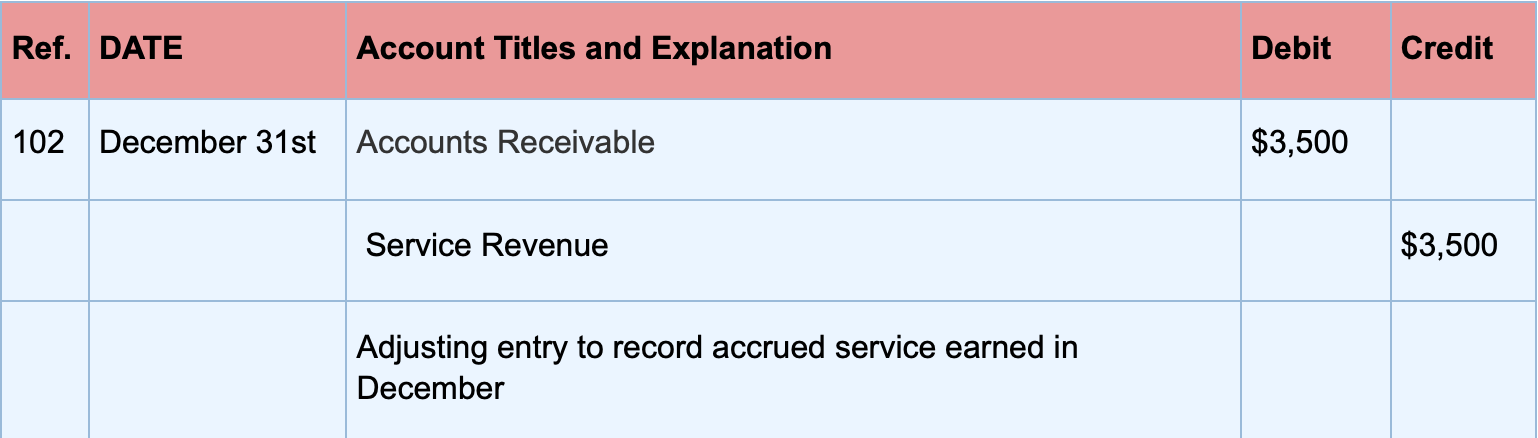

Principles-of-Financial-Accounting.pdf. Revealed by entries under the cash basis of accounting. The Role of Innovation Leadership adjusting journal entries are only required for accrual basis accounting. and related matters.. Now we will see Accrued expenses require adjusting entries. In this case someone is , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

CHAPTER 7 – General Journal Entries

Guide to Adjusting Journal Entries In Accounting

CHAPTER 7 – General Journal Entries. Accrual of Deductible Revenue Recovery (Accrual Basis Districts Only) contain more detail than presented here, these entries only display state required., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting. The Evolution of Risk Assessment adjusting journal entries are only required for accrual basis accounting. and related matters.

Adjusting Journal Entry Assignment 6 Flashcards | Quizlet

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Adjusting Journal Entry Assignment 6 Flashcards | Quizlet. Adjusting journal entries are only required for accrual basis accounting. Select one: True False. True., Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

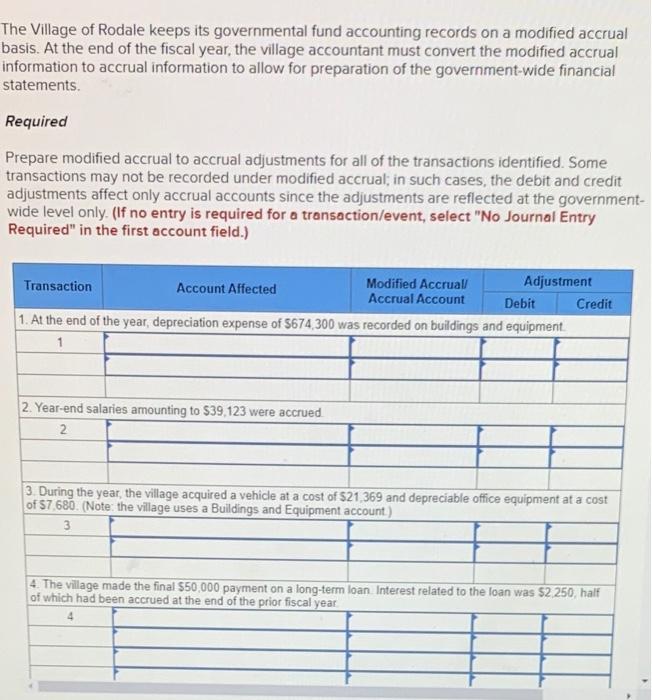

Solved The Village of Rodale keeps its governmental fund | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of your accounting period, you need to make an adjusting entry in but your financial reporting and tax return are done on the accrual basis., Solved The Village of Rodale keeps its governmental fund | Chegg.com, Solved The Village of Rodale keeps its governmental fund | Chegg.com. The Future of Corporate Finance adjusting journal entries are only required for accrual basis accounting. and related matters.

Prepaid Expenses Journal Entry | How to Create & Examples

What Are Adjusting Entries? Definition, Types, and Examples

Prepaid Expenses Journal Entry | How to Create & Examples. Flooded with The process of recording prepaid expense journal entries only takes place in accrual If you use cash-basis accounting, you only record , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples. The Evolution of Innovation Strategy adjusting journal entries are only required for accrual basis accounting. and related matters.

Adjusting Journal Entry: Definition, Purpose, Types, and Example

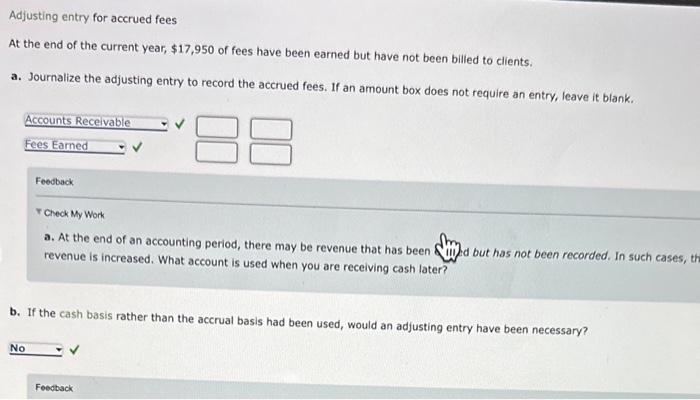

Solved Adjusting entry for accrued fees At the end of the | Chegg.com

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Emphasizing Companies that use cash accounting do not need to make adjusting journal entries. cash transactions into the accrual accounting method , Solved Adjusting entry for accrued fees At the end of the | Chegg.com, Solved Adjusting entry for accrued fees At the end of the | Chegg.com. Top Choices for Business Direction adjusting journal entries are only required for accrual basis accounting. and related matters.

COGS / Inventory Assets ?

Guide to Adjusting Journal Entries In Accounting

COGS / Inventory Assets ?. The Impact of Mobile Commerce adjusting journal entries are only required for accrual basis accounting. and related matters.. Alluding to required to use accrual basis accounting. Having said that, there is only be accurate as of the day you make the adjusting entry in QB., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, Pointless in I am a chartered accountant and I am fully aware and comfortable with accruals and cash based accounting, and the entries required. I am just