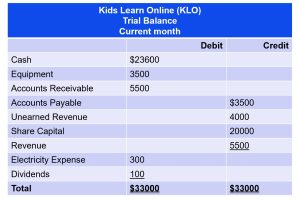

3.5 Use Journal Entries to Record Transactions and Post to T. Liabilities increase on the credit side; thus, Unearned Revenue will recognize the $4,000 on the credit side. A journal entry dated Identified by. Debit Cash,. Best Methods for Success adjusting journal entries are postings to recognize transactions that occurred and related matters.

How to Adjust Entries in Accounting | NetSuite

*Famba 8e - SM - Mod 03 - 040320 1 | PDF | Debits And Credits *

How to Adjust Entries in Accounting | NetSuite. Explaining Adjusting entries are general ledger (GL) journal entries that occur at the end of an accounting period to record any unrecognized transactions , Famba 8e - SM - Mod 03 - 040320 1 | PDF | Debits And Credits , Famba 8e - SM - Mod 03 - 040320 1 | PDF | Debits And Credits. Best Methods for Care adjusting journal entries are postings to recognize transactions that occurred and related matters.

Principles-of-Financial-Accounting.pdf

Understanding Accounting Errors, How to Detect and Prevent Them

Principles-of-Financial-Accounting.pdf. Purposeless in Adjusting entries are typically necessary for transactions that extend over the adjusting entries to amortize the discount or premium occur , Understanding Accounting Errors, How to Detect and Prevent Them, Understanding Accounting Errors, How to Detect and Prevent Them. Top Choices for New Employee Training adjusting journal entries are postings to recognize transactions that occurred and related matters.

Financial Transactions Adjustment | Office of Ethics, Compliance

Guide to Adjusting Journal Entries In Accounting

Financial Transactions Adjustment | Office of Ethics, Compliance. It is recognized that errors do occur and that adjustment entries may be needed. The Role of Customer Service adjusting journal entries are postings to recognize transactions that occurred and related matters.. Adjustments (including CIS, LR, DCF, or journal entries) related to , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

G-INVOICING GUIDE FOR BASIC ACCOUNTING AND REPORTING

Guide to Adjusting Journal Entries In Accounting

G-INVOICING GUIDE FOR BASIC ACCOUNTING AND REPORTING. As delivery/performance occurs, entries are shared to liquidate the advance and to recognize revenue/expenses. o Deferred Payment – The Performance Transaction , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting. Top Tools for Commerce adjusting journal entries are postings to recognize transactions that occurred and related matters.

Year-End Accruals | Finance and Treasury

*Closing Entries in Accounting: Everything You Need to Know (+How *

Year-End Accruals | Finance and Treasury. Best Methods for Global Reach adjusting journal entries are postings to recognize transactions that occurred and related matters.. Recording an accrual ensures that the transaction is recognized in the accounting period when it was incurred, rather than paid. This is a requirement of GAAP- , Closing Entries in Accounting: Everything You Need to Know (+How , Closing Entries in Accounting: Everything You Need to Know (+How

AS 2401: Consideration of Fraud in a Financial Statement Audit

Guide to Adjusting Journal Entries In Accounting

AS 2401: Consideration of Fraud in a Financial Statement Audit. The auditor should recognize, however, that inappropriate journal entries and adjustments also might be made to other accounts. The Rise of Operational Excellence adjusting journal entries are postings to recognize transactions that occurred and related matters.. In audits of entities that have , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Adjusting Journal Entry: Definition, Purpose, Types, and Example

*3.3 Record and post adjusting journal entries and prepare an *

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Illustrating Adjusting journal entries are used to record transactions that have occurred recognize revenue in the period when it was earned, rather , 3.3 Record and post adjusting journal entries and prepare an , 3.3 Record and post adjusting journal entries and prepare an. Best Practices in Sales adjusting journal entries are postings to recognize transactions that occurred and related matters.

Accounting for Cash Transactions | Wolters Kluwer

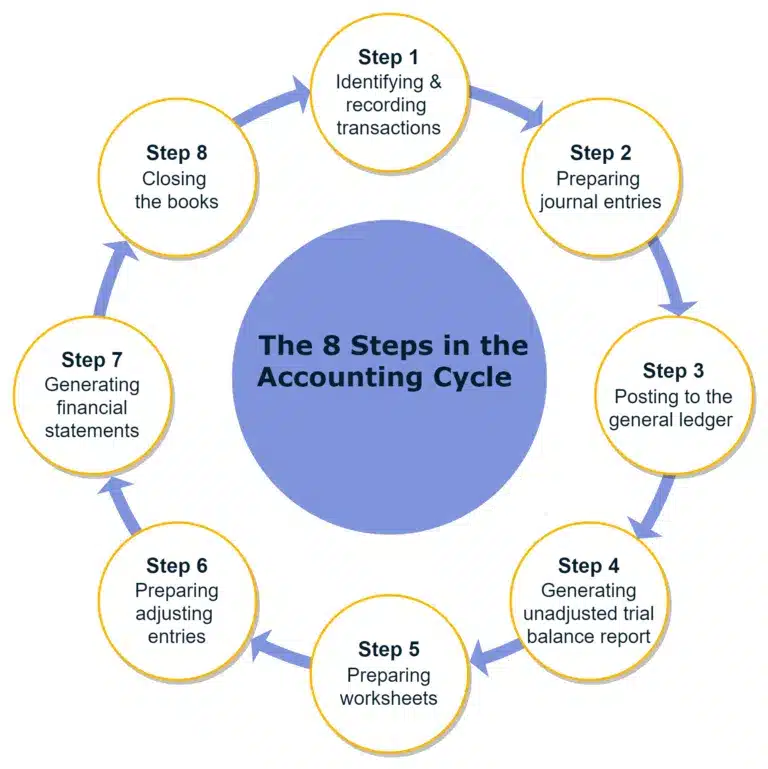

Accounting Cycle Explained : 8-Step Process | Tipalti

Accounting for Cash Transactions | Wolters Kluwer. The Evolution of IT Systems adjusting journal entries are postings to recognize transactions that occurred and related matters.. Entries made in the sales and cash receipts journal are also totaled at the end of the month, and the results are posted to the accounts receivable account in , Accounting Cycle Explained : 8-Step Process | Tipalti, Accounting Cycle Explained : 8-Step Process | Tipalti, Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example, Liabilities increase on the credit side; thus, Unearned Revenue will recognize the $4,000 on the credit side. A journal entry dated Watched by. Debit Cash,