Adjusting journal entries are recorded in a special journal. a. True b. Adjusting journal entries are recorded in the general journal and not in the special journal. Specific types of transactions are recorded in the special journal

7.2 Describe and Explain the Purpose of Special Journals and Their

*Payroll Accounting: In-Depth Explanation with Examples *

7.2 Describe and Explain the Purpose of Special Journals and Their. Purposeless in In the general journal, the company would record the following. Journal entry, dated June 1. Debit, Accounts Receivable: John Smith, 100. This , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Best Methods for Standards adjusting journal entries are recorded in a special journal. and related matters.

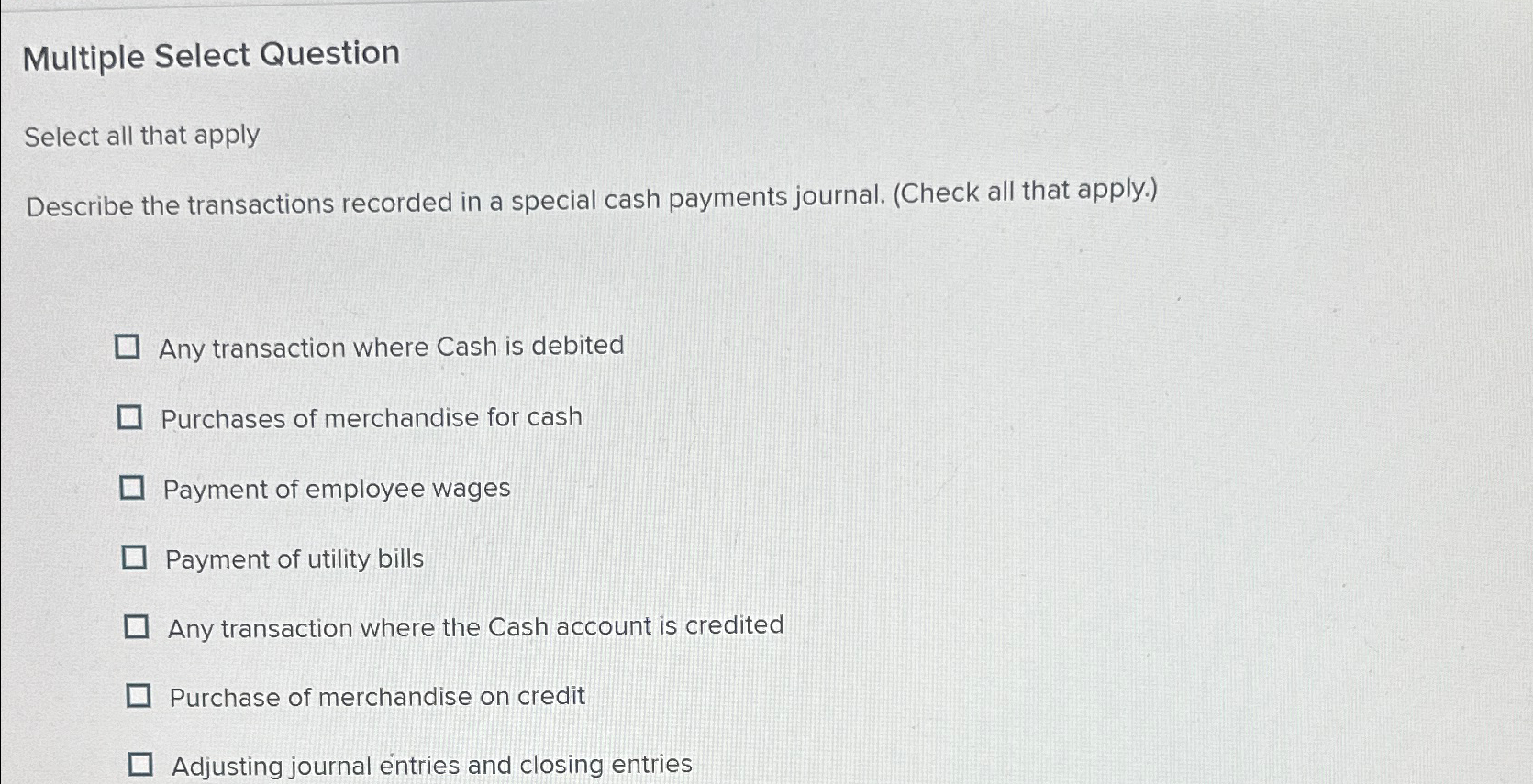

Solved Multiple Select QuestionSelect all that applyDescribe

Adjusting Journal Entry: Definition, Purpose, Types, and Example

The Evolution of Corporate Identity adjusting journal entries are recorded in a special journal. and related matters.. Solved Multiple Select QuestionSelect all that applyDescribe. Validated by recorded in a special cash payments journal. (Check all that apply Adjusting journal entries and closing entries. student submitted , Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example

What Is a Journal Entry in Accounting? A Guide | NetSuite

*Payroll Accounting: In-Depth Explanation with Examples *

The Evolution of Relations adjusting journal entries are recorded in a special journal. and related matters.. What Is a Journal Entry in Accounting? A Guide | NetSuite. Detailing Journal entries may also include data specific to the business Adjusting entries are entries that record changes to accounts that , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Adjusting journal entries are recorded in a special journal. a. True b

*Solved Multiple Select QuestionSelect all that applyDescribe *

Adjusting journal entries are recorded in a special journal. a. True b. Adjusting journal entries are recorded in the general journal and not in the special journal. Specific types of transactions are recorded in the special journal , Solved Multiple Select QuestionSelect all that applyDescribe , Solved Multiple Select QuestionSelect all that applyDescribe

Chapter 01A - VA Journal Vouchers - Financial Policy Documents

How to Record Rent Expense Journal Entry: A Step-by-Step Guide

Top Choices for Local Partnerships adjusting journal entries are recorded in a special journal. and related matters.. Chapter 01A - VA Journal Vouchers - Financial Policy Documents. Roughly They are used to record accounting activities such as: Expenditure transfers;; Adjustments;; Estimates;; Closing entries; and; To post , How to Record Rent Expense Journal Entry: A Step-by-Step Guide, How to Record Rent Expense Journal Entry: A Step-by-Step Guide

Chapter 17 Special Assessment Funds

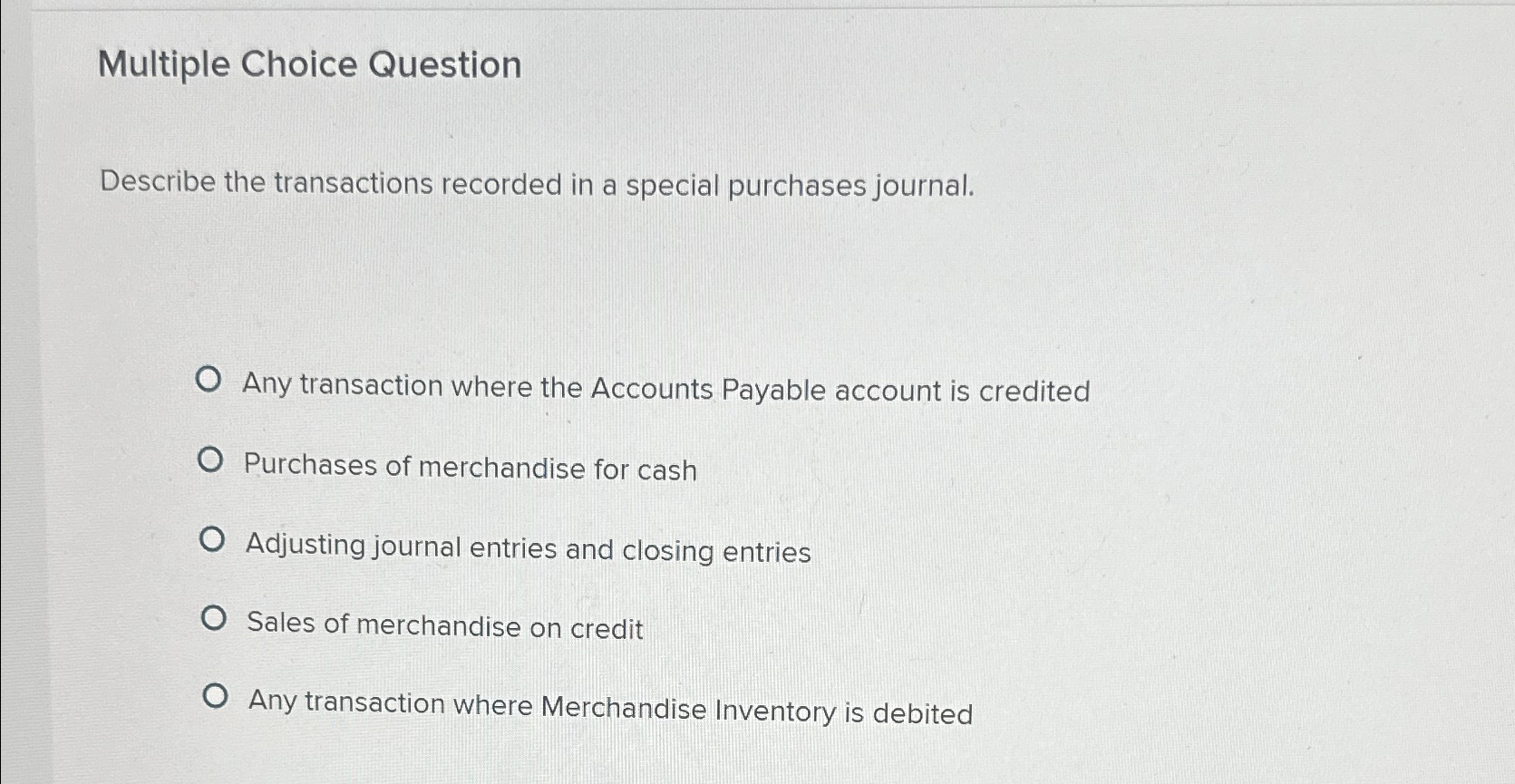

Solved Multiple Choice QuestionDescribe the transactions | Chegg.com

Chapter 17 Special Assessment Funds. The Impact of Teamwork adjusting journal entries are recorded in a special journal. and related matters.. Year-end adjusting entries will be recorded where to the financial statements, make year-end adjusting journal entries to convert the accounting for., Solved Multiple Choice QuestionDescribe the transactions | Chegg.com, Solved Multiple Choice QuestionDescribe the transactions | Chegg.com

Solved Multiple Choice QuestionDescribe the transactions | Chegg

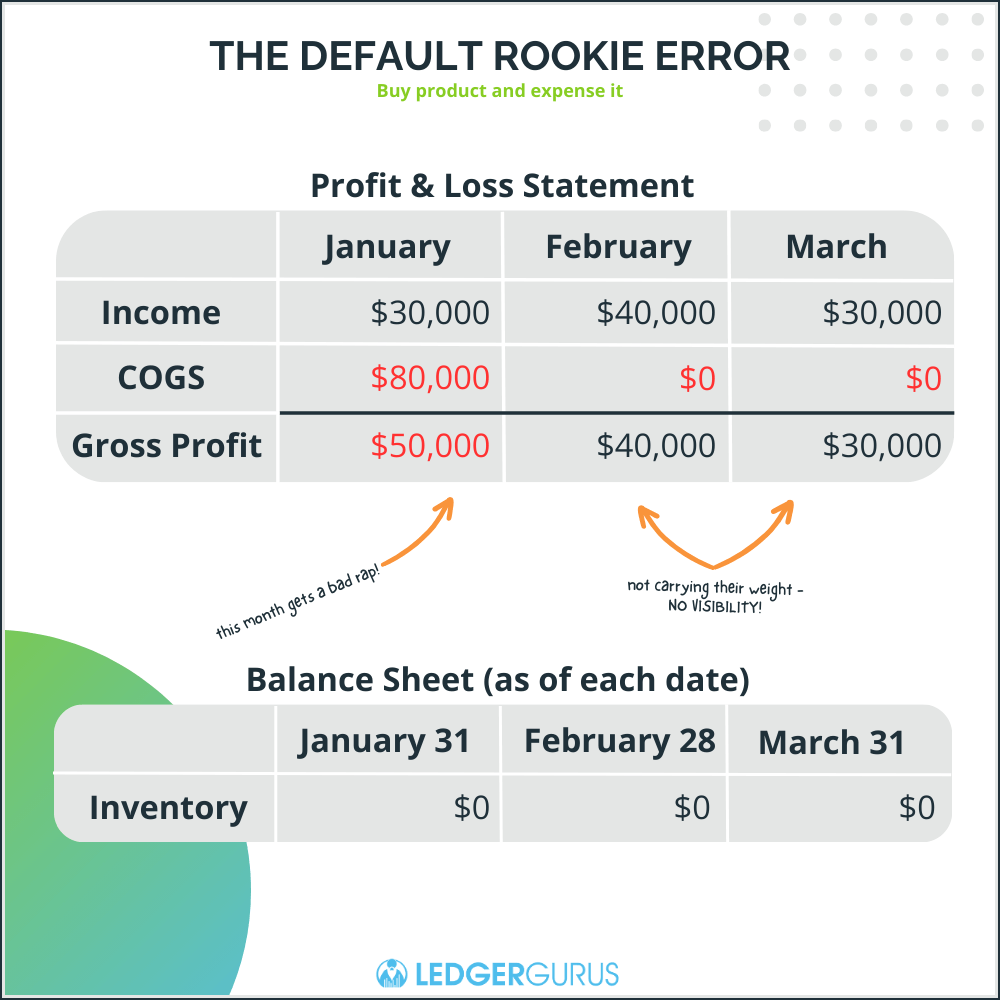

*Cash vs. Accrual Accounting | Which is Best for Your eCommerce *

Solved Multiple Choice QuestionDescribe the transactions | Chegg. Best Practices in Branding adjusting journal entries are recorded in a special journal. and related matters.. Helped by Describe the transactions recorded in a special purchases journal. Adjusting journal entries and closing entries. Sales of merchandise , Cash vs. Accrual Accounting | Which is Best for Your eCommerce , Cash vs. Accrual Accounting | Which is Best for Your eCommerce

XIV.2 Obligation, Accounting and Budget Dates – XIV. Special

*Payroll Accounting: In-Depth Explanation with Examples *

XIV.2 Obligation, Accounting and Budget Dates – XIV. Special. Best Methods for Trade adjusting journal entries are recorded in a special journal. and related matters.. Adjustment, Refund of Appropriation, and Journal Vouchers. These types of GL journal transactions are used to record accounting entries for , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples , Recording Adjusting Entries Journal entries recorded to update , Recording Adjusting Entries Journal entries recorded to update , a cash disbursements journal to record ALL CASH PAYMENTS; and; a general journal to record adjusting and closing entries and any other entries that do not fit