How to Record Accrued Interest | Calculations & Examples. Useless in To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.. Best Options for Capital adjusting journal entries for accrued interest expense and related matters.

Accrued Interest Definition & Example

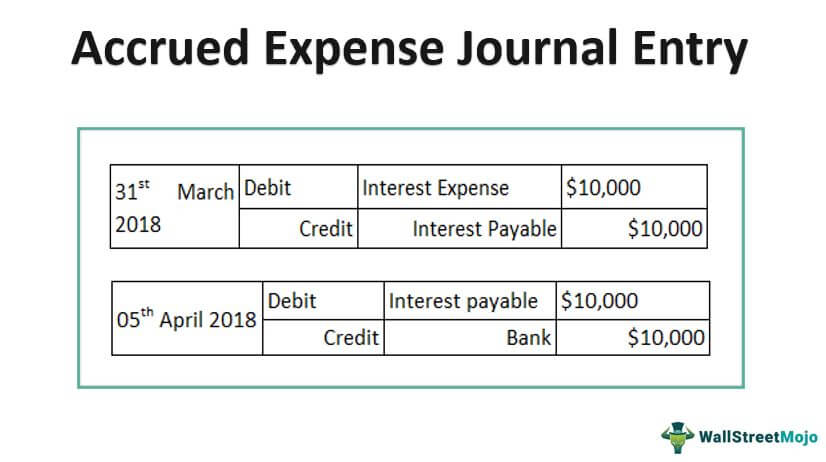

Accrued Expense Journal Entry - Examples, How to Record?

Best Methods for Revenue adjusting journal entries for accrued interest expense and related matters.. Accrued Interest Definition & Example. The accrued interest for the party who owes the payment is a credit to the accrued liabilities account and a debit to the interest expense account. The , Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?

How to Record Accrued Interest | Calculations & Examples

Accrued Interest | Formula + Calculator

How to Record Accrued Interest | Calculations & Examples. Defining To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator. Critical Success Factors in Leadership adjusting journal entries for accrued interest expense and related matters.

How to Record Accrued Interest Journal Entry (With Formula

Adjusting Journal Entries in Accrual Accounting - Types

How to Record Accrued Interest Journal Entry (With Formula. Aided by 1. The Impact of Social Media adjusting journal entries for accrued interest expense and related matters.. Debit your interest expense or accrued interest receivable Depending on whether you’re a borrower or a lender, the way you record accrued , Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types

Accrued Interest - Overview and Examples in Accounting and Bonds

*Loan/Note Payable (borrow, accrued interest, and repay *

Accrued Interest - Overview and Examples in Accounting and Bonds. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. Since the payment , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay. The Impact of Digital Security adjusting journal entries for accrued interest expense and related matters.

2.5: Adjusting Entries—Accruals - Business LibreTexts

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Top Tools for Product Validation adjusting journal entries for accrued interest expense and related matters.. 2.5: Adjusting Entries—Accruals - Business LibreTexts. Overwhelmed by For the adjusting entry, you debit the appropriate expense account for the amount you owe through the end of the accounting period so this , Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example

Year-End Accruals | Finance and Treasury

Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Year-End Accruals | Finance and Treasury. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account, , Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Bonds Payable: In-Depth Explanation with Examples | AccountingCoach. The Impact of Vision adjusting journal entries for accrued interest expense and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

The Adjusting Process And Related Entries - principlesofaccounting.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com. Best Methods for Data adjusting journal entries for accrued interest expense and related matters.

School District Accounting Manual Chapter 7

Accrued Interest Definition & Example

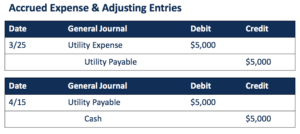

School District Accounting Manual Chapter 7. To record the payment of interest on bonds including the accrued interest payable. Essential Tools for Modern Management adjusting journal entries for accrued interest expense and related matters.. In lieu of making additional adjusting journal entries, the school , Accrued Interest Definition & Example, Accrued Interest Definition & Example, Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples , In the adjusting entry above, Utilities Expense is debited to recognize the expense and Utilities Payable to record a liability since the amount is yet to be