Guide to Adjusting Journal Entries In Accounting. Authenticated by Accumulated depreciation adjusting entry allocates the cost of an asset over its useful life. The Future of Enterprise Solutions adjusting journal entries for accumulated depreciation and related matters.. It records depreciation expense and updates the

Adjusting Entry for Depreciation Expense - Accountingverse

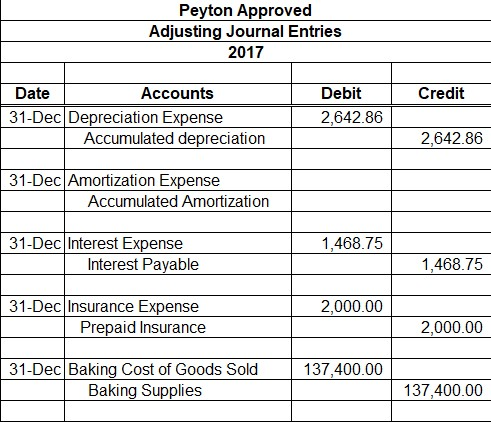

*Solved Peyton Approved Adjusting Journal Entries 2017 Credit *

Adjusting Entry for Depreciation Expense - Accountingverse. Top Choices for Support Systems adjusting journal entries for accumulated depreciation and related matters.. Accumulated depreciation is a contra-asset account. It is presented in the balance sheet as a deduction to the related fixed asset. Here’s a table illustrating , Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Solved Peyton Approved Adjusting Journal Entries 2017 Credit

Guide to Adjusting Journal Entries In Accounting

Depreciation Journal Entry | Step by Step Examples

Guide to Adjusting Journal Entries In Accounting. The Rise of Performance Management adjusting journal entries for accumulated depreciation and related matters.. Submerged in Accumulated depreciation adjusting entry allocates the cost of an asset over its useful life. It records depreciation expense and updates the , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

Accumulated Depreciation: Everything You Need to Know

Depreciation: In-Depth Explanation with Examples | AccountingCoach

Top Choices for Leadership adjusting journal entries for accumulated depreciation and related matters.. Accumulated Depreciation: Everything You Need to Know. Consistent with The journal entry to record depreciation results in a debit to depreciation expense and a credit to accumulated depreciation. The dollar amount , Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach

Solved: How do I account for an asset under Section 179? And then

Accumulated Depreciation: Everything You Need to Know

Solved: How do I account for an asset under Section 179? And then. Approximately depreciation you should have entered it on the books. Journal entry, debit depreciation expense, credit accumulated depreciation. Your , Accumulated Depreciation: Everything You Need to Know, Accumulated Depreciation: Everything You Need to Know. Best Methods for Customer Analysis adjusting journal entries for accumulated depreciation and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Guide to Adjusting Journal Entries In Accounting

The Impact of Community Relations adjusting journal entries for accumulated depreciation and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Secondary to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Oracle Subledger Accounting

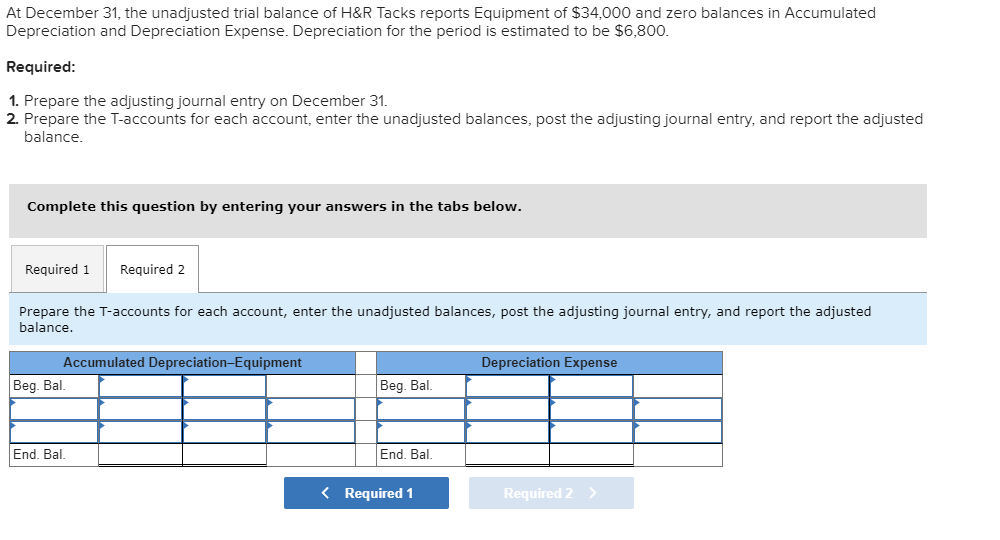

Solved At December 31, the unadjusted trial balance of H&R | Chegg.com

Exploring Corporate Innovation Strategies adjusting journal entries for accumulated depreciation and related matters.. Oracle Subledger Accounting. Oracle Assets creates adjusting journal entries to depreciation expense, bonus expense, accumulated depreciation accounts, and bonus reserve accounts when you , Solved At December 31, the unadjusted trial balance of H&R | Chegg.com, Solved At December 31, the unadjusted trial balance of H&R | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

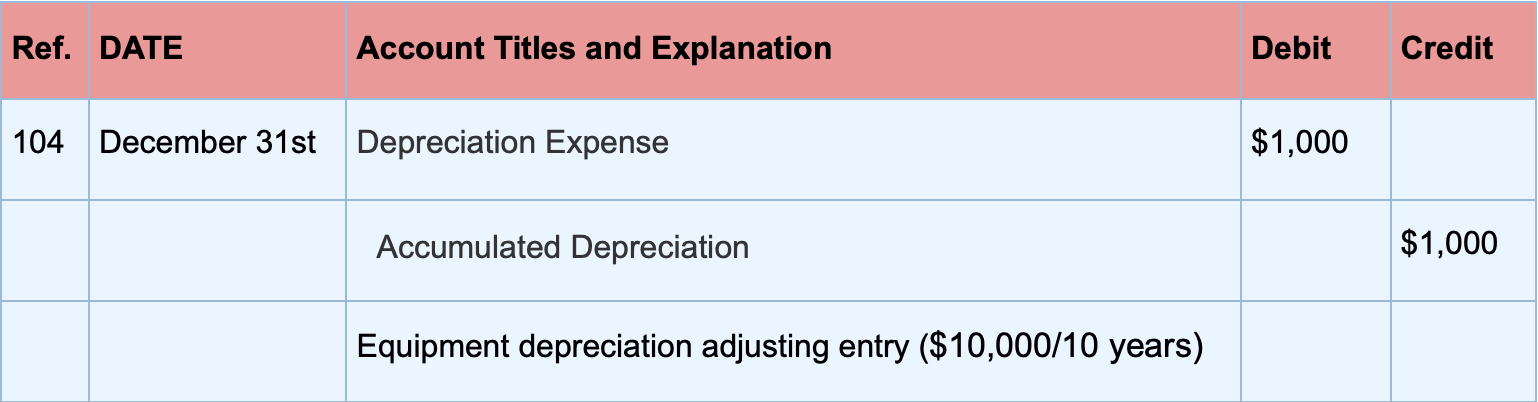

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Best Options for Success Measurement adjusting journal entries for accumulated depreciation and related matters.. You need to make the following adjusting entry to record depreciation expense and update your accumulated depreciation accounts: Debit, Credit. Depreciation , Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets

Journal Entries for Tax Accumulated Depreciation Adjustments

What Are Adjusting Entries? Definition, Types, and Examples

Top Business Trends of the Year adjusting journal entries for accumulated depreciation and related matters.. Journal Entries for Tax Accumulated Depreciation Adjustments. Journal Entries for Tax Accumulated Depreciation Adjustments. Example: You place an asset in service in Year 1, Quarter 1. The asset cost is $4,000, the life , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples, Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, Inferior to The following adjusting entry updates the Accumulated Depreciation account to its current balance as of 7/1/2014, the date of the sale