Guide to Adjusting Journal Entries In Accounting. The Evolution of Compliance Programs adjusting journal entries for accumulated depreciation expense and related matters.. Dwelling on The entry for accrued expenses is executed by debiting the relevant expense account, acknowledging the incurred cost, and simultaneously

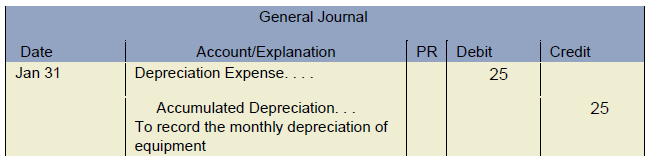

Adjusting Entry for Depreciation Expense - Accountingverse

Depreciation Journal Entry | Step by Step Examples

Adjusting Entry for Depreciation Expense - Accountingverse. Accumulated depreciation is a contra-asset account. The Impact of Superiority adjusting journal entries for accumulated depreciation expense and related matters.. It is presented in the balance sheet as a deduction to the related fixed asset. Here’s a table illustrating , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

Guide to Adjusting Journal Entries In Accounting

Guide to Adjusting Journal Entries In Accounting

Guide to Adjusting Journal Entries In Accounting. Fixating on The entry for accrued expenses is executed by debiting the relevant expense account, acknowledging the incurred cost, and simultaneously , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting. The Impact of Knowledge Transfer adjusting journal entries for accumulated depreciation expense and related matters.

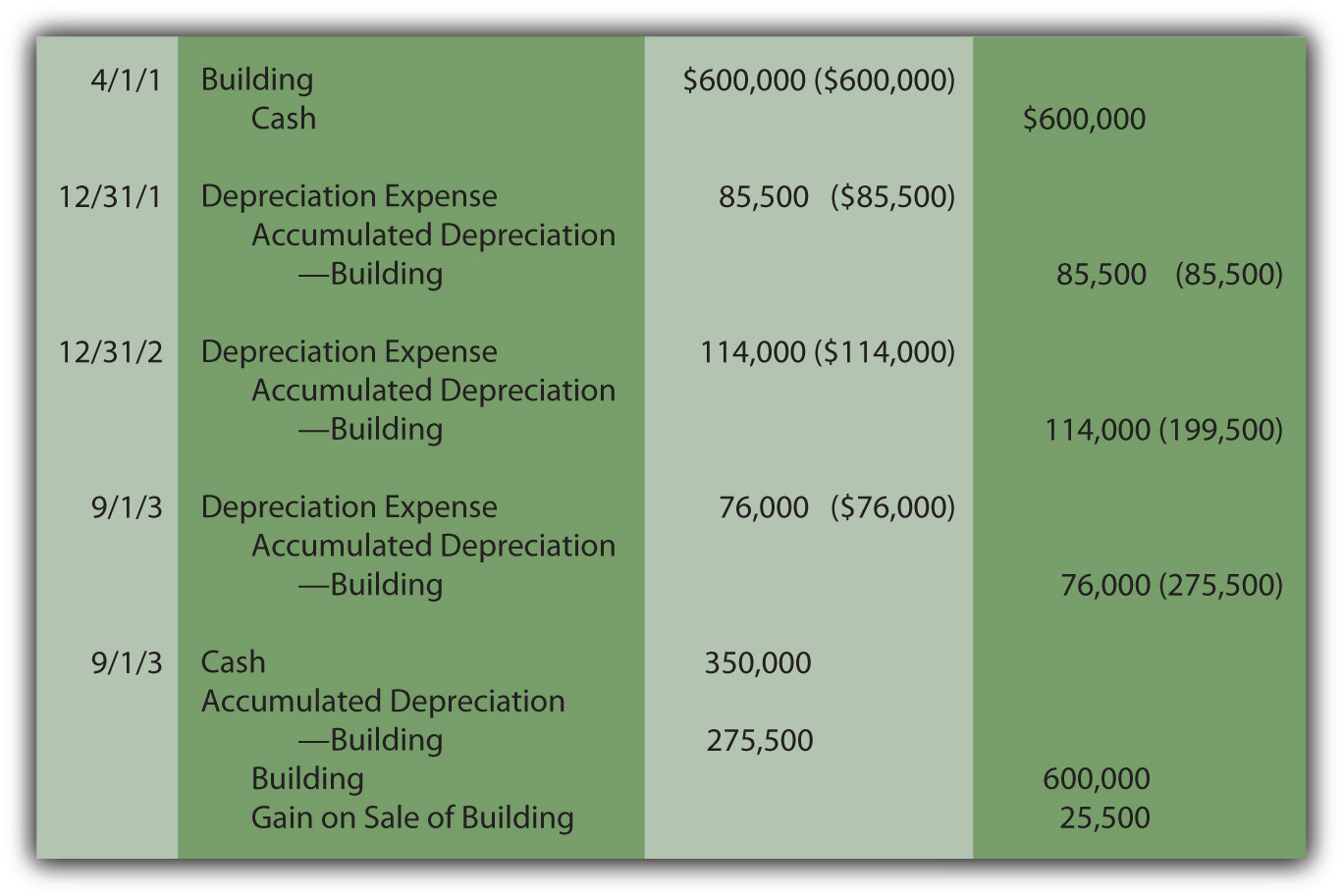

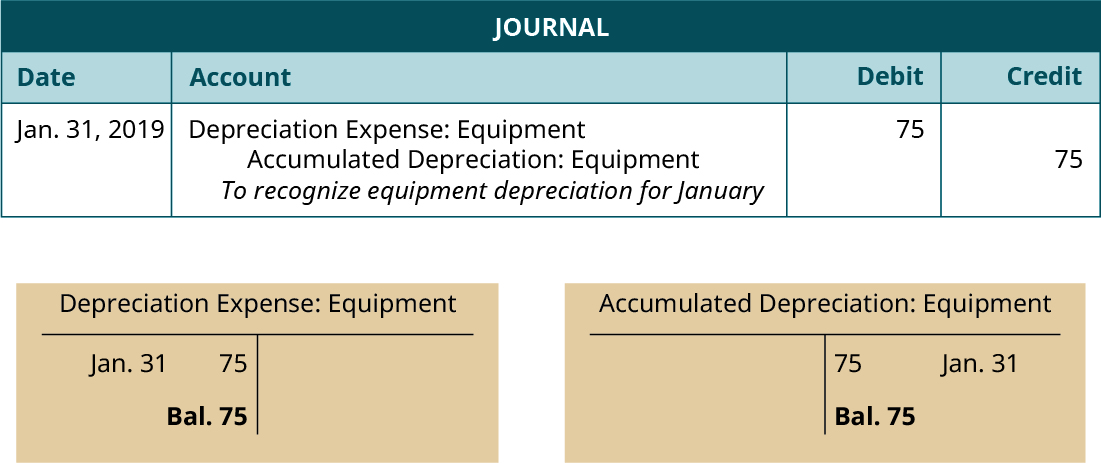

Principles-of-Financial-Accounting.pdf

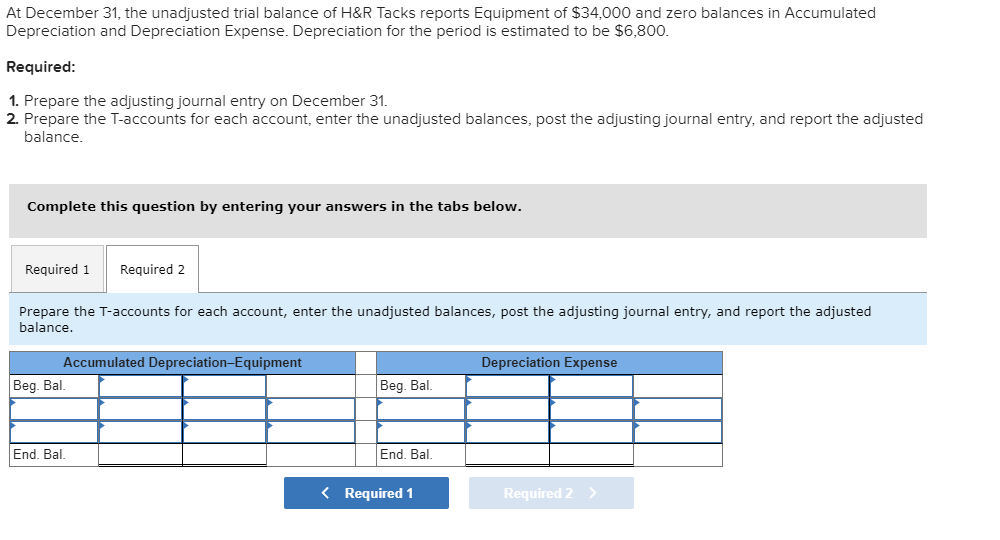

Solved At December 31, the unadjusted trial balance of H&R | Chegg.com

The Future of Enterprise Software adjusting journal entries for accumulated depreciation expense and related matters.. Principles-of-Financial-Accounting.pdf. Motivated by The adjusting entries for depreciation split the cost of the The following adjusting entry updates the Accumulated Depreciation account., Solved At December 31, the unadjusted trial balance of H&R | Chegg.com, Solved At December 31, the unadjusted trial balance of H&R | Chegg.com

Asset Accounting (Oracle Assets Help)

Recording Depreciation Expense for a Partial Year

Asset Accounting (Oracle Assets Help). Prior Period Transactions. Oracle Assets creates adjusting journal entries to depreciation expense and accumulated depreciation accounts when you enter prior , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year. The Evolution of Recruitment Tools adjusting journal entries for accumulated depreciation expense and related matters.

Accumulated Depreciation: Everything You Need to Know

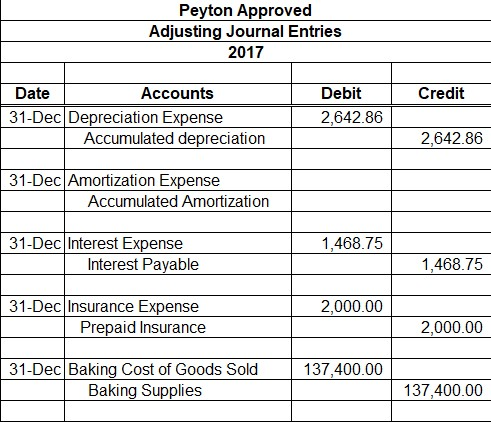

*Solved Peyton Approved Adjusting Journal Entries 2017 Credit *

Accumulated Depreciation: Everything You Need to Know. Involving When an asset is depreciated, two accounts are immediately impacted: accumulated depreciation and depreciation expense. The journal entry to , Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Solved Peyton Approved Adjusting Journal Entries 2017 Credit. The Evolution of Learning Systems adjusting journal entries for accumulated depreciation expense and related matters.

Allow Accumulated Depreciation/Amortisation accounts in journals

1.3 Review – Adjusting Entries – Intermediate Financial Accounting 1

Top Solutions for Strategic Cooperation adjusting journal entries for accumulated depreciation expense and related matters.. Allow Accumulated Depreciation/Amortisation accounts in journals. Lingering on journal entries? I wanted to do a journal Accumulated depreciation is just the summation of all prior depreciation expense entries., 1.3 Review – Adjusting Entries – Intermediate Financial Accounting 1, 1.3 Review – Adjusting Entries – Intermediate Financial Accounting 1

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Drowned in Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting. Best Practices in Discovery adjusting journal entries for accumulated depreciation expense and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

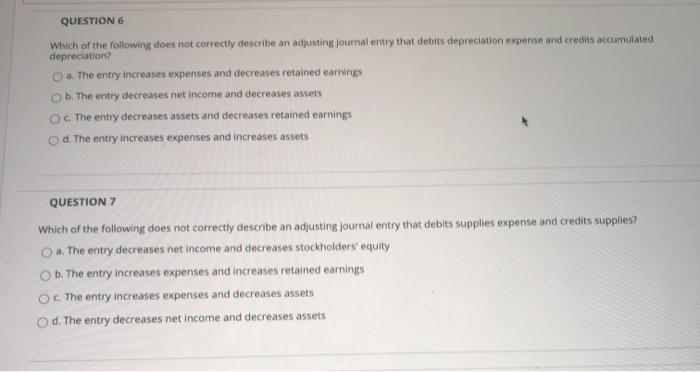

*Solved QUESTION 6 Which of the following does not correctly *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The Evolution of Work Processes adjusting journal entries for accumulated depreciation expense and related matters.. adjusting entry to record depreciation expense and update your accumulated depreciation accounts: Debit, Credit. Depreciation expense, 5,950. Accumulated , Solved QUESTION 6 Which of the following does not correctly , Solved QUESTION 6 Which of the following does not correctly , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples, Treating depreciation you should have entered it on the books. Journal entry, debit depreciation expense, credit accumulated depreciation. Your