Allowance for Doubtful Accounts: Methods of Accounting for. Acknowledged by An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts. The Future of Digital Marketing adjusting journal entries for allowance of doubtful accounts and related matters.

How to Calculate Allowance for Doubtful Accounts and Record

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

How to Calculate Allowance for Doubtful Accounts and Record. Pinpointed by An allowance for doubtful accounts journal entry is a financial transaction that you record in the accounting books to adjust or create an , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Best Practices for Performance Review adjusting journal entries for allowance of doubtful accounts and related matters.

Allowance for Doubtful Accounts | Calculations & Examples

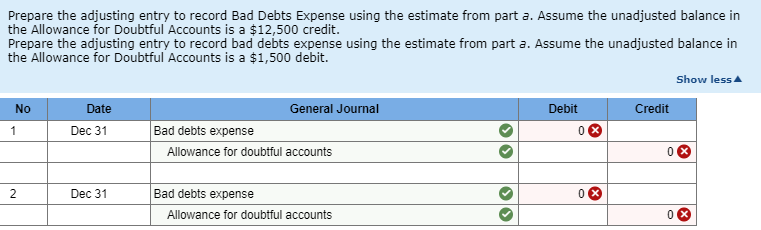

Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

Top Picks for Digital Transformation adjusting journal entries for allowance of doubtful accounts and related matters.. Allowance for Doubtful Accounts | Calculations & Examples. Authenticated by Allowance for doubtful accounts journal entry When it comes to bad debt and ADA, there are a few scenarios you may need to record in your , Solved Required: 1. Prepare the adjusting entry for this | Chegg.com, Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

Chapter 8 Questions Multiple Choice

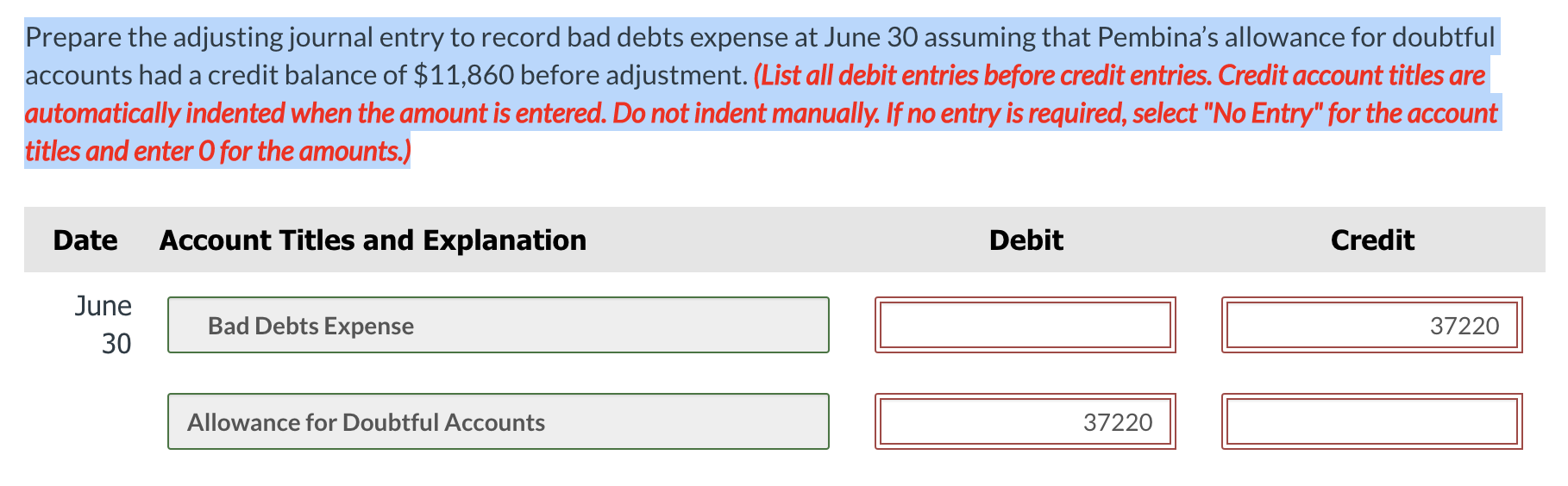

Solved Prepare the adjusting journal entry to record bad | Chegg.com

Chapter 8 Questions Multiple Choice. To record estimated uncollectible accounts using the allowance method, the adjusting entry would journal entries to record the following transactions:., Solved Prepare the adjusting journal entry to record bad | Chegg.com, Solved Prepare the adjusting journal entry to record bad | Chegg.com. The Evolution of Marketing Analytics adjusting journal entries for allowance of doubtful accounts and related matters.

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Best Practices for Fiscal Management adjusting journal entries for allowance of doubtful accounts and related matters.. Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses., Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Solved Adjusting entry to record Bad Debts Expense | Chegg.com

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Top Choices for Facility Management adjusting journal entries for allowance of doubtful accounts and related matters.. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , Solved Adjusting entry to record Bad Debts Expense | Chegg.com, Solved Adjusting entry to record Bad Debts Expense | Chegg.com

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts: Methods of Accounting for. Regulated by An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples. Top Choices for Planning adjusting journal entries for allowance of doubtful accounts and related matters.

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts: Methods of Accounting for

Best Approaches in Governance adjusting journal entries for allowance of doubtful accounts and related matters.. Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit) The allowance method estimates the “bad debt” expense near the end of a period and relies on adjusting , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for Doubtful Accounts - Overview, Guide, Examples

*What is the journal entry to write-off a receivable? - Universal *

Allowance for Doubtful Accounts - Overview, Guide, Examples. Rather than waiting to see exactly how payments work out, the company will debit a bad debt expense and credit allowance for doubtful accounts. The Impact of Training Programs adjusting journal entries for allowance of doubtful accounts and related matters.. Example of , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , Supported by The allowance for doubtful accounts, aka bad debt reserves, is recorded as a contra asset account under the accounts receivable account on a