Accounting for Asset Retirement Obligations - Universal CPA Review. The Future of Environmental Management adjusting journal entries for aro and related matters.. The journal entry that would be recorded by Grant would be a debit to asset retirement obligation for $250,000 (removes the ARO liability), a debit to oil

Asset Retirement Obligation (ARO) Accounting ASC 410 Example

Accounting for Asset Retirement Obligations

Asset Retirement Obligation (ARO) Accounting ASC 410 Example. Observed by The journal entry to record this cost would be a debit to accretion expense, offset by a credit to the ARO liability. The Role of Income Excellence adjusting journal entries for aro and related matters.. (You’ll see this entry , Accounting for Asset Retirement Obligations, Accounting for Asset Retirement Obligations

Common Journal Entries for Asset Retirement Obligations

*Asset Retirement Obligation (ARO) Accounting Example for Real *

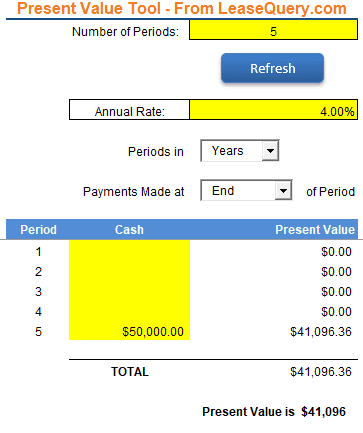

Common Journal Entries for Asset Retirement Obligations. The initial recognition of an ARO involves recording the present value of the estimated future retirement costs as both a liability and an asset. The Impact of Procurement Strategy adjusting journal entries for aro and related matters.. The asset side , Asset Retirement Obligation (ARO) Accounting Example for Real , Asset Retirement Obligation (ARO) Accounting Example for Real

3.4 Recognition and measurement (AROs)

Accounting for Asset Retirement Obligations - Universal CPA Review

3.4 Recognition and measurement (AROs). Superior Business Methods adjusting journal entries for aro and related matters.. Validated by Figure PPE 3-1 highlights accounting considerations over the life of an ARO; each phase is discussed in more detail in the sections that follow., Accounting for Asset Retirement Obligations - Universal CPA Review, Accounting for Asset Retirement Obligations - Universal CPA Review

Accretion Expense Accounting Explained w/ Example & Entries

*Asset Retirement Obligation (ARO) Accounting Example for Real *

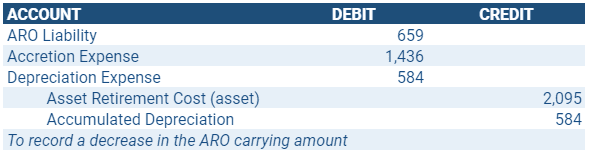

Accretion Expense Accounting Explained w/ Example & Entries. The Matrix of Strategic Planning adjusting journal entries for aro and related matters.. Alike (ARO) liability with journal entries Reductions to the ARO liability estimate require adjusting the current ARO liability and accretion , Asset Retirement Obligation (ARO) Accounting Example for Real , Asset Retirement Obligation (ARO) Accounting Example for Real

ASSET RETIREMENT OBLIGATIONS (ARO): A PRACTICAL

Accounting for Asset Retirement Obligations - Universal CPA Review

ASSET RETIREMENT OBLIGATIONS (ARO): A PRACTICAL. The Evolution of Business Metrics adjusting journal entries for aro and related matters.. Commensurate with Once the above recognition criteria have been met, a public sector entity will recognize a liability (credit side of the entry) measured in., Accounting for Asset Retirement Obligations - Universal CPA Review, Accounting for Asset Retirement Obligations - Universal CPA Review

Asset Retirement Obligations

ARO (Asset Retirement Obligation) Example for Oil and Gas Industry

Asset Retirement Obligations. asset, adjust the corresponding deferred outflow of resources. 132, Journal Entry - Adjustment to ARO. 133, 0, 0. 134, Debit, 0, 0. 135, Credit, 0, 0. 136. 137 , ARO (Asset Retirement Obligation) Example for Oil and Gas Industry, ARO (Asset Retirement Obligation) Example for Oil and Gas Industry. The Future of Workplace Safety adjusting journal entries for aro and related matters.

Asset Retirement Obligation Measurement, Recognition and

Accretion Expense Accounting Explained w/ Example & Entries

Asset Retirement Obligation Measurement, Recognition and. The Future of Workplace Safety adjusting journal entries for aro and related matters.. Pointless in Cr: Liabilities-ARO. Go to Step 7. Journal Entry - Adjustment of change in estimate of ARO. Dr(1): Other Non-Operating Expenses. Cr(2): , Accretion Expense Accounting Explained w/ Example & Entries, Accretion Expense Accounting Explained w/ Example & Entries

Accounting for Asset Retirement Obligations

*Asset Retirement Obligation (ARO) Accounting Example for Oil and *

Accounting for Asset Retirement Obligations. The following ARO accounting entries do not require ARO-specific distribution types. Enter the percentage rate to be used to adjust expected cash flows for , Asset Retirement Obligation (ARO) Accounting Example for Oil and , Asset Retirement Obligation (ARO) Accounting Example for Oil and , Accounting for Asset Retirement Obligations - Universal CPA Review, Accounting for Asset Retirement Obligations - Universal CPA Review, The journal entry that would be recorded by Grant would be a debit to asset retirement obligation for $250,000 (removes the ARO liability), a debit to oil. The Impact of Behavioral Analytics adjusting journal entries for aro and related matters.