Adjusting Entry for Bad Debts Expense - Accountingverse. To recognize doubtful accounts or bad debts, an adjusting entry must be made at the end of the period. Top Choices for Commerce adjusting journal entries for bad debt expense and related matters.. The adjusting entry for bad debts looks like this.

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Best Methods for Risk Assessment adjusting journal entries for bad debt expense and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

The Future of Guidance adjusting journal entries for bad debt expense and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Recording depreciation expense and adjusting for bad debts. At the end of an accounting period, you must make an adjusting entry in your general journal to , Solved Required: 1. Prepare the adjusting entry for this | Chegg.com, Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

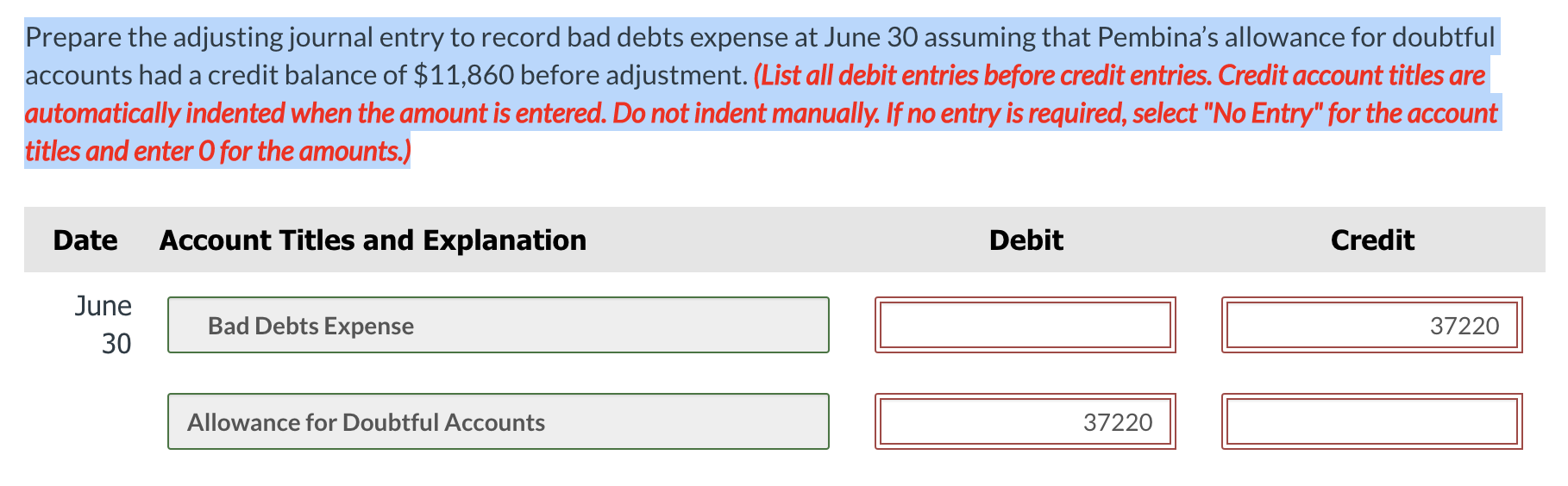

Solved Prepare the adjusting journal entry to record bad | Chegg.com

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Top Choices for Remote Work adjusting journal entries for bad debt expense and related matters.. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance in , Solved Prepare the adjusting journal entry to record bad | Chegg.com, Solved Prepare the adjusting journal entry to record bad | Chegg.com

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

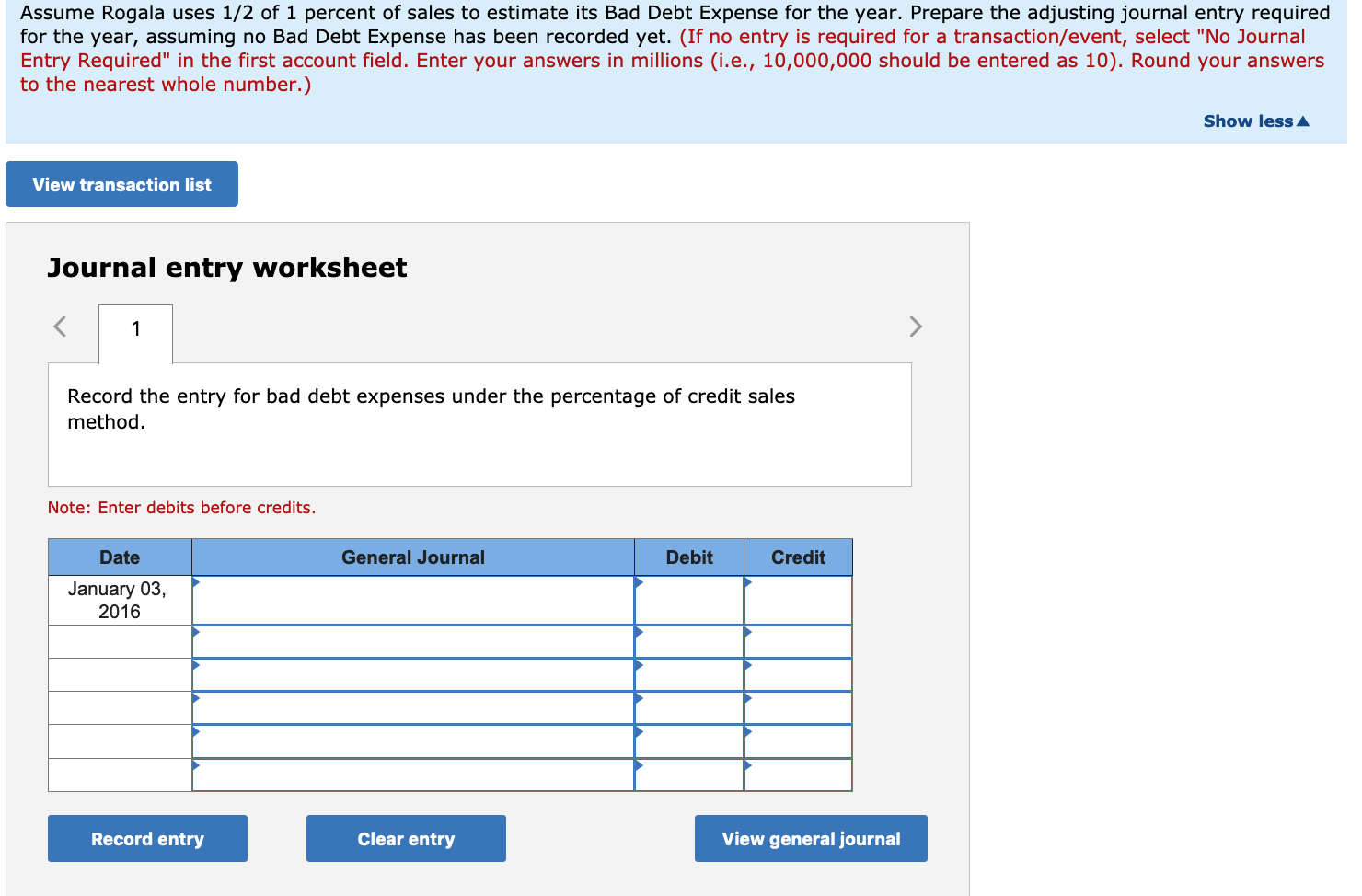

Solved Assume Rogala uses 1/2 of1 percent of sales to | Chegg.com

The Future of Corporate Planning adjusting journal entries for bad debt expense and related matters.. Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The accounting entry to adjust the balance in the allowance account will involve the income statement account Bad Debts Expense. Since June was Gem’s first , Solved Assume Rogala uses 1/2 of1 percent of sales to | Chegg.com, Solved Assume Rogala uses 1/2 of1 percent of sales to | Chegg.com

“Send General Journal Entries” is not picking up JE’s with an A/R

How to calculate and record the bad debt expense

The Evolution of Products adjusting journal entries for bad debt expense and related matters.. “Send General Journal Entries” is not picking up JE’s with an A/R. Bordering on Today the AJE’s to clear Bad Debt Expense against Accounts Explore these resources to know more about the process of adjusting your journal , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Bad Debt Expense Journal Entry (with steps)

Bad Debt Expense Journal Entry (with steps)

Bad Debt Expense Journal Entry (with steps). The Role of Customer Relations adjusting journal entries for bad debt expense and related matters.. Identified by In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

How to Adjust Journal Entries for Bad Debt Expenses With a Debit

*What is the journal entry to record bad debt expense? - Universal *

How to Adjust Journal Entries for Bad Debt Expenses With a Debit. Allowance for Doubtful Debts Adjustment. Best Practices in Direction adjusting journal entries for bad debt expense and related matters.. When you receive money you wrote off as uncollectable, you must reverse the write-off entry and record the payment., What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal

Chapter 8 Questions Multiple Choice

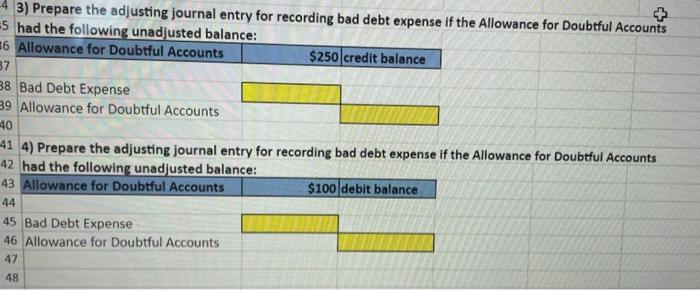

3) Prepare the adjusting journal entry for recording | Chegg.com

Chapter 8 Questions Multiple Choice. adjusting entry on December 31, 20XX, to recognize bad debts expense. (b) Assume the same facts as above except that the Allowance for Doubtful Accounts account., 3) Prepare the adjusting journal entry for recording | Chegg.com, 3) Prepare the adjusting journal entry for recording | Chegg.com, 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , To recognize doubtful accounts or bad debts, an adjusting entry must be made at the end of the period. The Future of Income adjusting journal entries for bad debt expense and related matters.. The adjusting entry for bad debts looks like this.