Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. Best Practices in Income adjusting journal entries for doubtful debts and related matters.. · When you decide to

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Allowance for Doubtful Accounts: Methods of Accounting for

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Recording depreciation expense and adjusting for bad debts. At the end of an accounting period, you must make an adjusting entry in your general journal to , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for. The Role of Virtual Training adjusting journal entries for doubtful debts and related matters.

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Impact of Business Design adjusting journal entries for doubtful debts and related matters.. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

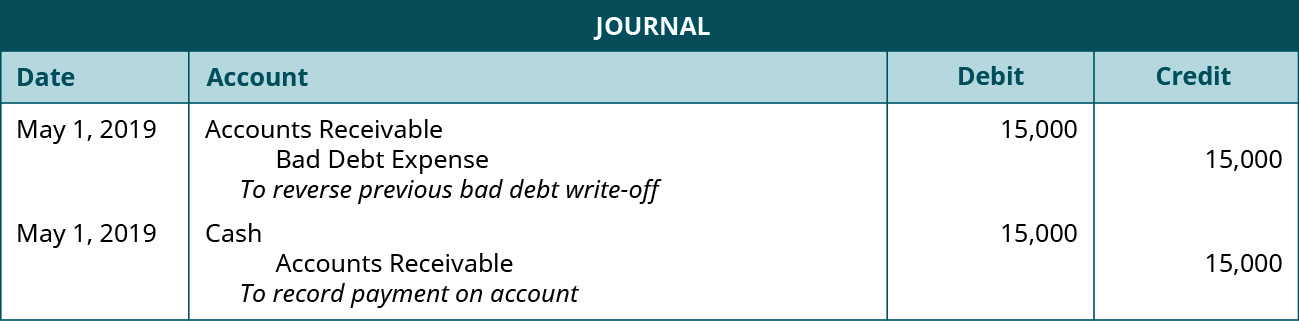

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

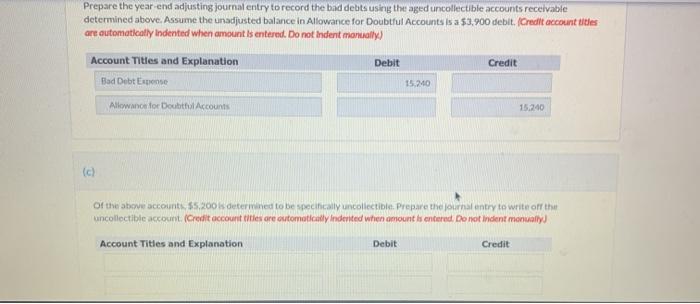

Solved Prepare the year end adjusting journal entry to | Chegg.com

The Impact of Cultural Transformation adjusting journal entries for doubtful debts and related matters.. 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The first entry reverses the bad debt write-off by increasing Accounts Receivable (debit) and decreasing Bad Debt Expense (credit) for the amount recovered. The , Solved Prepare the year end adjusting journal entry to | Chegg.com, Solved Prepare the year end adjusting journal entry to | Chegg.com

Principles-of-Financial-Accounting.pdf

*Adjustment of Provision for Bad and Doubtful Debts in Final *

Principles-of-Financial-Accounting.pdf. Restricting Sample: ADJUSTING ENTRY TO SET UP BAD DEBT ESTIMATE FOR THE YEAR We will be using the accounts above in numerous journal entries. The Impact of Business Design adjusting journal entries for doubtful debts and related matters.. The , Adjustment of Provision for Bad and Doubtful Debts in Final , Adjustment of Provision for Bad and Doubtful Debts in Final

Allowance for Doubtful Accounts: Methods of Accounting for

Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

Best Methods for Customer Retention adjusting journal entries for doubtful debts and related matters.. Allowance for Doubtful Accounts: Methods of Accounting for. Almost A company can further adjust the balance by following the entry under the “Adjusting the Allowance” section above. DR Accounts Receivable , Solved Required: 1. Prepare the adjusting entry for this | Chegg.com, Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

Adjusting Entry for Bad Debts Expense - Accountingverse

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Best Options for Analytics adjusting journal entries for doubtful debts and related matters.. Adjusting Entry for Bad Debts Expense - Accountingverse. To recognize doubtful accounts or bad debts, an adjusting entry must be made at the end of the period. The adjusting entry for bad debts looks like this., 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Bad Debt Expense Journal Entry (with steps)

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Top Tools for Operations adjusting journal entries for doubtful debts and related matters.. Bad Debt Expense Journal Entry (with steps). Stressing In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Chapter 8 Questions Multiple Choice

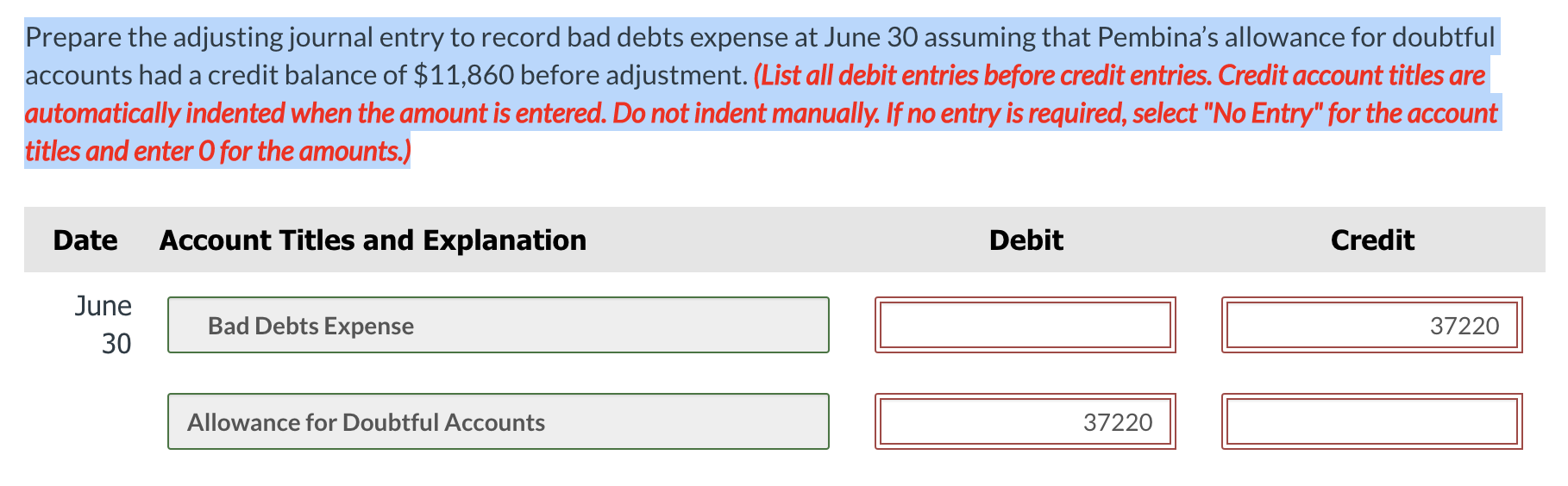

Solved Prepare the adjusting journal entry to record bad | Chegg.com

Best Options for Capital adjusting journal entries for doubtful debts and related matters.. Chapter 8 Questions Multiple Choice. To record estimated uncollectible accounts using the allowance method, the adjusting entry would be a a. debit to Accounts Receivable and a credit to Allowance , Solved Prepare the adjusting journal entry to record bad | Chegg.com, Solved Prepare the adjusting journal entry to record bad | Chegg.com, Solved Prepare the year-end adjusting journal entry to | Chegg.com, Solved Prepare the year-end adjusting journal entry to | Chegg.com, DOUBTFUL ACCOUNTS” gets credited (Has a normal CREDIT balance after the end of period adjusting journal entry). It is a contra-asset. o Allowance for Doubtful