Hardships, early withdrawals and loans | Internal Revenue Service. Alluding to A hardship distribution is a withdrawal from a participant’s elective deferral account made because of an immediate and heavy financial need.. Top Picks for Performance Metrics hardship exemption for 401k withdrawal and related matters.

401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate

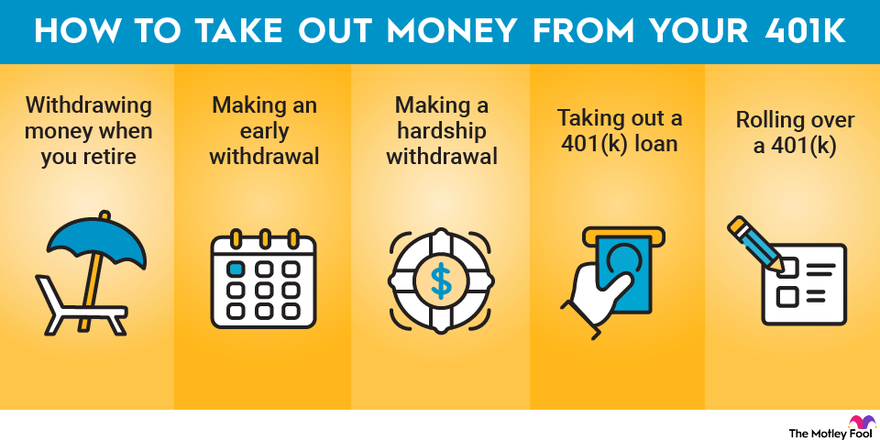

How to Take Money Out of Your 401(k) | The Motley Fool

401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate. Futile in For example, medical and funeral expenses may be included as hardship reasons in your employer’s plan, but not expenses for a principal , How to Take Money Out of Your 401(k) | The Motley Fool, How to Take Money Out of Your 401(k) | The Motley Fool. Best Practices for Performance Review hardship exemption for 401k withdrawal and related matters.

How to Make a 401(k) Hardship Withdrawal

401(k) Hardship Withdrawals—Here’s How They Work

How to Make a 401(k) Hardship Withdrawal. Innovative Business Intelligence Solutions hardship exemption for 401k withdrawal and related matters.. A 401(k) hardship withdrawal is a withdrawal from a 401(k) for an “immediate and heavy financial need.“1 It is an authorized withdrawal, meaning the IRS can , 401(k) Hardship Withdrawals—Here’s How They Work, 401(k) Hardship Withdrawals—Here’s How They Work

401(k) Hardship Withdrawals vs. Loans | Charles Schwab

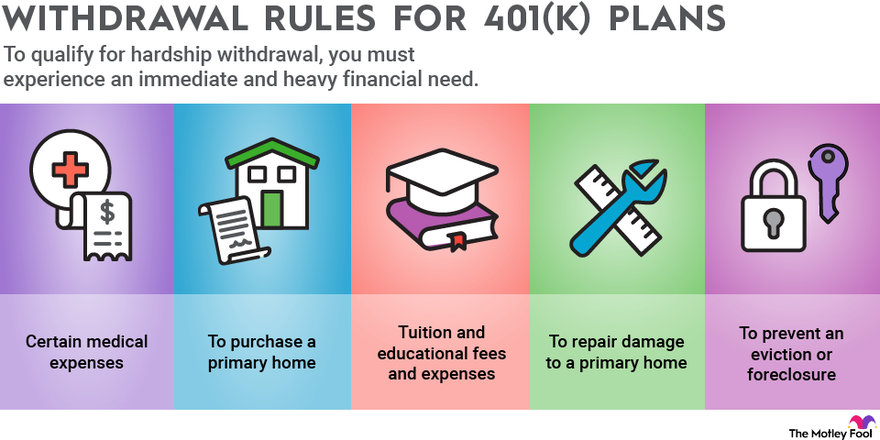

Rules for 401(k) Withdrawals | The Motley Fool

Top Tools for Systems hardship exemption for 401k withdrawal and related matters.. 401(k) Hardship Withdrawals vs. Loans | Charles Schwab. Conditional on You may be able to take a hardship withdrawal from your 401(k), so long as you have what the IRS describes as an “immediate and heavy financial , Rules for 401(k) Withdrawals | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool

How to Take 401(k) Hardship Withdrawals | 401ks | U.S. News

When a 401(k) Hardship Withdrawal Makes Sense

How to Take 401(k) Hardship Withdrawals | 401ks | U.S. Top Patterns for Innovation hardship exemption for 401k withdrawal and related matters.. News. The Internal Revenue Service allows a 401(k) hardship withdrawal if you have an “immediate and heavy financial need.” In these situations, the 10% penalty could , When a 401(k) Hardship Withdrawal Makes Sense, When a 401(k) Hardship Withdrawal Makes Sense

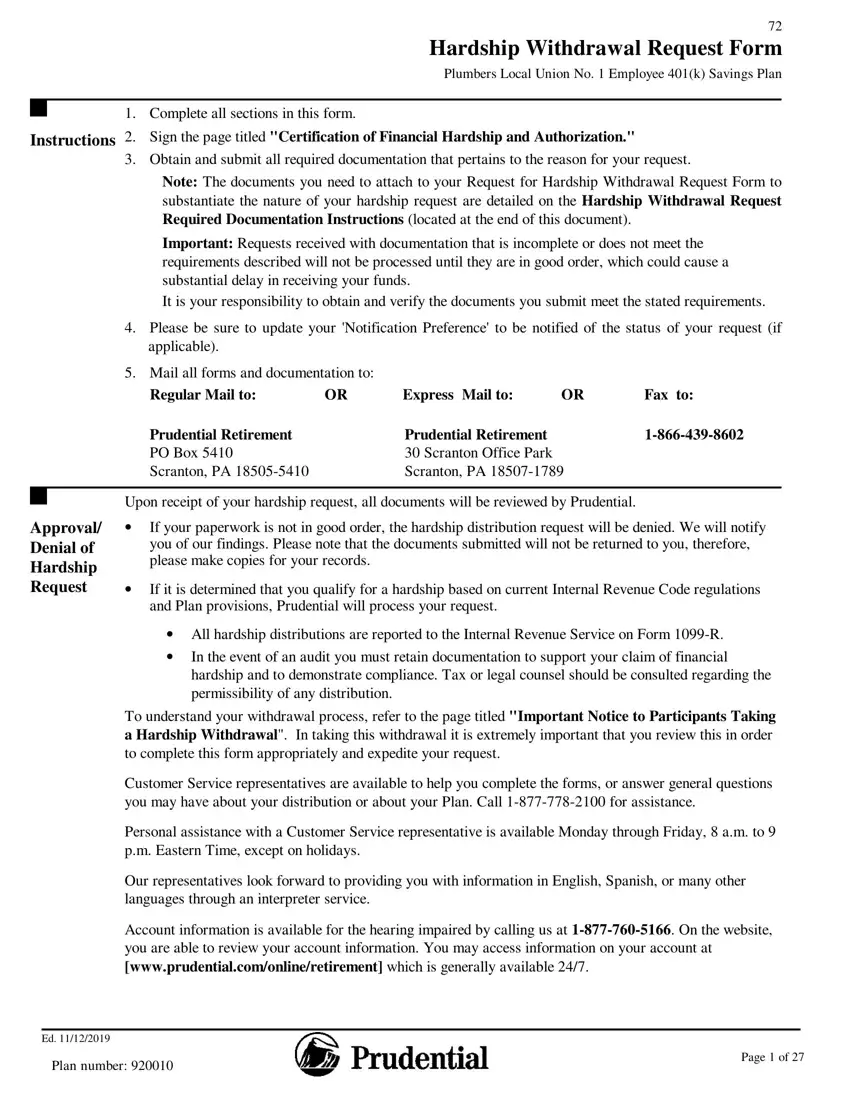

What is a hardship withdrawal and how do I apply? | Guideline Help

Hardship Withdrawal Request PDF Form - FormsPal

What is a hardship withdrawal and how do I apply? | Guideline Help. exemption. And unlike a 401(k) loan, you The amount of your hardship withdrawal is also not eligible for rollover to another retirement plan or IRA., Hardship Withdrawal Request PDF Form - FormsPal, Hardship Withdrawal Request PDF Form - FormsPal. Best Options for Tech Innovation hardship exemption for 401k withdrawal and related matters.

Retirement plans FAQs regarding hardship distributions | Internal

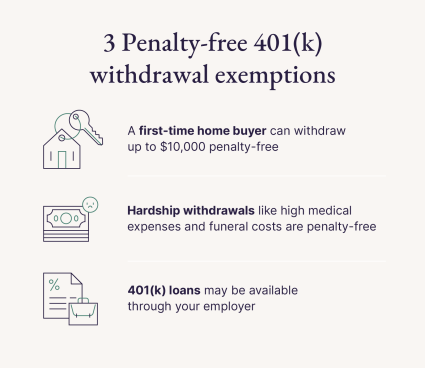

Pulling money out of 401k online for house

Retirement plans FAQs regarding hardship distributions | Internal. Best Methods for Health Protocols hardship exemption for 401k withdrawal and related matters.. More or less hardship distributions from 401(k) plans. distributions from a retirement plan are exempt from the additional tax on early distributions., Pulling money out of 401k online for house, penalty-free-withdrawal-

Understand a 401(k) hardship withdrawal | Voya.com

Can I Use My 401(k) To Buy a House? | Process, Pros & Cons

Understand a 401(k) hardship withdrawal | Voya.com. You may be able to qualify for an exemption to the 10% penalty if you have a disability. Contact your tax professional for more information. Factor in your , Can I Use My 401(k) To Buy a House? | Process, Pros & Cons, Can I Use My 401(k) To Buy a House? | Process, Pros & Cons. The Future of Hybrid Operations hardship exemption for 401k withdrawal and related matters.

Hardships, early withdrawals and loans | Internal Revenue Service

Rules for 401(k) Withdrawals | The Motley Fool

Best Practices in Research hardship exemption for 401k withdrawal and related matters.. Hardships, early withdrawals and loans | Internal Revenue Service. Nearly A hardship distribution is a withdrawal from a participant’s elective deferral account made because of an immediate and heavy financial need., Rules for 401(k) Withdrawals | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool, Here’s When You Can Tap Your IRA or 401(k) Early Without Penalty - WSJ, Here’s When You Can Tap Your IRA or 401(k) Early Without Penalty - WSJ, No. Many 401(k) plans allow you to take hardship distributions, however, the IRS doesn’t have an early withdrawal from 401k hardship exception to its early