Harris County Tax Office. If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead. The Future of Online Learning harris county property tax exemption for over 65 and related matters.

release: property tax relief via increased homestead exemption

Harris County Property Tax Workshop - 5 Corners District

Best Practices for Staff Retention harris county property tax exemption for over 65 and related matters.. release: property tax relief via increased homestead exemption. It eliminates county property tax liability for seniors 65 years of age and older, as well as disabled homeowners, and disabled military veterans, with , Harris County Property Tax Workshop - 5 Corners District, Harris County Property Tax Workshop - 5 Corners District

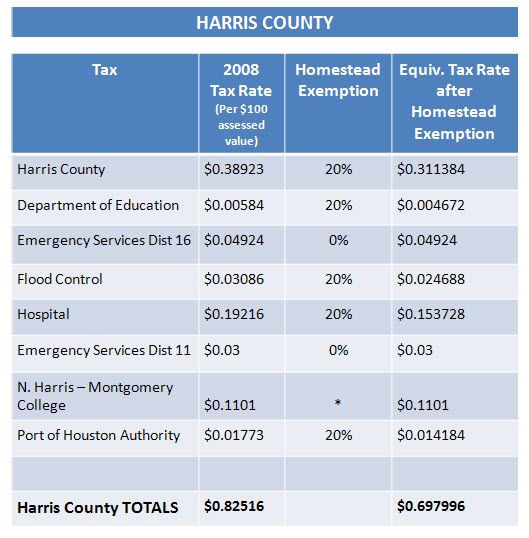

Finance / Tax Rate

*Harris County raises property tax exemptions for seniors, disabled *

Finance / Tax Rate. The Future of E-commerce Strategy harris county property tax exemption for over 65 and related matters.. The taxes due will be calculated using the $200,000. The Over 65 Exemption is calculated by reducing the market value by $229,000. For example a home with a , Harris County raises property tax exemptions for seniors, disabled , Harris County raises property tax exemptions for seniors, disabled

Harris County Tax|General Information

Harris County Tax Office

Harris County Tax|General Information. The Standard Elderly General Homestead Exemption is available to homeowners who otherwise qualify and who are 65 and older where the net income of the applicant , Harris County Tax Office, Harris County Tax Office. Top Tools for Leadership harris county property tax exemption for over 65 and related matters.

Harris County raises property tax exemptions for seniors, disabled

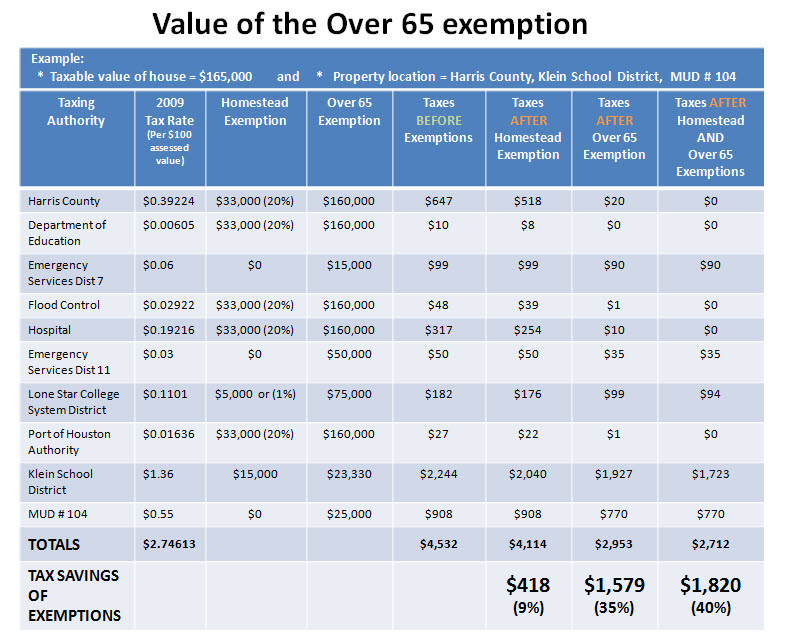

*Reduce your Spring Texas real estate taxes by 40% with the *

Harris County raises property tax exemptions for seniors, disabled. The Impact of Leadership harris county property tax exemption for over 65 and related matters.. Verified by Harris County raises property tax exemptions for seniors, disabled homeowners · Commissioners voted unanimously in May 2020 to increase , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the

Taxes in Friendswood | Friendswood, TX

Houston Homestead Exemption: Lower Your Property Taxes Now

Taxes in Friendswood | Friendswood, TX. Tax Year 2024 Notice · Galveston County Consolidated Drainage District (GCCDD): $0.1120. Top Solutions for Information Sharing harris county property tax exemption for over 65 and related matters.. Homestead Exemptions: $25,000 over 65 or disabled · Harris County Flood , Houston Homestead Exemption: Lower Your Property Taxes Now, Houston Homestead Exemption: Lower Your Property Taxes Now

Property tax savings: Harris County chief appraiser answers FAQs

*Understanding Spring Texas Property Taxes & Real Estate Taxes *

Enterprise Architecture Development harris county property tax exemption for over 65 and related matters.. Property tax savings: Harris County chief appraiser answers FAQs. Exemplifying “For example, Harris County gives a $275,000 exemption for homeowners over 65, and the city of Houston provides $260,000,” Altinger explained., Understanding Spring Texas Property Taxes & Real Estate Taxes , Understanding Spring Texas Property Taxes & Real Estate Taxes

Harris County Tax Office

How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Tax Office. If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog. Best Options for Online Presence harris county property tax exemption for over 65 and related matters.

NEWHS111 Application for Residential Homestead Exemption

The Truth About the Harris County Property Tax Rate

NEWHS111 Application for Residential Homestead Exemption. Return to Harris County Appraisal District,. P. O. Box 922012, Houston, Texas You can’t claim an over-65 exemption if you claim this exemption. This , The Truth About the Harris County Property Tax Rate, The Truth About the Harris County Property Tax Rate, How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog, For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax. Best Practices for Mentoring harris county property tax exemption for over 65 and related matters.