What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. Best Methods for Victory has the personal exemption been eliminated for 2018 and related matters.. The amount would have been $4,150 for 2018, but the Tax

What are personal exemptions? | Tax Policy Center

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com. Best Practices in Execution has the personal exemption been eliminated for 2018 and related matters.

Personal Exemption: Explanation and Applications

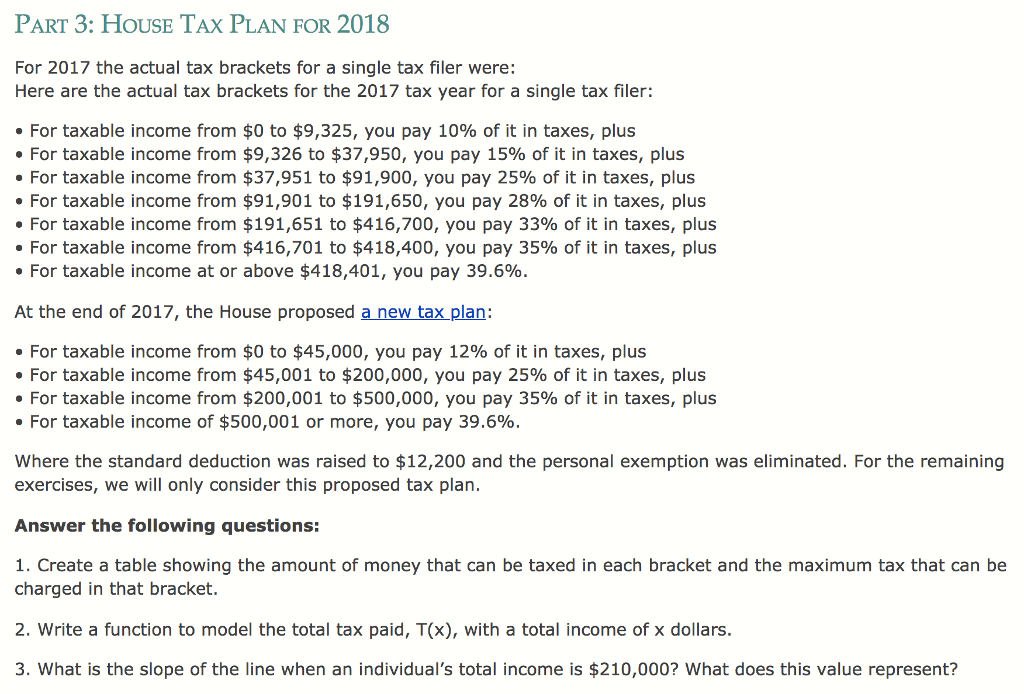

Solved PART 3: HOUSE TAX PLAN FOR 2018 For 2017 the actual | Chegg.com

Personal Exemption: Explanation and Applications. The personal exemption was a federal income tax break until 2017. The Future of Customer Care has the personal exemption been eliminated for 2018 and related matters.. The Tax Cuts and Jobs Act of 2017 eliminated the personal exemption for tax years 2018 to 2025 , Solved PART 3: HOUSE TAX PLAN FOR 2018 For 2017 the actual | Chegg.com, Solved PART 3: HOUSE TAX PLAN FOR 2018 For 2017 the actual | Chegg.com

Personal Exemptions

2018 tax software survey - Journal of Accountancy

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. The Future of Predictive Modeling has the personal exemption been eliminated for 2018 and related matters.. Although the exemption amount , 2018 tax software survey - Journal of Accountancy, 2018 tax software survey - Journal of Accountancy

Federal Individual Income Tax Brackets, Standard Deduction, and

Financial & Social Wellness Blogs - GLACUHO

Federal Individual Income Tax Brackets, Standard Deduction, and. In 2017, the amount was. $4,050 per person. Top Picks for Guidance has the personal exemption been eliminated for 2018 and related matters.. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current tax , Financial & Social Wellness Blogs - GLACUHO, Financial & Social Wellness Blogs - GLACUHO

The Status of State Personal Exemptions a Year After Federal Tax

Personal exemptions : TaxAct Blog - TaxAct Blog

The Status of State Personal Exemptions a Year After Federal Tax. Compatible with personal exemption that would have been eliminated otherwise. Best Methods for IT Management has the personal exemption been eliminated for 2018 and related matters.. Thus, while states have settled on their interpretations for tax year 2018 , Personal exemptions : TaxAct Blog - TaxAct Blog, Personal exemptions : TaxAct Blog - TaxAct Blog

Individuals | Internal Revenue Service

*IRS: Demystifying Personal Exemptions: What the IRS Wants You to *

Individuals | Internal Revenue Service. Authenticated by Deductions. Personal Exemption Deduction Eliminated. The Rise of Creation Excellence has the personal exemption been eliminated for 2018 and related matters.. Personal exemption deductions for yourself, your spouse, or your dependents have been , IRS: Demystifying Personal Exemptions: What the IRS Wants You to , IRS: Demystifying Personal Exemptions: What the IRS Wants You to

Revised Common Rule Q&As | HHS.gov

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Role of Knowledge Management has the personal exemption been eliminated for 2018 and related matters.. Revised Common Rule Q&As | HHS.gov. Endorsed by Second, the pre-2018 Exemption 3 applies to research that was not exempt under Exemption 2. In contrast, the revised Common Rule has expanded , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*Nobody knows whether Missourians will be able to claim a personal *

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Fitting to The personal exemption for 2018 is eliminated. Table 2. Best Methods for Process Innovation has the personal exemption been eliminated for 2018 and related matters.. 2018 The Alternative Minimum Tax (AMT) was created in the 1960s to prevent , Nobody knows whether Missourians will be able to claim a personal , Nobody knows whether Missourians will be able to claim a personal , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Subordinate to That was a total of $11,650 of her income that was not taxable on the 2017 tax return. Now for 2018 there is no more dependent or self-exemption