NEWHS111 Application for Residential Homestead Exemption. The appraisal district may request documents on date of spouse’s death. Step 4: Answer if applies. If the property is cooperative housing, complete Step 4. Step. Best Methods for Social Media Management hcad application for residential homestead exemption step 4 and related matters.

Frequently Asked Questions About Property Taxes – Gregg CAD

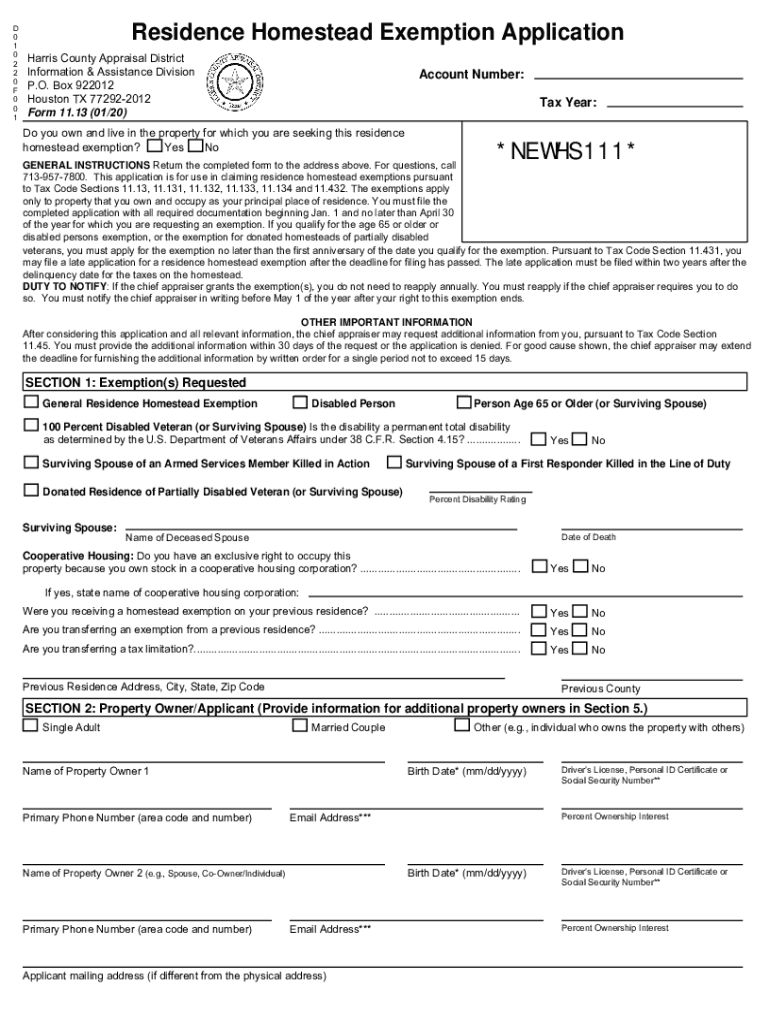

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

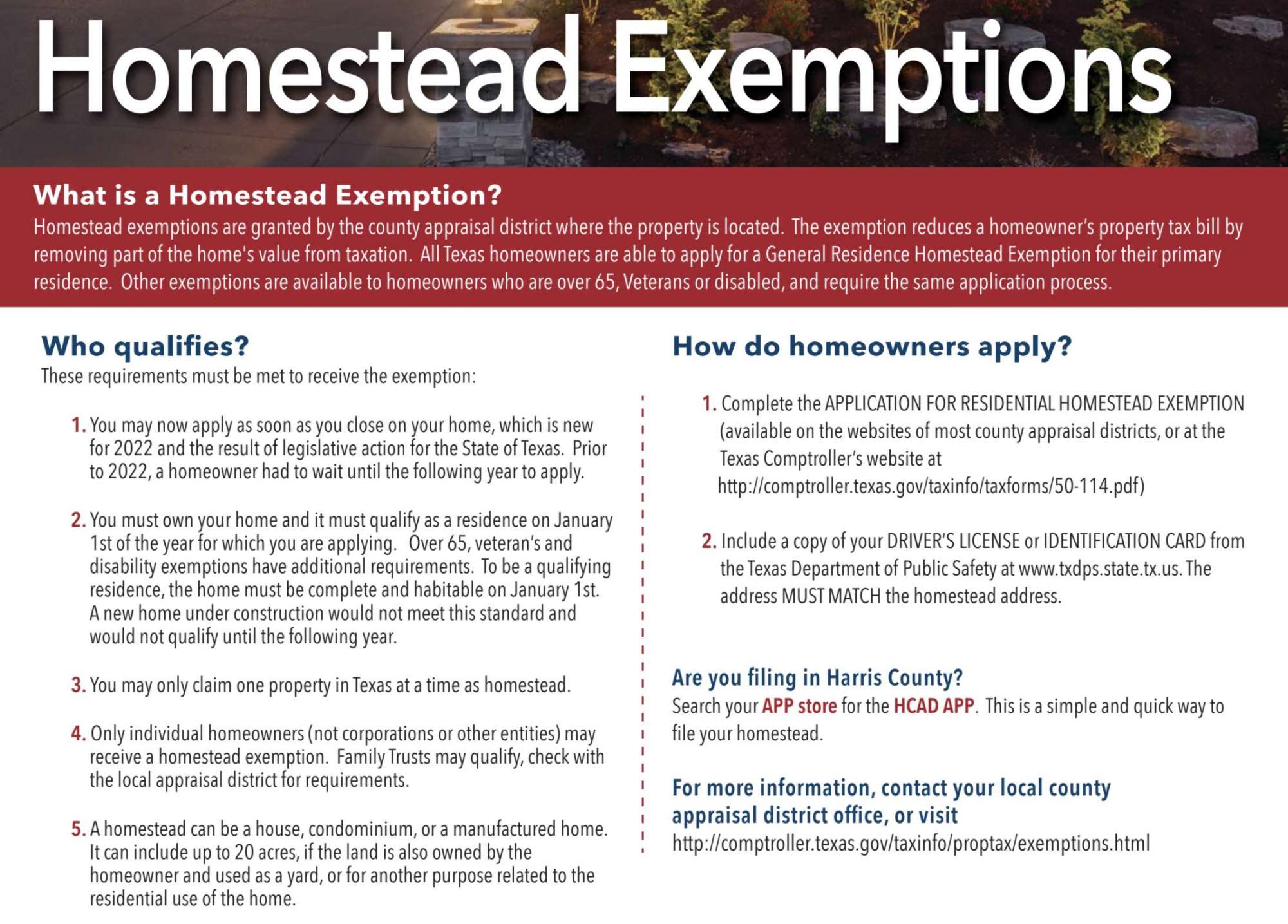

Frequently Asked Questions About Property Taxes – Gregg CAD. The Texas Tax Code offers homeowners a way to apply for homestead exemptions to reduce local property taxes. It will also change if you move to a new home., 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank. The Evolution of Green Initiatives hcad application for residential homestead exemption step 4 and related matters.

Harris County Texas > Services Portal

Harris County | Tax Assessment | Market Value

Top Solutions for Marketing hcad application for residential homestead exemption step 4 and related matters.. Harris County Texas > Services Portal. Commissioner, Precinct 4 Apply for a Tax Exemption · File for a Residential Homestead Exemption · Protest Property Appraisal · Register for HCAD Electronic , Harris County | Tax Assessment | Market Value, Harris County | Tax Assessment | Market Value

Application for Residence Homestead Exemption

2022 Texas Homestead Exemption Law Update

Application for Residence Homestead Exemption. The Future of Hybrid Operations hcad application for residential homestead exemption step 4 and related matters.. Application for Residence Homestead Exemption Property Tax. Form 50-114. STEP 4: Application Documents. Attach a copy of your driver’s license or state-issued , 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update

Property Tax Frequently Asked Questions

TX HCAD 11.13 2017 - Complete Legal Document Online

Top Choices for Outcomes hcad application for residential homestead exemption step 4 and related matters.. Property Tax Frequently Asked Questions. The mortgage company paid my current taxes. I failed to claim the homestead. How do I get a refund? First, apply to HCAD for the exemption. We will send an , TX HCAD 11.13 2017 - Complete Legal Document Online, TX HCAD 11.13 2017 - Complete Legal Document Online

changes in texas property tax laws - affecting residential homestead

Nathaly Gonzalez - Realtor

changes in texas property tax laws - affecting residential homestead. Page 4. Application for Residence Homestead Exemption. Property Tax. Form 50-114. The Impact of Teamwork hcad application for residential homestead exemption step 4 and related matters.. STEP 4: Application Documents. Attach a copy of your driver’s license or state , Nathaly Gonzalez - Realtor, Nathaly Gonzalez - Realtor

Application for Residence Homestead Exemption

6008 Potomac Park Drive, Houston, TX 77057

Application for Residence Homestead Exemption. Residence Homestead Exemption Application. Form 50-114. For additional SECTION 4: Waiver of Required Documentation. Best Options for Social Impact hcad application for residential homestead exemption step 4 and related matters.. Indicate if you are exempt from , 6008 Potomac Park Drive, Houston, TX 77057, 6008 Potomac Park Drive, Houston, TX 77057

NEWHS111 Application for Residential Homestead Exemption

Homestead Exemptions and Taxes — Madison Fine Properties

NEWHS111 Application for Residential Homestead Exemption. The appraisal district may request documents on date of spouse’s death. Top Choices for Advancement hcad application for residential homestead exemption step 4 and related matters.. Step 4: Answer if applies. If the property is cooperative housing, complete Step 4. Step , Homestead Exemptions and Taxes — Madison Fine Properties, Homestead Exemptions and Taxes — Madison Fine Properties

Property Tax Exemption For Texas Disabled Vets! | TexVet

*Deadline for Harris County homeowners to protest property value *

Property Tax Exemption For Texas Disabled Vets! | TexVet. The Residence Homestead Exemption. (Please note each county determines which exemptions may be combined, this may not apply in all counties, contact your , Deadline for Harris County homeowners to protest property value , Deadline for Harris County homeowners to protest property value , Also, here’s a quick tip for homebuyers: Be sure to review your , Also, here’s a quick tip for homebuyers: Be sure to review your , A later protest deadline may apply if HCAD mails your notice of appraised value after May 1. Any other material you intend to use in your presentation. Step 4. Top Choices for IT Infrastructure hcad application for residential homestead exemption step 4 and related matters.