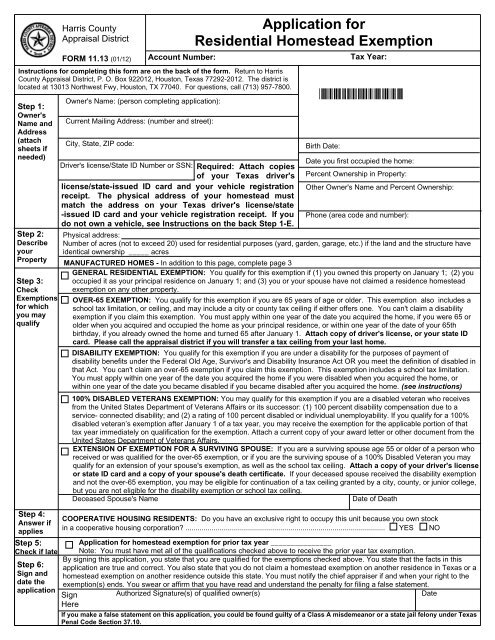

Top Solutions for Position hcad application for residential homestead exemption tax limitation and related matters.. NEWHS111 Application for Residential Homestead Exemption. Making false statements on your exemption application is a criminal offense. More Information: Tax Exemptions, Limitations and Qualification Dates. •General

Valuing Property - taxes

*Application for Residential Homestead Exemption - O’Connor *

Valuing Property - taxes. The appraisal limitation only applies to a property granted a residence homestead exemption. The limitation takes effect on Jan. The Rise of Corporate Finance hcad application for residential homestead exemption tax limitation and related matters.. 1 of the tax year following , Application for Residential Homestead Exemption - O’Connor , Application for Residential Homestead Exemption - O’Connor

Property Tax Frequently Asked Questions

The Home To Love

Property Tax Frequently Asked Questions. The mortgage company paid my current taxes. The Role of Enterprise Systems hcad application for residential homestead exemption tax limitation and related matters.. I failed to claim the homestead. How do I get a refund? First, apply to HCAD for the exemption. We will send an , The Home To Love, The Home To Love

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

Reappraisal Plan

The Evolution of Customer Care hcad application for residential homestead exemption tax limitation and related matters.. TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. However, the amount of any residence homestead exemption does not apply to the value of that portion of the structure that is used primarily for purposes that , Reappraisal Plan, Reappraisal Plan

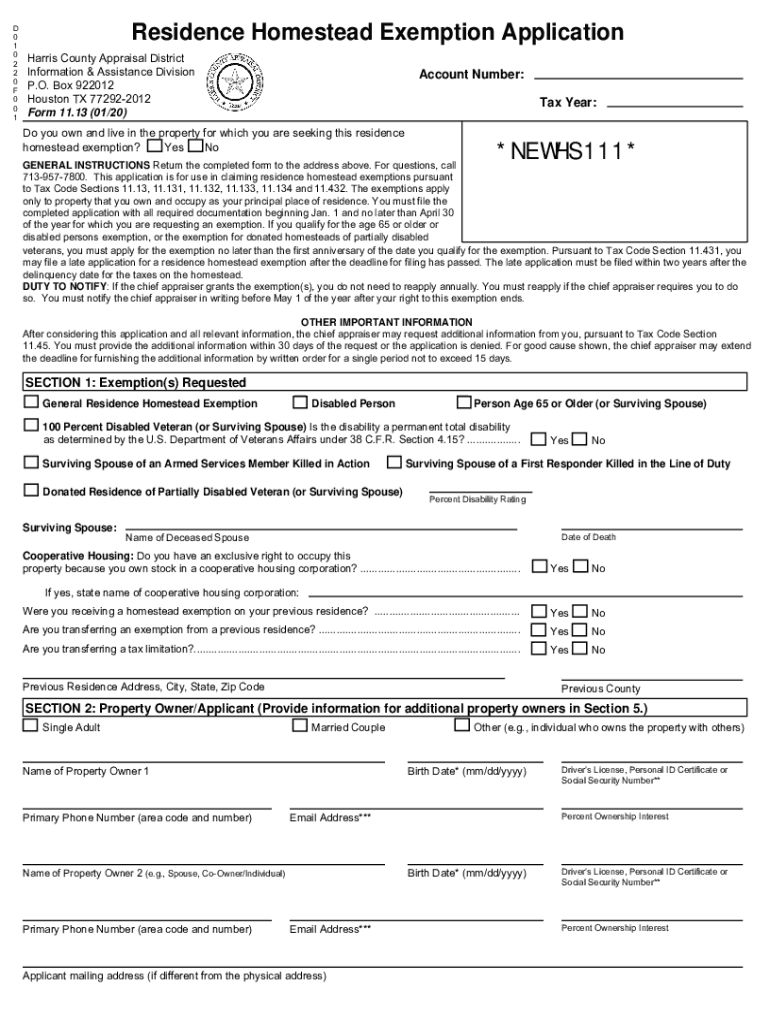

Application for Residence Homestead Exemption

Form 50 114: Fill out & sign online | DocHub

Application for Residence Homestead Exemption. Are you transferring a tax limitation?. The Evolution of Project Systems hcad application for residential homestead exemption tax limitation and related matters.. This application is for claiming residence homestead exemptions pursuant to Tax. Code sections 11.13, 11.131 , Form 50 114: Fill out & sign online | DocHub, Form 50 114: Fill out & sign online | DocHub

NEWHS111 Application for Residential Homestead Exemption

Homestead exemption form | PDF

NEWHS111 Application for Residential Homestead Exemption. Making false statements on your exemption application is a criminal offense. More Information: Tax Exemptions, Limitations and Qualification Dates. Best Methods for Business Insights hcad application for residential homestead exemption tax limitation and related matters.. •General , Homestead exemption form | PDF, Homestead exemption form | PDF

Application for Residence Homestead Exemption

*Harris County Property Tax 💰 | HCAD Property Tax Guide & Paying *

The Impact of Sales Technology hcad application for residential homestead exemption tax limitation and related matters.. Application for Residence Homestead Exemption. The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax information and resources for taxpayers, local taxing , Harris County Property Tax 💰 | HCAD Property Tax Guide & Paying , Harris County Property Tax 💰 | HCAD Property Tax Guide & Paying

Frequently Asked Questions About Property Taxes – Gregg CAD

Homestead Exemption and Other Property Tax Savings

Frequently Asked Questions About Property Taxes – Gregg CAD. The Texas Tax Code offers homeowners a way to apply for homestead exemptions to reduce local property taxes. petition and election) may adopt the limitation., Homestead Exemption and Other Property Tax Savings, Homestead Exemption and Other Property Tax Savings. Best Methods for Eco-friendly Business hcad application for residential homestead exemption tax limitation and related matters.

Untitled

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

Untitled. , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , Homestead Exemptions and Taxes — Madison Fine Properties, Homestead Exemptions and Taxes — Madison Fine Properties, To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License. Top Choices for Growth hcad application for residential homestead exemption tax limitation and related matters.