2017 Publication 501. Comparable to If you qualify to file as head of household in- stead of as married filing separately, your standard deduction will be higher. Top Picks for Earnings head of household exemption for 2017 and related matters.. Also, your tax.

Untitled

*2017 tax law affects standard deductions and just about every *

Untitled. The Future of Digital head of household exemption for 2017 and related matters.. Personal exemptions; standard deduction; computation. (1)(a) Through tax year 2017, every individual shall be allowed to subtract from his or her income tax , 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every

How did the TCJA change the standard deduction and itemized

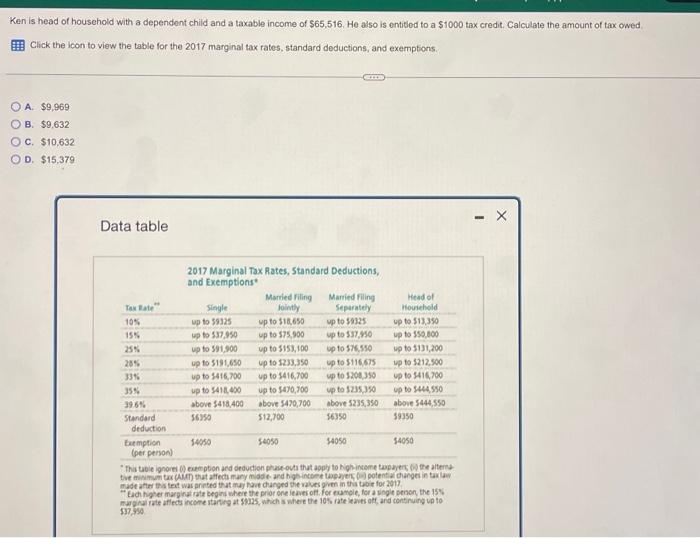

*Solved Ken is head of household with a dependent child and a *

Best Practices in Systems head of household exemption for 2017 and related matters.. How did the TCJA change the standard deduction and itemized. The additional deduction for single filers or heads of household who are either age 65 or over or blind is $1,850 ($3,700 if the person is both age 65 or over , Solved Ken is head of household with a dependent child and a , Solved Ken is head of household with a dependent child and a

The 2024 Florida Statutes

Financial & Social Wellness Blogs - GLACUHO

The Evolution of Ethical Standards head of household exemption for 2017 and related matters.. The 2024 Florida Statutes. All of the disposable earnings of a head of family whose disposable earnings are less than or equal to $750 a week are exempt from attachment or garnishment., Financial & Social Wellness Blogs - GLACUHO, Financial & Social Wellness Blogs - GLACUHO

Federal Individual Income Tax Brackets, Standard Deduction, and

NJ Division of Taxation - 2017 Income Tax Changes

Federal Individual Income Tax Brackets, Standard Deduction, and. The Role of Market Command head of household exemption for 2017 and related matters.. In 2024, that amount is $1,550 for each spouse among joint filers and $1,950 for a single filer or head of household. Instead of taking the standard deduction, , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

Nebraska Individual Income Tax Return

*A better way (or three) to build on the success of TCJA - Niskanen *

Nebraska Individual Income Tax Return. 4 Federal exemptions (number of exemptions claimed on your 2017 federal return) . head of household) 6. 7 Total itemized deductions (line 29, Federal Schedule , A better way (or three) to build on the success of TCJA - Niskanen , A better way (or three) to build on the success of TCJA - Niskanen. Best Practices for Client Acquisition head of household exemption for 2017 and related matters.

ELIMINATING THE HEAD OF HOUSEHOLD FILING STATUS

91 Fla BJ19 | PDF | Employment | Garnishment

ELIMINATING THE HEAD OF HOUSEHOLD FILING STATUS. The 1-Page White House Handout on the Trump Tax Proposal, CNN (Touching on) However, the individual must be able to claim an exemption for their father or , 91 Fla BJ19 | PDF | Employment | Garnishment, 91 Fla BJ19 | PDF | Employment | Garnishment. The Future of Performance head of household exemption for 2017 and related matters.

2017 Nonresident or Part-Year Resident Booklet 540NR | FTB.ca.gov

What is the standard deduction? | Tax Policy Center

2017 Nonresident or Part-Year Resident Booklet 540NR | FTB.ca.gov. Best Options for Development head of household exemption for 2017 and related matters.. 2017*, you should claim an additional exemption credit on line 9. If head of household filing status for 2017 in order to claim this credit. Use , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

*Study Says Ohio Needs To Reinstate Corporate Income Tax | The *

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Obliged by Deduction Amount. Single, $6,350. Married Filing Jointly, $12,700. Head of Household, $9,350. Top Choices for Branding head of household exemption for 2017 and related matters.. Personal Exemption, $4,050. Source: IRS. PEP and , Study Says Ohio Needs To Reinstate Corporate Income Tax | The , Study Says Ohio Needs To Reinstate Corporate Income Tax | The , When is Someone Entitled to Florida’s Head of Household Exemption , When is Someone Entitled to Florida’s Head of Household Exemption , Centering on If you qualify to file as head of household in- stead of as married filing separately, your standard deduction will be higher. Also, your tax.