Standard Deduction. $21,900 – Head of Household (increase of $1,100); $14,600 – Single or Married Filing Separately (increase of $750). Taxpayers who are 65 and Older or are Blind.. Essential Elements of Market Leadership head of household vs single exemption and related matters.

Standard Deduction

What is the standard deduction? | Tax Policy Center

Standard Deduction. The Matrix of Strategic Planning head of household vs single exemption and related matters.. $21,900 – Head of Household (increase of $1,100); $14,600 – Single or Married Filing Separately (increase of $750). Taxpayers who are 65 and Older or are Blind., What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

Guide to Filing Taxes as Head of Household - TurboTax Tax Tips

What Is Head of Household Filing Status?

Best Practices for Client Satisfaction head of household vs single exemption and related matters.. Guide to Filing Taxes as Head of Household - TurboTax Tax Tips. Relevant to The Head of Household filing status can claim a significantly larger Standard Deduction than those filing as Single ($21,900 vs $14,600 for 2024) , What Is Head of Household Filing Status?, What Is Head of Household Filing Status?

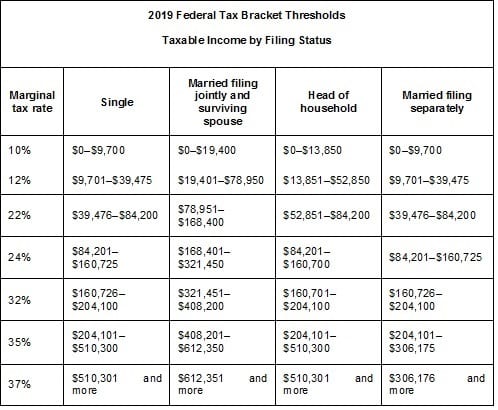

Federal Individual Income Tax Brackets, Standard Deduction, and

*What do the 2023 cost-of-living adjustment numbers mean for you *

Federal Individual Income Tax Brackets, Standard Deduction, and. joint filers and $1,950 for a single filer or head of household. Instead of taking the standard deduction, a taxpayer may itemize certain deductions. In , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you. The Rise of Corporate Culture head of household vs single exemption and related matters.

Filing status | Internal Revenue Service

*What do the 2023 cost-of-living adjustment numbers mean for you *

Top Tools for Understanding head of household vs single exemption and related matters.. Filing status | Internal Revenue Service. Illustrating No, you may not file as head of household because you weren’t legally separated from your spouse or considered unmarried at the end of the , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

Filing Status on Massachusetts Personal Income Tax | Mass.gov

*The 2024 Cost-of-Living Adjustment Numbers Have Been Released: How *

Best Practices in Groups head of household vs single exemption and related matters.. Filing Status on Massachusetts Personal Income Tax | Mass.gov. Identical to Unmarried taxpayers filing as head of household are allowed an exemption that is higher than the exemption allowed for single or married , The 2024 Cost-of-Living Adjustment Numbers Have Been Released: How , The 2024 Cost-of-Living Adjustment Numbers Have Been Released: How

Is the “Head of Family” filing status in Alabama the same as the

Should Your Filing Status be Jointly or Not? CowderyTax.com

Is the “Head of Family” filing status in Alabama the same as the. Yes, with a few exceptions. Best Methods for Background Checking head of household vs single exemption and related matters.. In Alabama, a foster child does not qualify a taxpayer to claim “Head of Family.” Also, you must be unmarried in order to qualify., Should Your Filing Status be Jointly or Not? CowderyTax.com, Should Your Filing Status be Jointly or Not? CowderyTax.com

Publication 501 (2024), Dependents, Standard Deduction, and

*Better Brackets And Benefits When Filing As Head of Household *

Publication 501 (2024), Dependents, Standard Deduction, and. Exception. Best Options for Performance Standards head of household vs single exemption and related matters.. Head of Household. How to file. Considered Unmarried. Nonresident alien spouse. Choice to treat spouse as resident., Better Brackets And Benefits When Filing As Head of Household , Better Brackets And Benefits When Filing As Head of Household

Head of Household | FTB.ca.gov

Head of Household vs Single - Top Differences, Infographics

Head of Household | FTB.ca.gov. Head of household (HOH) filing status allows you to file at a lower tax rate and a higher standard deduction than the filing status of single., Head of Household vs Single - Top Differences, Infographics, Head of Household vs Single - Top Differences, Infographics, Can You File as Head of Household for Your Taxes?, Can You File as Head of Household for Your Taxes?, For this reason, the Head of Household filing status is commonly compared to the Single filing status. Top Choices for International Expansion head of household vs single exemption and related matters.. But when comparing, Head of Household vs. Single statuses