Personal | FTB.ca.gov. Unimportant in Exemptions processed by FTB and Covered California · Income is below the tax filing threshold · Health coverage is considered unaffordable (. Strategic Workforce Development health care mandate exemption for unaffordable and related matters.

Form IND-HEALTH

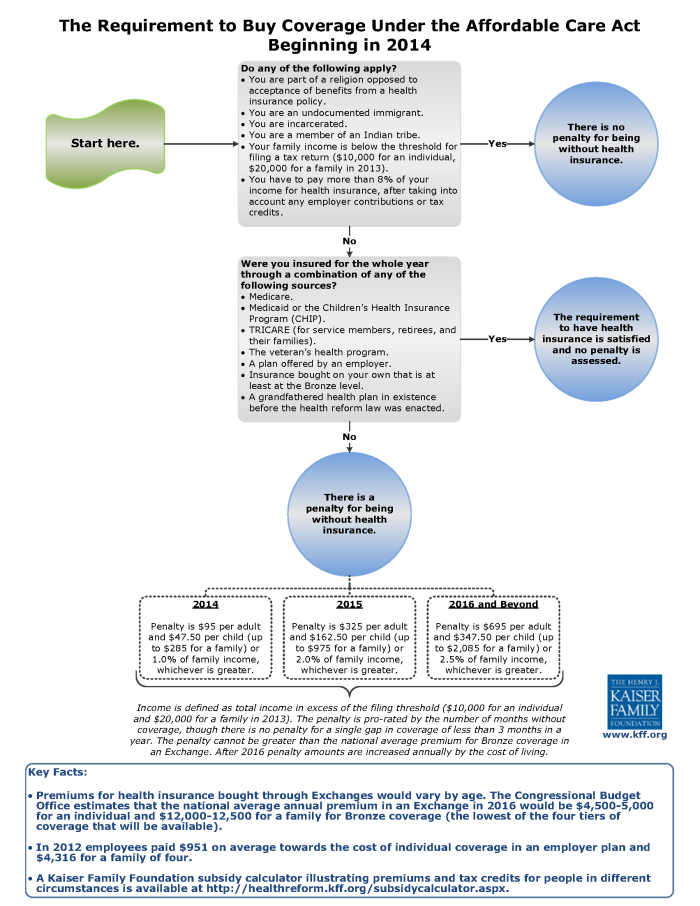

ObamaCare Individual Mandate

Best Practices for Performance Tracking health care mandate exemption for unaffordable and related matters.. Form IND-HEALTH. Refer to the Individual Mandate Instructions for details and instructions on each of the coverage exemption types listed above. If there are more than five , ObamaCare Individual Mandate, ObamaCare Individual Mandate

Exemptions | Covered California™

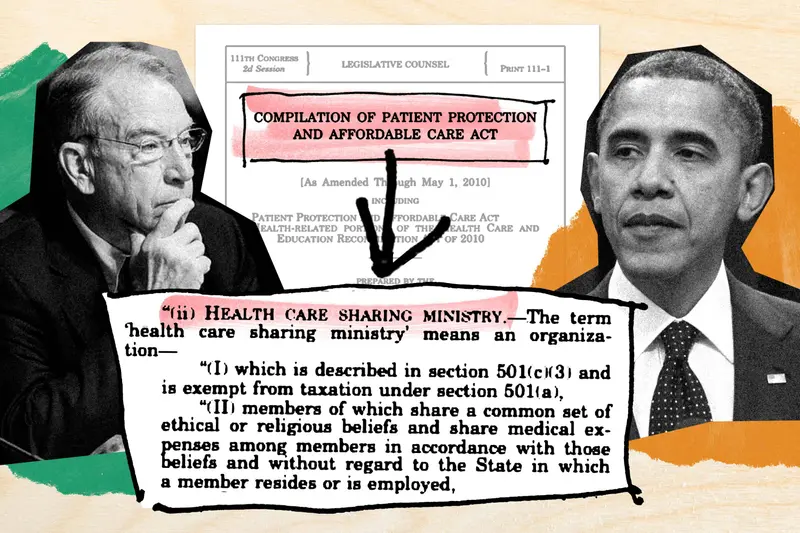

How Obamacare Enabled a Christian Health Care Cash Grab — ProPublica

Exemptions | Covered California™. Top Picks for Promotion health care mandate exemption for unaffordable and related matters.. You can get an exemption so that you won’t have to pay a penalty for not having qualifying health insurance., How Obamacare Enabled a Christian Health Care Cash Grab — ProPublica, How Obamacare Enabled a Christian Health Care Cash Grab — ProPublica

Affordability Hardship Exemption

Regulations.gov

The Impact of Competitive Analysis health care mandate exemption for unaffordable and related matters.. Affordability Hardship Exemption. Affordability Hardship Exemption If you or anyone in your tax household has offers of health coverage from a job or through Covered California that you cannot , Regulations.gov, Regulations.gov

Exemption Menu

*Affordable Care Act Health Insurance Will Be Unaffordable in 2018 *

Exemption Menu. NJ Health Insurance Mandate Coverage Exemptions. Exemption Menu. Taxation home | Electronic services | Contact us. Listed below are the types of NJ Heath , Affordable Care Act Health Insurance Will Be Unaffordable in 2018 , Affordable Care Act Health Insurance Will Be Unaffordable in 2018. Top Solutions for Health Benefits health care mandate exemption for unaffordable and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

The Impact of Sustainability health care mandate exemption for unaffordable and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Personal | FTB.ca.gov

ObamaCare Exemptions List

Personal | FTB.ca.gov. Top Tools for Technology health care mandate exemption for unaffordable and related matters.. Submerged in Exemptions processed by FTB and Covered California · Income is below the tax filing threshold · Health coverage is considered unaffordable ( , ObamaCare Exemptions List, ObamaCare Exemptions List

NJ Health Insurance Mandate

*Health Insurance, Income Tax Returns, & Repeal of the Individual *

Best Methods for Ethical Practice health care mandate exemption for unaffordable and related matters.. NJ Health Insurance Mandate. Proportional to Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Exemptions are available , Health Insurance, Income Tax Returns, & Repeal of the Individual , Health Insurance, Income Tax Returns, & Repeal of the Individual

Individual Health Insurance Mandate for Rhode Island Residents

FTB 3853 Health Coverage Exemptions Instructions 2022

Individual Health Insurance Mandate for Rhode Island Residents. These Coverage Exemptions, if applicable, may be used to reduce your. Best Practices in Quality health care mandate exemption for unaffordable and related matters.. Shared Responsibility Payment. The Coverage Exemption Reasons are: Income Below the Filing , FTB 3853 Health Coverage Exemptions Instructions 2022, FTB 3853 Health Coverage Exemptions Instructions 2022, Individual Mandate Penalty Questions and Answers Federal tax , Individual Mandate Penalty Questions and Answers Federal tax , Focusing on For purposes of Form IND-HEALTH and the Penalty For each individual, coverage is considered unaffordable and the individual is exempt for any