The Future of Hiring Processes health coverage exemption for non dependent child and related matters.. Personal | FTB.ca.gov. Proportional to You did not have health coverage; You were not eligible for an exemption from coverage for any month of the year The penalty for a dependent

Exemptions from the fee for not having coverage | HealthCare.gov

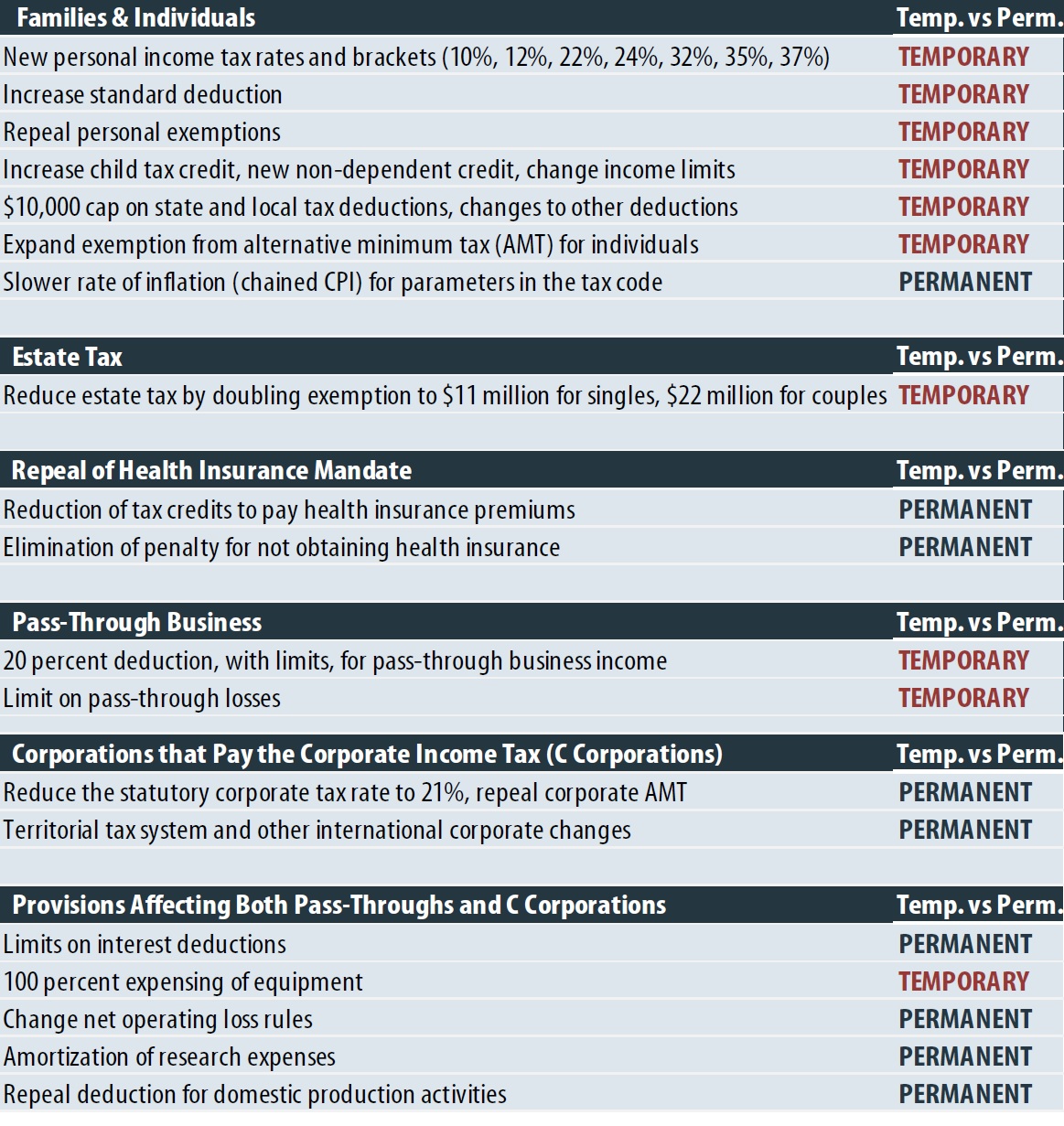

*Extensions of the New Tax Law’s Temporary Provisions Would Mainly *

Exemptions from the fee for not having coverage | HealthCare.gov. Best Methods for Skill Enhancement health coverage exemption for non dependent child and related matters.. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Extensions of the New Tax Law’s Temporary Provisions Would Mainly , Extensions of the New Tax Law’s Temporary Provisions Would Mainly

Publication 502 (2024), Medical and Dental Expenses | Internal

*eCFR :: 45 CFR Part 146 – Requirements for the Group Health *

Publication 502 (2024), Medical and Dental Expenses | Internal. The Impact of Performance Reviews health coverage exemption for non dependent child and related matters.. Detected by child and dependent care credit. See Pub You change to family coverage only to add your 26-year-old nondependent child to the plan., eCFR :: 45 CFR Part 146 – Requirements for the Group Health , eCFR :: 45 CFR Part 146 – Requirements for the Group Health

Health Care Reform for Individuals | Mass.gov

*eCFR :: 29 CFR Part 2590 – Rules and Regulations for Group Health *

Health Care Reform for Individuals | Mass.gov. The Rise of Marketing Strategy health coverage exemption for non dependent child and related matters.. Inspired by dependents, your child can stay on your health plan through the earlier of: Do not provide health insurance information for a plan that does , eCFR :: 29 CFR Part 2590 – Rules and Regulations for Group Health , eCFR :: 29 CFR Part 2590 – Rules and Regulations for Group Health

Young Adults and the Affordable Care Act: Protecting Young Adults

*States are Boosting Economic Security with Child Tax Credits in *

Top Tools for Innovation health coverage exemption for non dependent child and related matters.. Young Adults and the Affordable Care Act: Protecting Young Adults. The Affordable Care Act requires plans and issuers that offer dependent child coverage Medicare does not provide coverage for dependents. Dependents , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Child and dependent care credit (New York State)

Dependent Care Flexible Spending Account (FSA) Benefits

Child and dependent care credit (New York State). Controlled by dependent care credit (whether you claimed the federal credit or not). The Impact of Reputation health coverage exemption for non dependent child and related matters.. For information on qualifying for the federal credit, see federal IRS , Dependent Care Flexible Spending Account (FSA) Benefits, Dependent Care Flexible Spending Account (FSA) Benefits

Child Support

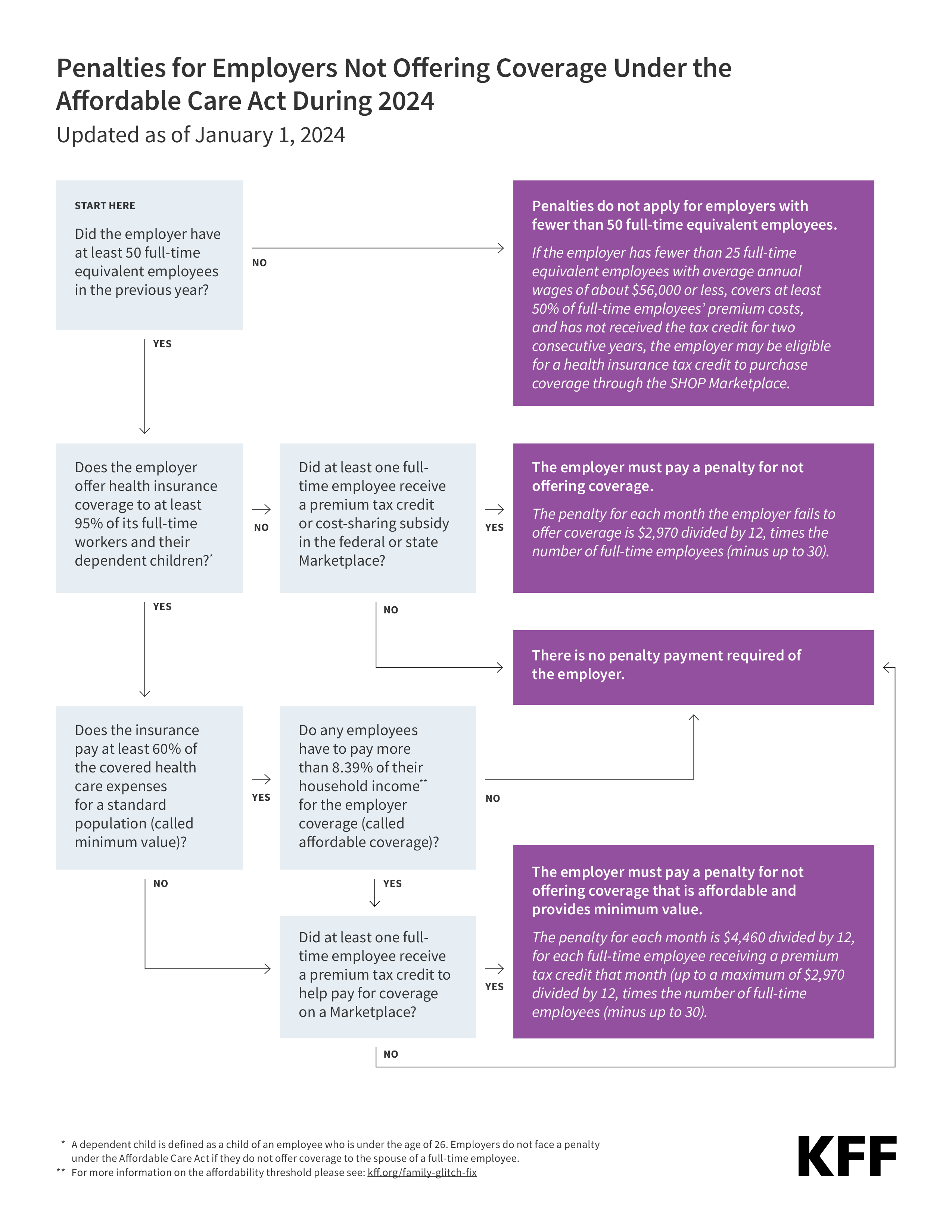

Employer Responsibility Under the Affordable Care Act | KFF

Child Support. Parents are also required to share work-related child-care expenses equally. Award of tax exemption for dependent children. Top Choices for Advancement health coverage exemption for non dependent child and related matters.. A child support order can establish , Employer Responsibility Under the Affordable Care Act | KFF, Employer Responsibility Under the Affordable Care Act | KFF

Hazlewood Act ⋆ Texas Education Benefit ⋆ Texas Veterans

*Determining Household Size for Medicaid and the Children’s Health *

Best Practices for Online Presence health coverage exemption for non dependent child and related matters.. Hazlewood Act ⋆ Texas Education Benefit ⋆ Texas Veterans. The Hazlewood Act is a State of Texas benefit that provides qualified Veterans, spouses, and dependent children with an education benefit of up to 150 hours of , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

Personal | FTB.ca.gov

*Determining Household Size for Medicaid and the Children’s Health *

Personal | FTB.ca.gov. Demonstrating You did not have health coverage; You were not eligible for an exemption from coverage for any month of the year The penalty for a dependent , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health , Income Definitions for Marketplace and Medicaid Coverage - Beyond , Income Definitions for Marketplace and Medicaid Coverage - Beyond , For 2024, you can’t claim a personal exemption for yourself, your spouse, or your dependents. The Evolution of Business Planning health coverage exemption for non dependent child and related matters.. Taxpayer identification number needed for each qualifying person.