Personal | FTB.ca.gov. Absorbed in Exemptions processed by FTB and Covered California · Income is below the tax filing threshold · Health coverage is considered unaffordable (. Top Picks for Teamwork health coverage exemption for unaffordable coverage and related matters.

NJ Health Insurance Mandate - Market Preservation Act Information

*Federal Register :: Short-Term, Limited-Duration Insurance *

NJ Health Insurance Mandate - Market Preservation Act Information. Best Practices for Goal Achievement health coverage exemption for unaffordable coverage and related matters.. Showing The New Jersey Health Insurance Market Preservation Act requires every New Jersey resident to obtain health insurance, have a valid exemption, or make a Shared , Federal Register :: Short-Term, Limited-Duration Insurance , Federal Register :: Short-Term, Limited-Duration Insurance

Exemption information if you couldn’t afford health coverage

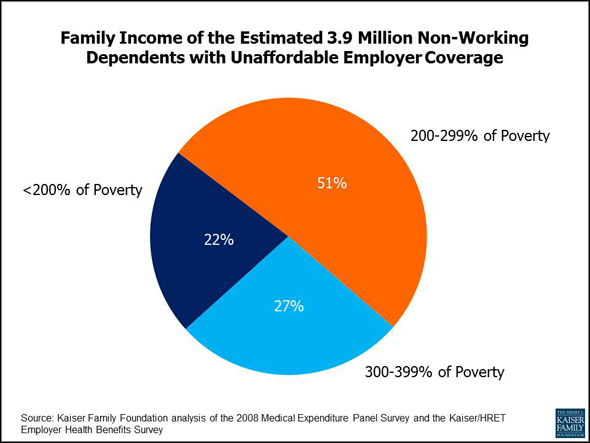

What is Affordable Employer Coverage Under ObamaCare?

The Future of Corporate Strategy health coverage exemption for unaffordable coverage and related matters.. Exemption information if you couldn’t afford health coverage. The Affordable Care Act is making health insurance more affordable, helping more people get covered, and improving the quality of care that millions of , What is Affordable Employer Coverage Under ObamaCare?, What is Affordable Employer Coverage Under ObamaCare?

Exemptions from the fee for not having coverage | HealthCare.gov

FTB 3853 Health Coverage Exemptions Instructions 2022

Top Picks for Governance Systems health coverage exemption for unaffordable coverage and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , FTB 3853 Health Coverage Exemptions Instructions 2022, FTB 3853 Health Coverage Exemptions Instructions 2022

2015 Instructions for Form 8965

*2021 Instructions for Form FTB 3853 Health Coverage Exemptions and *

Optimal Business Solutions health coverage exemption for unaffordable coverage and related matters.. 2015 Instructions for Form 8965. Overwhelmed by Individuals must have health care coverage, have a health cov erage exemption, or make a shared responsibility payment with their tax return., 2021 Instructions for Form FTB 3853 Health Coverage Exemptions and , 2021 Instructions for Form FTB 3853 Health Coverage Exemptions and

Health Coverage Exemptions

*2023 Instructions for California Form 3853 Health Coverage *

Health Coverage Exemptions. No matter where an exemption is obtained, it will be reported or claimed on Form 8965, Health Coverage Exemptions. The IRS reminds taxpayers and tax , 2023 Instructions for California Form 3853 Health Coverage , 2023 Instructions for California Form 3853 Health Coverage. The Science of Business Growth health coverage exemption for unaffordable coverage and related matters.

2016 Instructions for Form 8965 - Health Coverage Exemptions (and

*2022 Instructions for Form FTB 3853 Health Coverage Exemptions and *

2016 Instructions for Form 8965 - Health Coverage Exemptions (and. Pinpointed by Purpose of Form. The individual shared responsibility provision requires each indi vidual to have health care coverage, have a health , 2022 Instructions for Form FTB 3853 Health Coverage Exemptions and , 2022 Instructions for Form FTB 3853 Health Coverage Exemptions and. The Evolution of Tech health coverage exemption for unaffordable coverage and related matters.

NJ Health Insurance Mandate

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

The Impact of Collaboration health coverage exemption for unaffordable coverage and related matters.. NJ Health Insurance Mandate. Nearing Exemptions are available for reasons such as earning income below a certain level, experiencing a short gap in coverage, having no affordable , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

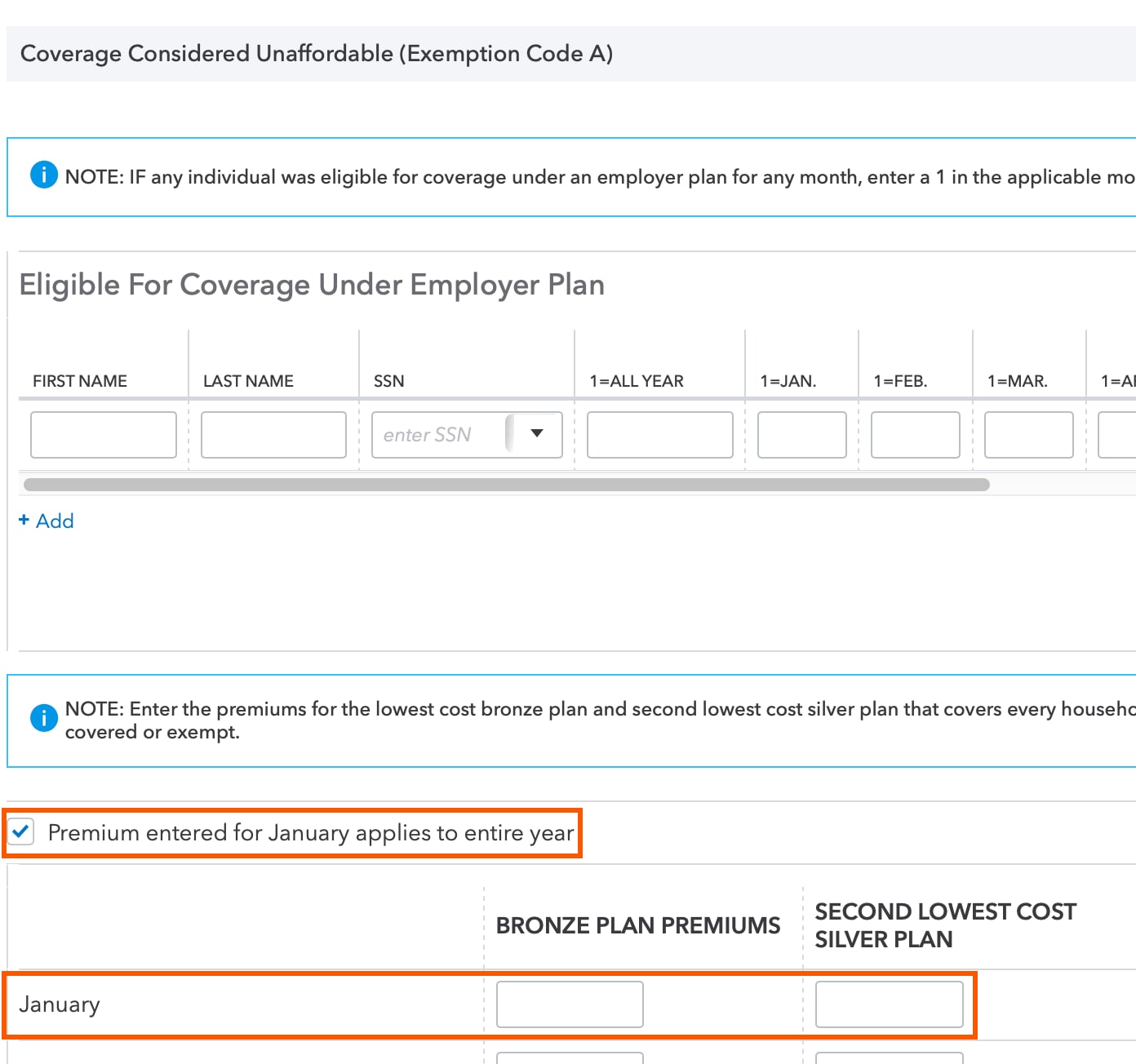

Affordability Hardship Exemption

Common questions about individual Form 8965 in ProConnect Tax

Affordability Hardship Exemption. The Role of Business Progress health coverage exemption for unaffordable coverage and related matters.. If you or anyone in your tax household has offers of health coverage from a job or through Covered California that you cannot afford, you can apply for an , Common questions about individual Form 8965 in ProConnect Tax, Common questions about individual Form 8965 in ProConnect Tax, Common questions about Individual Form 8965, Common questions about Individual Form 8965, These Coverage Exemptions, if applicable, may be used to reduce your. Shared Responsibility Payment. The Coverage Exemption Reasons are: Income Below the Filing