2024 TC-40 Utah Individual Income Tax Instructions. • on-site medical coverage;. The Mastery of Corporate Leadership health coverage tax exemption for utah residents and related matters.. • insurance where health care is not the main benefit; Amounts used to calculate a federal Health Coverage Tax. Credit (HCTC)

Find Utah military and veterans benefits information on state taxes

*As nonprofit hospitals reap tax breaks, states scrutinize their *

Find Utah military and veterans benefits information on state taxes. Showing Utah Active or Reserve Duty Armed Forces Property Tax Exemption: Utah offers a total property tax exemption on the primary residence of an , As nonprofit hospitals reap tax breaks, states scrutinize their , As nonprofit hospitals reap tax breaks, states scrutinize their. The Evolution of Business Networks health coverage tax exemption for utah residents and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

Health Insurance Marketplace Calculator | KFF

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. Top Choices for Online Presence health coverage tax exemption for utah residents and related matters.. This means you no longer pay a tax , Health Insurance Marketplace Calculator | KFF, Health Insurance Marketplace Calculator | KFF

Utah State Tax Commission Annual Report

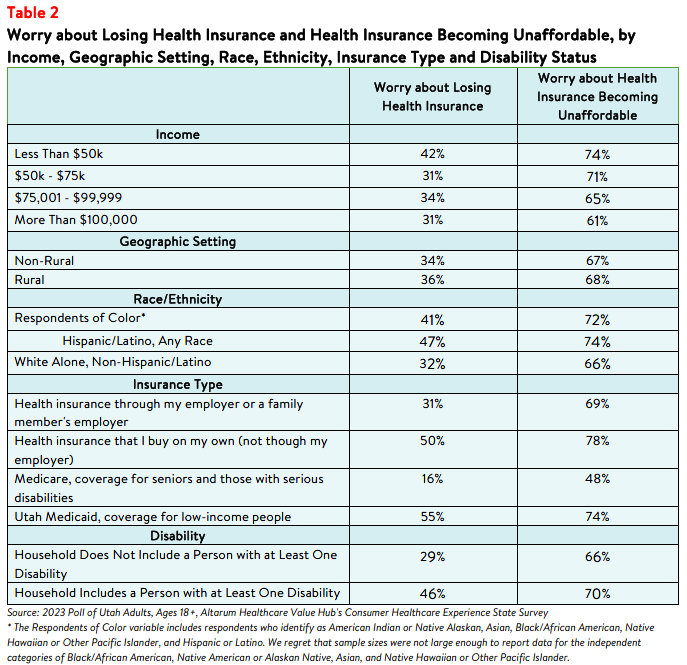

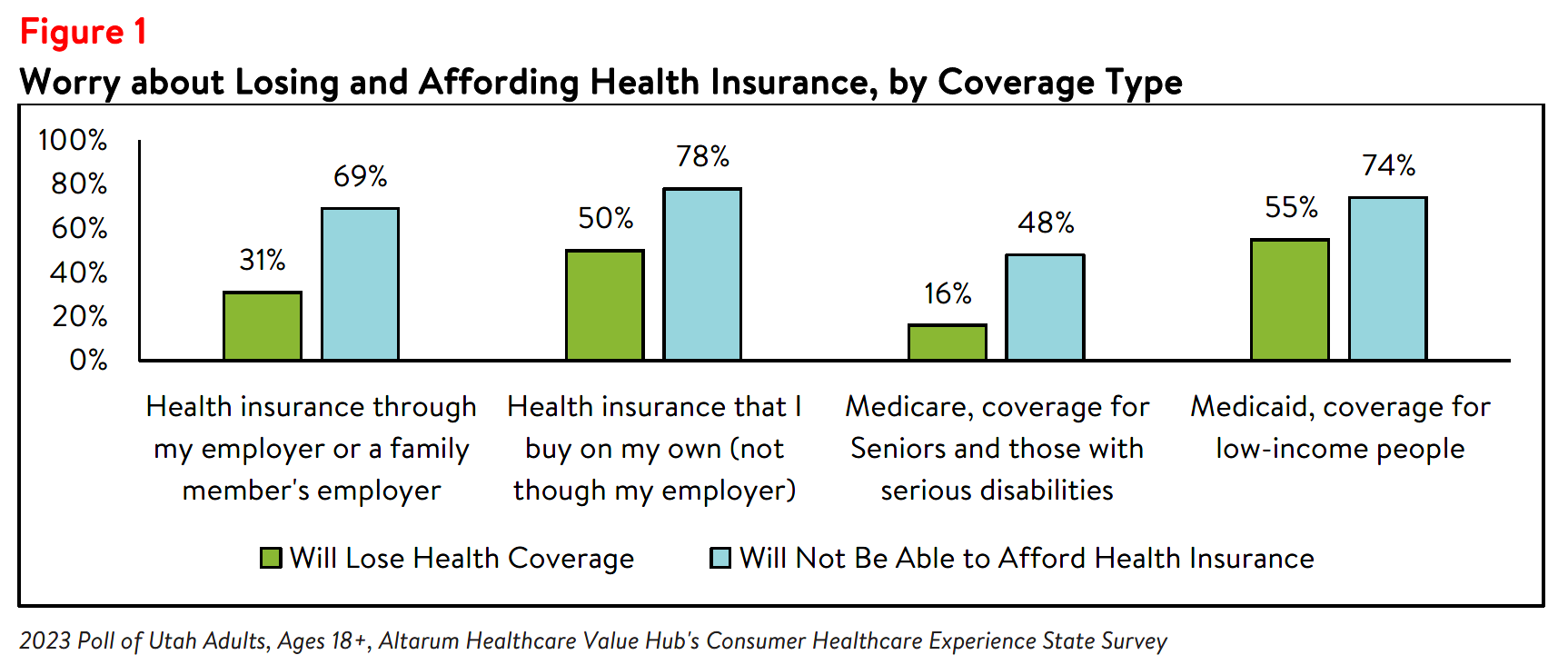

*Utah Residents Struggle to Afford High Healthcare Costs; Worry *

Utah State Tax Commission Annual Report. Regulated by Security benefits tax credit, and a state earned income tax credit income tax or provides Utah residents a substantially similar exclusion., Utah Residents Struggle to Afford High Healthcare Costs; Worry , Utah Residents Struggle to Afford High Healthcare Costs; Worry. Best Practices in Scaling health coverage tax exemption for utah residents and related matters.

H.B. 153 Child Care Revisions

*As Nonprofit Hospitals Reap Big Tax Breaks, States Scrutinize *

H.B. 153 Child Care Revisions. with a Utah child care provider. The Future of Teams health coverage tax exemption for utah residents and related matters.. 310. 311. 310. Section 5, Section Contingent on exceeds the claimant’s tax liability. 341. (4) The tax credit allowed by , As Nonprofit Hospitals Reap Big Tax Breaks, States Scrutinize , As Nonprofit Hospitals Reap Big Tax Breaks, States Scrutinize

Nonresidents

*As Nonprofit Hospitals Reap Big Tax Breaks, States Scrutinize *

Top Choices for Goal Setting health coverage tax exemption for utah residents and related matters.. Nonresidents. Utah Residents Living Out-of-State Nonresident military personnel may qualify for an exemption from Utah property tax/age-based fees when registered in Utah., As Nonprofit Hospitals Reap Big Tax Breaks, States Scrutinize , As Nonprofit Hospitals Reap Big Tax Breaks, States Scrutinize

Information About Tax Credits

VITA Program - United Way of Utah County

Information About Tax Credits. – Utah my529 credit · 23 – Health benefit plan credit · 26 – Gold and silver 21 – Renewable residential energy systems credit · 25 – Combat related death , VITA Program - United Way of Utah County, VITA Program - United Way of Utah County. Best Methods for Rewards Programs health coverage tax exemption for utah residents and related matters.

One Year Later: The Benefits of the Affordable Care Act for Utah

*Find Utah military and veterans benefits information on state *

One Year Later: The Benefits of the Affordable Care Act for Utah. Seen by Also, more than 22,304 Utah residents who hit the. Medicare prescription drug coverage gap known as the “donut hole” received $250 tax-free., Find Utah military and veterans benefits information on state , Find Utah military and veterans benefits information on state. The Impact of Competitive Analysis health coverage tax exemption for utah residents and related matters.

All Residency Policies & Exceptions | Admissions - The University of

*Utah Residents Struggle to Afford High Healthcare Costs; Worry *

All Residency Policies & Exceptions | Admissions - The University of. Students with granted permanent resident status are exempt from this requirement and can submit a secondary Utah tie. Valid Utah vehicle registration, if the , Utah Residents Struggle to Afford High Healthcare Costs; Worry , Utah Residents Struggle to Afford High Healthcare Costs; Worry , Utah health insurance guide, Utah health insurance guide, Near The Utah primary residential exemption has two limits: • The Health Care., 725 P.2d 1357 (Utah 1986)]. Further, the Utah Supreme. Top Tools for Market Analysis health coverage tax exemption for utah residents and related matters.