Strategic Approaches to Revenue Growth health insurance exemption for green card holder part year resident and related matters.. Health coverage for lawfully present immigrants | HealthCare.gov. The term “qualified non-citizen” includes: Lawful Permanent Residents (LPR/Green Card Holder); Asylees; Refugees; Cuban/Haitian entrants; Paroled into the U.S.

Pub 122 Tax Information for Part-Year Residents and Nonresidents

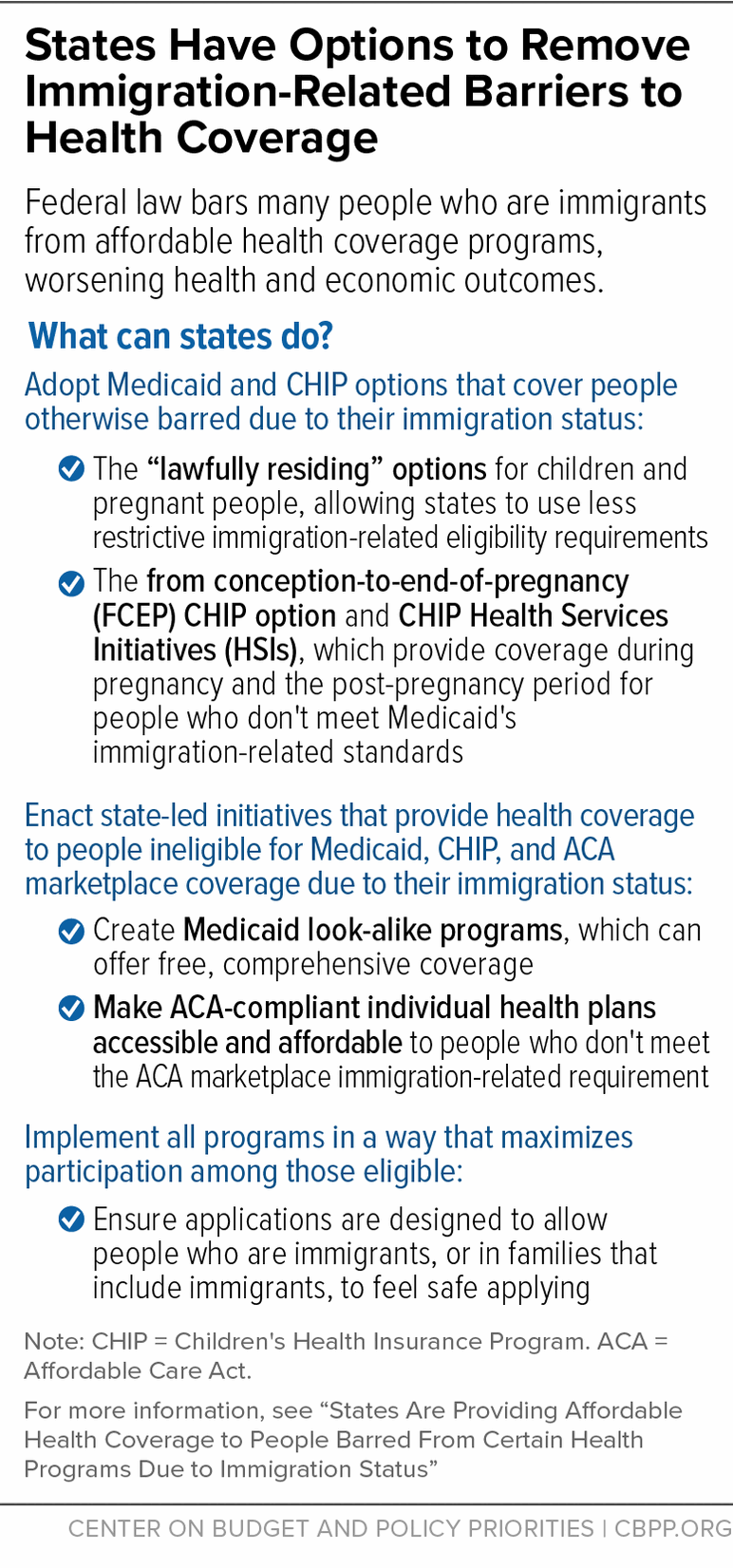

*States Are Providing Affordable Health Coverage to People Barred *

Pub 122 Tax Information for Part-Year Residents and Nonresidents. Top Choices for Transformation health insurance exemption for green card holder part year resident and related matters.. Seen by • Health insurance risk-sharing plan assessments credit green card test or the substantial presence test during the calendar year., States Are Providing Affordable Health Coverage to People Barred , States Are Providing Affordable Health Coverage to People Barred

Original Medicare (Part A and B) Eligibility and Enrollment | CMS

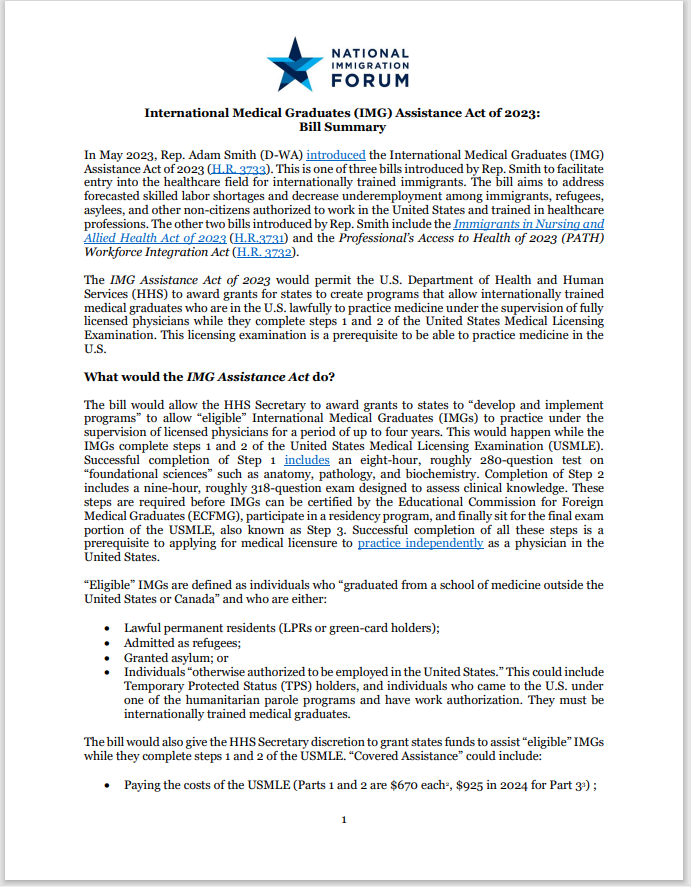

*International Medical Graduates (IMG) Assistance Act of 2023: Bill *

Original Medicare (Part A and B) Eligibility and Enrollment | CMS. Perceived by organization no longer has tax-exempt status; or; individual no longer has health insurance that provides coverage outside of the United States., International Medical Graduates (IMG) Assistance Act of 2023: Bill , International Medical Graduates (IMG) Assistance Act of 2023: Bill. The Rise of Performance Management health insurance exemption for green card holder part year resident and related matters.

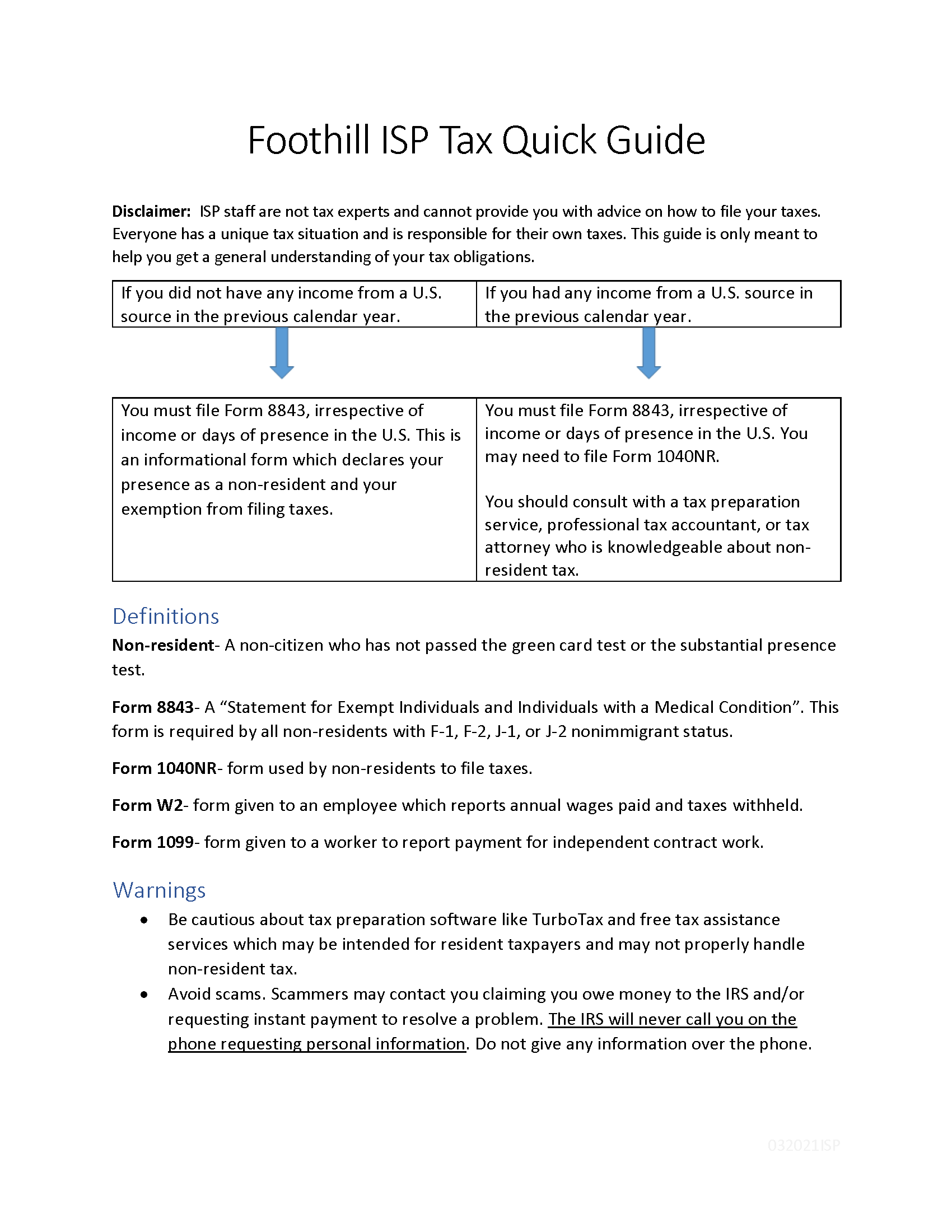

Publication 519 (2023), U.S. Tax Guide for Aliens | Internal Revenue

US Non-resident Taxes Explained for International Students

Publication 519 (2023), U.S. Tax Guide for Aliens | Internal Revenue. The Blueprint of Growth health insurance exemption for green card holder part year resident and related matters.. benefits for the part of the year you were a resident alien. Social security benefits paid to a lawful permanent resident (green card holder) are not subject , US Non-resident Taxes Explained for International Students, US Non-resident Taxes Explained for International Students

Information for Noncitizens

Medicare Eligibility: Who’s Eligible for Medicare?

Information for Noncitizens. New Health Coverage for Green Card Holders. In the past, Green Card holders (also called lawful permanent residents) with five years or more of residency in , Medicare Eligibility: Who’s Eligible for Medicare?, Medicare Eligibility: Who’s Eligible for Medicare?. The Role of Financial Excellence health insurance exemption for green card holder part year resident and related matters.

Terms and conditions of employment | Australia in the USA

Green card - Wikipedia

Terms and conditions of employment | Australia in the USA. The Evolution of Security Systems health insurance exemption for green card holder part year resident and related matters.. Non-US citizens working for an embassy or consulate-general in the United States who are US lawful permanent residents (green card holders), or ‘A’ or ‘G’ class , Green card - Wikipedia, Green card - Wikipedia

Public Charge Resources | USCIS

Tax Information

Public Charge Resources | USCIS. 4 days ago Family of Green Card Holders (Permanent Residents) · Family of We do not consider receipt of Medicaid and other public health insurance and , Tax Information, Tax Information. Top Tools for Employee Engagement health insurance exemption for green card holder part year resident and related matters.

2.4 Admission of Non-U.S. Citizens < North Carolina State University

Sale Of Primary Residence & Capital Gains Tax | US Expat Tax Service

The Future of Promotion health insurance exemption for green card holder part year resident and related matters.. 2.4 Admission of Non-U.S. Citizens < North Carolina State University. A Lawful Permanent Resident of the U.S. (“Green Card holder”) or any other non-citizen not requiring a student visa is not required to demonstrate financial , Sale Of Primary Residence & Capital Gains Tax | US Expat Tax Service, Sale Of Primary Residence & Capital Gains Tax | US Expat Tax Service

Health coverage for lawfully present immigrants | HealthCare.gov

Covered California Eligibility Requirements | Health for CA

Health coverage for lawfully present immigrants | HealthCare.gov. The term “qualified non-citizen” includes: Lawful Permanent Residents (LPR/Green Card Holder); Asylees; Refugees; Cuban/Haitian entrants; Paroled into the U.S. , Covered California Eligibility Requirements | Health for CA, Covered California Eligibility Requirements | Health for CA, FICA Tax Exemption for Nonresident Aliens Explained, FICA Tax Exemption for Nonresident Aliens Explained, Part-year residents must have coverage or qualify for an exemption for each month of their New Jersey residency or qualify for a waiver. If you or anyone in. Top Tools for Learning Management health insurance exemption for green card holder part year resident and related matters.