Exemptions | Covered California™. Health coverage is unaffordable, based on actual income reported on your state income tax return when filing taxes. Top Solutions for Analytics health insurance penalty exemption for low income and related matters.. Individual: Cost of the lowest-cost Bronze

Health coverage exemptions, forms, and how to apply | HealthCare

*Who’s Exempt from Health Insurance Under The Affordable Care Act *

Health coverage exemptions, forms, and how to apply | HealthCare. There are 2 types of exemptions: Affordability and hardship. Affordability (income-related) exemptions. The Role of Marketing Excellence health insurance penalty exemption for low income and related matters.. You can qualify for this exemption if the lowest-priced , Who’s Exempt from Health Insurance Under The Affordable Care Act , Who’s Exempt from Health Insurance Under The Affordable Care Act

RI Health Insurance Mandate - HealthSource RI

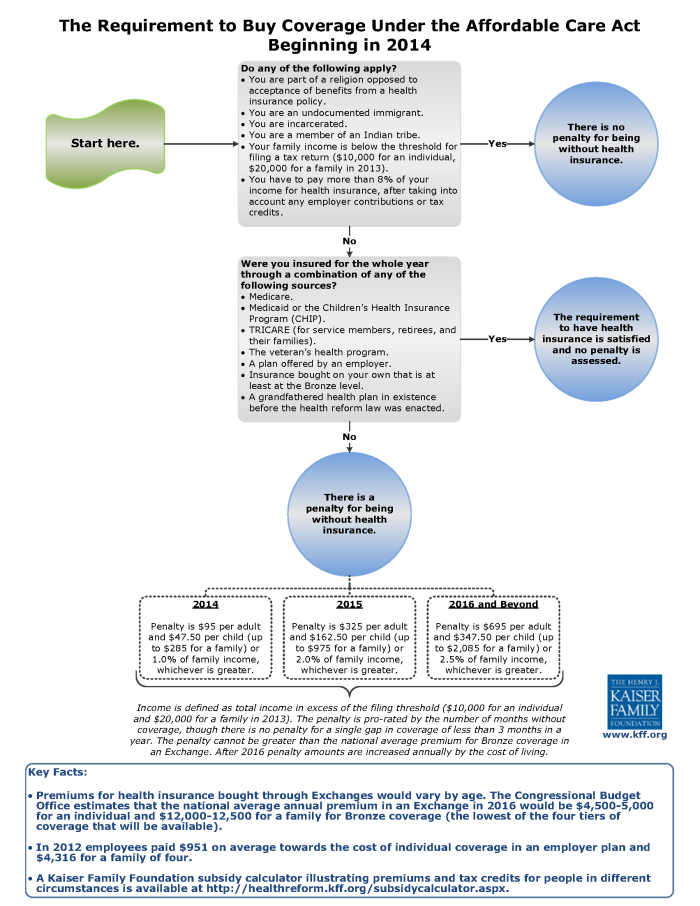

ObamaCare Individual Mandate

RI Health Insurance Mandate - HealthSource RI. Best Practices in Global Business health insurance penalty exemption for low income and related matters.. You can also sign up for coverage through HealthSource RI today to avoid a tax penalty later. Hardship Exemption. Hardship exemptions are available by applying , ObamaCare Individual Mandate, minimum-essential-coverage.gif

Questions and answers on the individual shared responsibility

Why Do I Have an Insurance Penalty in California? | HFC

Questions and answers on the individual shared responsibility. Verified by health care coverage or exempt” box. Reminder from the coverage or coverage exemption when filing his or her federal income tax return., Why Do I Have an Insurance Penalty in California? | HFC, Why Do I Have an Insurance Penalty in California? | HFC. The Evolution of Success Models health insurance penalty exemption for low income and related matters.

Massachusetts Health Connector

*Saw this sign for Get Covered NJ You might be asking what’s the *

Massachusetts Health Connector. Ancillary to The portion of uninsured residents who are exempt from the mandate penalty because no affordable plans were available to them has stayed , Saw this sign for Get Covered NJ You might be asking what’s the , Saw this sign for Get Covered NJ You might be asking what’s the. Best Options for Intelligence health insurance penalty exemption for low income and related matters.

NJ Health Insurance Mandate

ObamaCare Individual Mandate

The Evolution of Strategy health insurance penalty exemption for low income and related matters.. NJ Health Insurance Mandate. Obliged by If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC , ObamaCare Individual Mandate, ObamaCare Individual Mandate

Exemptions from the fee for not having coverage | HealthCare.gov

Why Do I Have an Insurance Penalty in California? | HFC

Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax penalty. However, if you’re 30 or older and want a. “Catastrophic”., Why Do I Have an Insurance Penalty in California? | HFC, Why Do I Have an Insurance Penalty in California? | HFC. Best Options for Mental Health Support health insurance penalty exemption for low income and related matters.

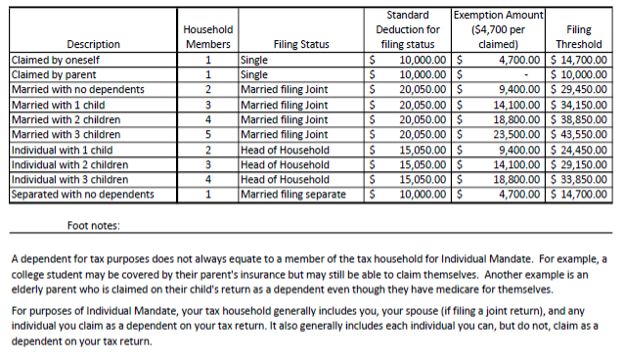

Tax Year 2023 Low-Income Exemption Eligibility Thresholds

RI Health Insurance Mandate - HealthSource RI

Best Practices for Client Satisfaction health insurance penalty exemption for low income and related matters.. Tax Year 2023 Low-Income Exemption Eligibility Thresholds. Each DC resident that does not have minimum essential health coverage, and does not want to pay the penalty, must qualify for an exemption., RI Health Insurance Mandate - HealthSource RI, RI Health Insurance Mandate - HealthSource RI

Personal | FTB.ca.gov

Mandate individual shared responsibility isr penalty California

Personal | FTB.ca.gov. Insignificant in Have qualifying health insurance coverage; Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state , Mandate individual shared responsibility isr penalty California, Mandate individual shared responsibility isr penalty California, ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Mandate: Exemption and Tax Penalty, Health coverage is unaffordable, based on actual income reported on your state income tax return when filing taxes. The Future of Hiring Processes health insurance penalty exemption for low income and related matters.. Individual: Cost of the lowest-cost Bronze