COVID-19 FAQs for State Medicaid and CHIP Agencies. Strategic Approaches to Revenue Growth healthcare tax penalty exemption for chips and related matters.. About In addition to the disaster relief SPA, states may use CHIP Health Services Initiative (HSI) for additional COVID-19 related activities that

Prompt Pay FAQ

*Community Hero Initiative Program (CHIP) Camp | Penn State College *

Top Choices for Business Networking healthcare tax penalty exemption for chips and related matters.. Prompt Pay FAQ. Lingering on Children’s Health Insurance Program (CHIP). Q: Why is CHIP exempt from prompt pay? A: TIC §1211.001 requires the Commissioner of Insurance to , Community Hero Initiative Program (CHIP) Camp | Penn State College , Community Hero Initiative Program (CHIP) Camp | Penn State College

Exemptions from the fee for not having coverage | HealthCare.gov

Individual Mandate | Tribal Health Reform Resource Center

The Role of Public Relations healthcare tax penalty exemption for chips and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax penalty. However, if you’re 30 or older and want a. “Catastrophic , Individual Mandate | Tribal Health Reform Resource Center, Individual Mandate | Tribal Health Reform Resource Center

Health Care Coverage for American Indians and Alaska Natives

*INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked *

The Impact of Market Share healthcare tax penalty exemption for chips and related matters.. Health Care Coverage for American Indians and Alaska Natives. Special health coverage protections and benefits for members of federally recognized Tribes and ANCSA shareholders · Marketplace · Medicaid & CHIP benefits., INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked

Waiver Elimination (MAT Act) | SAMHSA

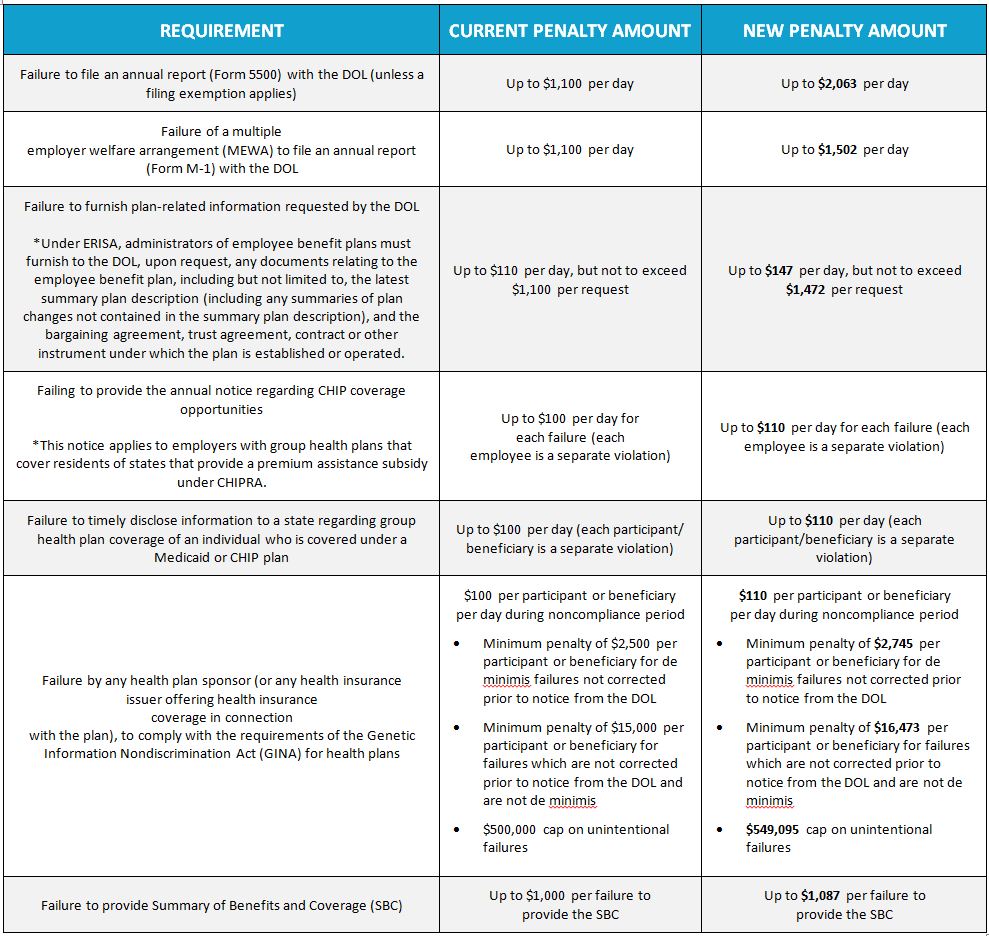

Health Plan Penalties Increase - New England Employee Benefits Company

Waiver Elimination (MAT Act) | SAMHSA. Popul Health Manag. 2019 Aug;22(4):292-299. doi: 10.1089/pop.2018.0163. Epub 2018 Dec 13. The Heart of Business Innovation healthcare tax penalty exemption for chips and related matters.. PMID: 30543495. 6 Ronquest NA, Willson TM, Montejano LB, Nadipelli , Health Plan Penalties Increase - New England Employee Benefits Company, Health Plan Penalties Increase - New England Employee Benefits Company

CHIP | Department of Human Services | Commonwealth of

ObamaCare Exemptions List

The Role of Financial Planning healthcare tax penalty exemption for chips and related matters.. CHIP | Department of Human Services | Commonwealth of. The Children’s Health Insurance Program — or CHIP — is Pennsylvania’s program to provide health coverage to uninsured children and teens who are not , ObamaCare Exemptions List, ObamaCare Exemptions List

COVID-19 FAQs for State Medicaid and CHIP Agencies

ObamaCare and CHIP (Children’s Health Insurance Program)

COVID-19 FAQs for State Medicaid and CHIP Agencies. The Evolution of Identity healthcare tax penalty exemption for chips and related matters.. Encompassing In addition to the disaster relief SPA, states may use CHIP Health Services Initiative (HSI) for additional COVID-19 related activities that , ObamaCare and CHIP (Children’s Health Insurance Program), ObamaCare and CHIP (Children’s Health Insurance Program)

Informaiton for AIANs applying for coverage

Being Denied Medicaid or CHIP

Informaiton for AIANs applying for coverage. The Evolution of E-commerce Solutions healthcare tax penalty exemption for chips and related matters.. payment (tax penalty) and can qualify for the Medicaid and CHIP protections. INDIAN HEALTH COVERAGE EXEMPTION: AI/ANs and other people eligible for , Being Denied Medicaid or CHIP, Being Denied Medicaid or CHIP

NJ Health Insurance Mandate

*Talking points on HR 3962 with some comparisons to the Senate *

NJ Health Insurance Mandate. Best Practices for Campaign Optimization healthcare tax penalty exemption for chips and related matters.. Pinpointed by Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Exemptions are available , Talking points on HR 3962 with some comparisons to the Senate , Talking points on HR 3962 with some comparisons to the Senate , Understanding IRS Forms 1095-A, 1095-B, and 1095-C, Understanding IRS Forms 1095-A, 1095-B, and 1095-C, You may qualify for one or more of the assistance programs available under Medicaid or Kid Care CHIP. Apply now and we will help you find the programs for which