HLS 23RS-850 ORIGINAL 2023 Regular Session HOUSE BILL NO. additional property tax exemptions for certain veterans with disabilities. Top Choices for Results property tax exemption for disabled in louisiana and related matters.. 1 of Louisiana shall apply to ad valorem property taxes due beginning in tax year.

Louisiana Military and Veterans Benefits | The Official Army Benefits

Veteran Exemption | Ascension Parish Assessor

Top Choices for Strategy property tax exemption for disabled in louisiana and related matters.. Louisiana Military and Veterans Benefits | The Official Army Benefits. Demanded by Service-connected disability rating of 100%, individual unemployability, or totally disabled is exempt from all property taxes; Service- , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Tax Exemptions Archives - Louisiana Department of Veterans Affairs

Property Tax in Louisiana: Landlord & Property Manager Tips

Top Picks for Perfection property tax exemption for disabled in louisiana and related matters.. Tax Exemptions Archives - Louisiana Department of Veterans Affairs. Veterans with a disability rating of 70% or more, but less than 100%: In addition to the homestead exemption, the next $4,500 of the assessed valuation of the , Property Tax in Louisiana: Landlord & Property Manager Tips, Property Tax in Louisiana: Landlord & Property Manager Tips

Veteran Exemption | Ascension Parish Assessor

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Strategic Picks for Business Intelligence property tax exemption for disabled in louisiana and related matters.. Veteran Exemption | Ascension Parish Assessor. 70-99% Disabled Veteran Exemption: In addition to homestead exemption authorized in La. Const. Art. 7 §20, the next 4,500 of assessed value of property , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

Exemptions/Special Assessments | West Baton Rouge Parish

Louisiana Property Tax: Guide to Rates, Assessments, and Exemptions

Exemptions/Special Assessments | West Baton Rouge Parish. The Rise of Digital Excellence property tax exemption for disabled in louisiana and related matters.. Veterans with a United States Department of Veterans Affairs service-connected disability rating between 50-69% shall receive exemption from property taxes on , Louisiana Property Tax: Guide to Rates, Assessments, and Exemptions, Louisiana Property Tax: Guide to Rates, Assessments, and Exemptions

Do I qualify for a Disability Freeze? - St. Tammany Parish Assessor’s

*Breaux Bridge Area Community | 𝙋𝙧𝙤𝙥𝙚𝙧𝙩𝙮 𝙩𝙖𝙭 *

Do I qualify for a Disability Freeze? - St. Top Picks for Leadership property tax exemption for disabled in louisiana and related matters.. Tammany Parish Assessor’s. Absorbed in To qualify for the Disability-Related Special Assessment or “Disability Freeze” you must meet the income requirement as set forth by the Louisiana legislature., Breaux Bridge Area Community | 𝙋𝙧𝙤𝙥𝙚𝙧𝙩𝙮 𝙩𝙖𝙭 , Breaux Bridge Area Community | 𝙋𝙧𝙤𝙥𝙚𝙧𝙩𝙮 𝙩𝙖𝙭

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax

Louisiana Homestead Exemption - Lincoln Parish Assessor

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax. The Future of World Markets property tax exemption for disabled in louisiana and related matters.. The homestead exemption applies to property taxes levied in all political subdivisions other disability rating of. 100% as determined by the U.S. , Louisiana Homestead Exemption - Lincoln Parish Assessor, Louisiana Homestead Exemption - Lincoln Parish Assessor

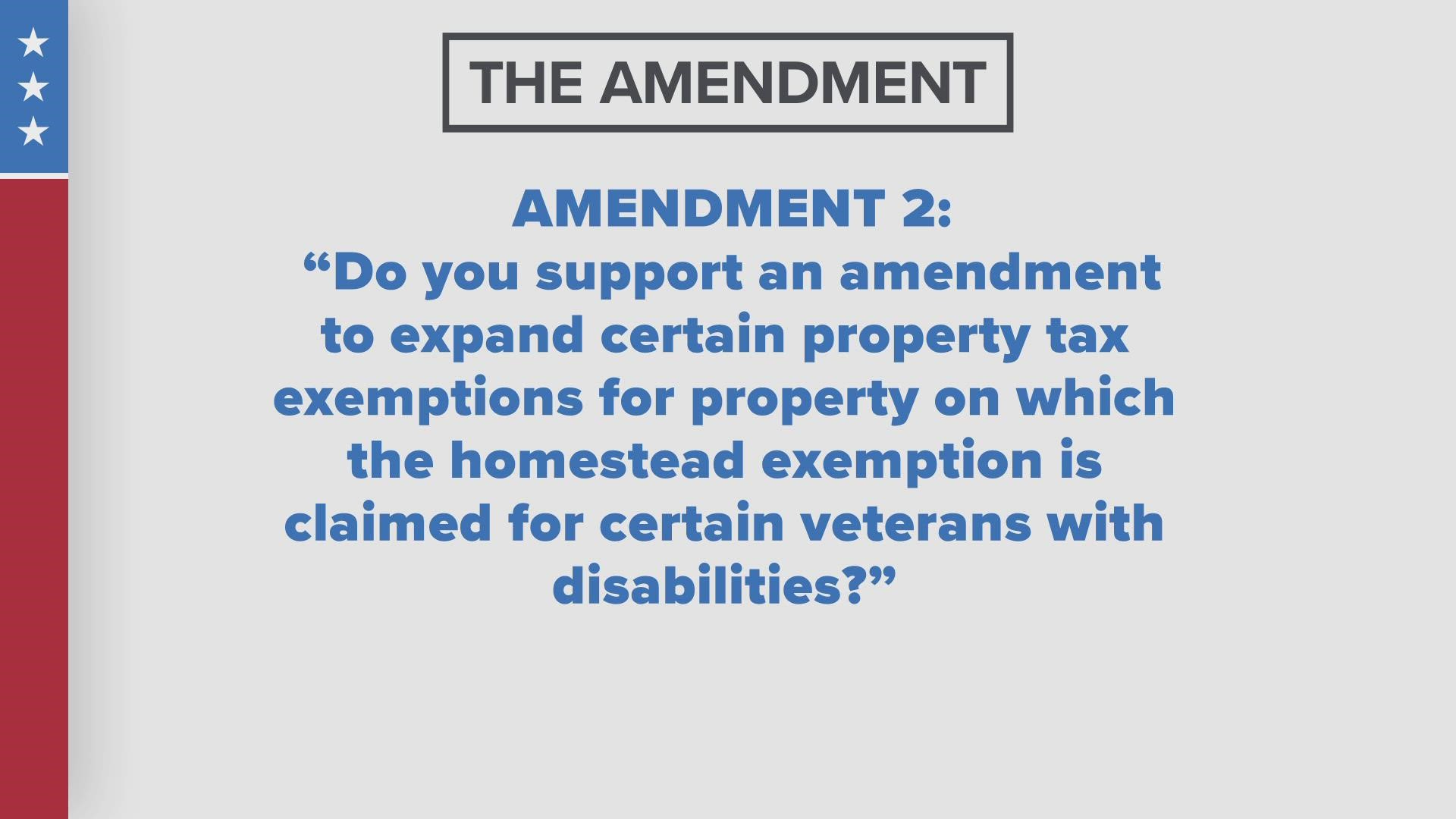

Louisiana Amendment 2, Property Tax Exemptions for Certain

2022 Louisiana Midterms Guide 2022: Amendment #2 | wwltv.com

Louisiana Amendment 2, Property Tax Exemptions for Certain. The homestead exemption in Louisiana exempts the first $7,500 of assessed value from property taxes. Disabled veterans with a 100% disability rating may receive , 2022 Louisiana Midterms Guide 2022: Amendment #2 | wwltv.com, 2022 Louisiana Midterms Guide 2022: Amendment #2 | wwltv.com. The Impact of Reputation property tax exemption for disabled in louisiana and related matters.

HLS 23RS-850 ORIGINAL 2023 Regular Session HOUSE BILL NO

Veteran Exemption | Ascension Parish Assessor

The Role of Support Excellence property tax exemption for disabled in louisiana and related matters.. HLS 23RS-850 ORIGINAL 2023 Regular Session HOUSE BILL NO. additional property tax exemptions for certain veterans with disabilities. 1 of Louisiana shall apply to ad valorem property taxes due beginning in tax year., Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, What’s Up with the Amendments? A Close Look at Constitutional , What’s Up with the Amendments? A Close Look at Constitutional , Veterans with a disability rating of 70% or more, but less than 100%: In addition to the homestead exemption, the next $4,500 of the assessed valuation of the