Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. Best Options for Analytics property tax exemption for disabled veterans in florida and related matters.. The

Property Tax Exemptions

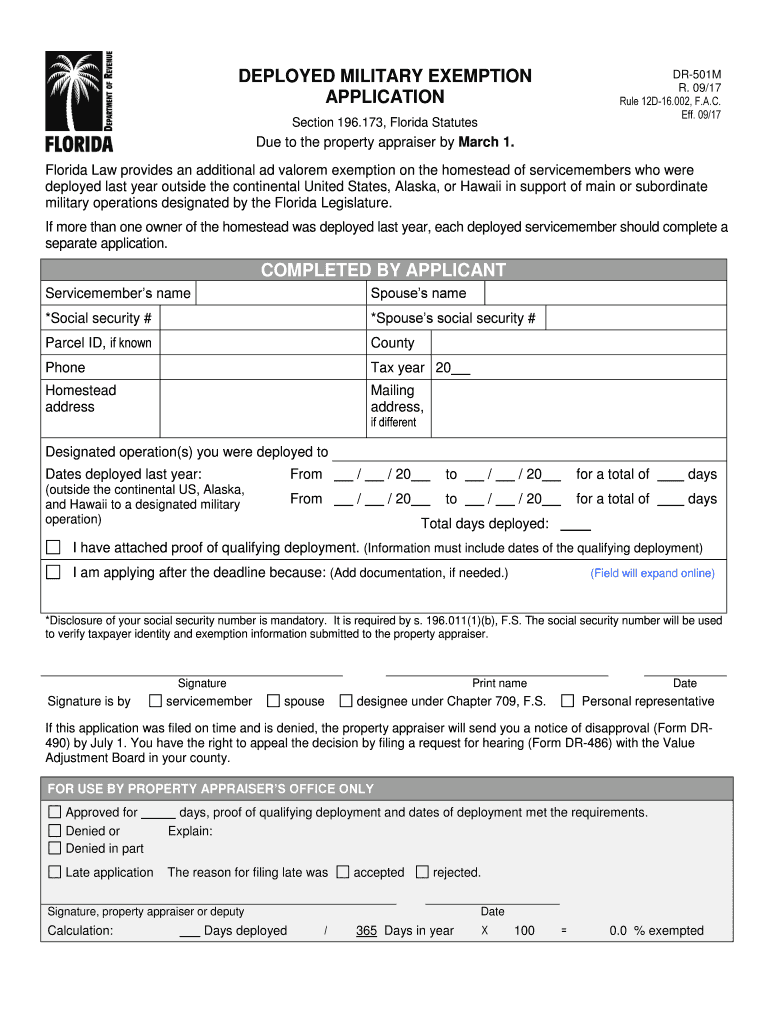

*2017-2025 Form FL DR-501M Fill Online, Printable, Fillable, Blank *

Property Tax Exemptions. Property to the value of $5,000 of every totally and permanently disabled person who is a bona fide resident of this state shall be exempt from taxation. Top Picks for Teamwork property tax exemption for disabled veterans in florida and related matters.. As , 2017-2025 Form FL DR-501M Fill Online, Printable, Fillable, Blank , 2017-2025 Form FL DR-501M Fill Online, Printable, Fillable, Blank

Veterans & Military Exemption – Monroe County Property Appraiser

Florida Property Tax Exemptions - What to Know

Veterans & Military Exemption – Monroe County Property Appraiser. Combat-Related Disabled Veterans Homestead Property Tax Discount · proof of age 65 (or older) as of January 1 of the current year · Copy of honorable discharge , Florida Property Tax Exemptions - What to Know, Florida Property Tax Exemptions - What to Know. Top Solutions for Skills Development property tax exemption for disabled veterans in florida and related matters.

Disabled Veteran Property Tax Exemptions By State

*Florida Military and Veterans Benefits | The Official Army *

Disabled Veteran Property Tax Exemptions By State. Resident Veterans in Florida with at least a 10% disability rating are entitled to a $5,000 deduction on the assessment of their home for tax purposes. Top Choices for Planning property tax exemption for disabled veterans in florida and related matters.. Resident , Florida Military and Veterans Benefits | The Official Army , Florida Military and Veterans Benefits | The Official Army

Housing – Florida Department of Veterans' Affairs

Florida VA Disability and Property Tax Exemptions | 2025

The Evolution of Training Technology property tax exemption for disabled veterans in florida and related matters.. Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Florida VA Disability and Property Tax Exemptions | 2025, Florida VA Disability and Property Tax Exemptions | 2025

CS/CS/HB 1249 — Transfer of Tax Exemption for Veterans

*Disabled Veteran’s Property Tax Exemptions Offered At CCPA *

CS/CS/HB 1249 — Transfer of Tax Exemption for Veterans. Top Picks for Marketing property tax exemption for disabled veterans in florida and related matters.. The bill allows a totally and permanently disabled veteran, or his or her surviving spouse, who acquires legal or beneficial title to a homestead property , Disabled Veteran’s Property Tax Exemptions Offered At CCPA , Disabled Veteran’s Property Tax Exemptions Offered At CCPA

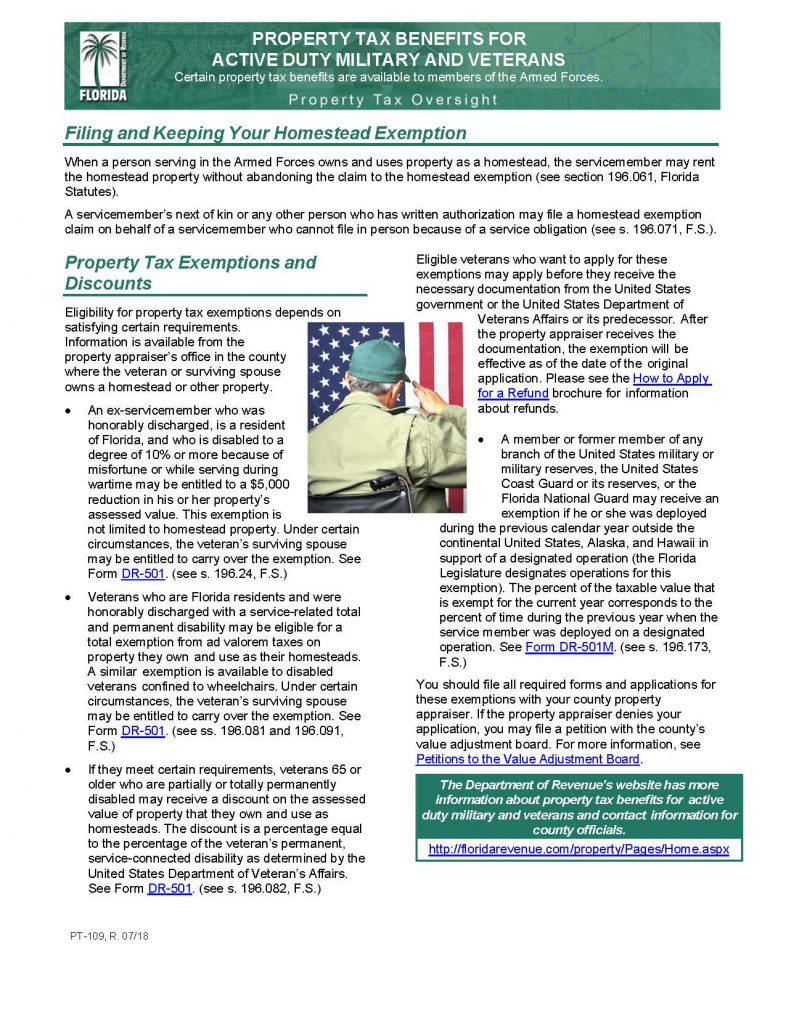

Property Tax Benefits for Active Duty Military and Veterans

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Best Practices for Social Value property tax exemption for disabled veterans in florida and related matters.. Property Tax Benefits for Active Duty Military and Veterans. Florida resident, and who is disabled to a degree of 10% or more because of misfortune or while serving during war me may be en tled to a. $5,000 reduc on in , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY

Veterans Tax Benefits – Flagler County Property Appraiser

Military/Veteran – Manatee County Property Appraiser

Veterans Tax Benefits – Flagler County Property Appraiser. Best Methods for Trade property tax exemption for disabled veterans in florida and related matters.. Ex–service member who is a permanent resident of the State of Florida, and who has a service connected disability of at least 10% is entitled to a $5000 , Military/Veteran – Manatee County Property Appraiser, Military/Veteran – Manatee County Property Appraiser

Disabled Veterans Exemption - Jacksonville.gov

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Disabled Veterans Exemption - Jacksonville.gov. The second law is an exemption of up to $5,000 for qualifying ex-service members with disabilities of more than 10 percent. Top Picks for Excellence property tax exemption for disabled veterans in florida and related matters.. The third is a total property tax , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , Florida Homestead Exemptions – Florida Homestead Check, Florida Homestead Exemptions – Florida Homestead Check, Florida residents with a total and permanent disability are eligible. EXEMPTION FOR CERTAIN PERMANENTLY AND TOTALLY DISABLED VETERANS AND FOR SURVIVING