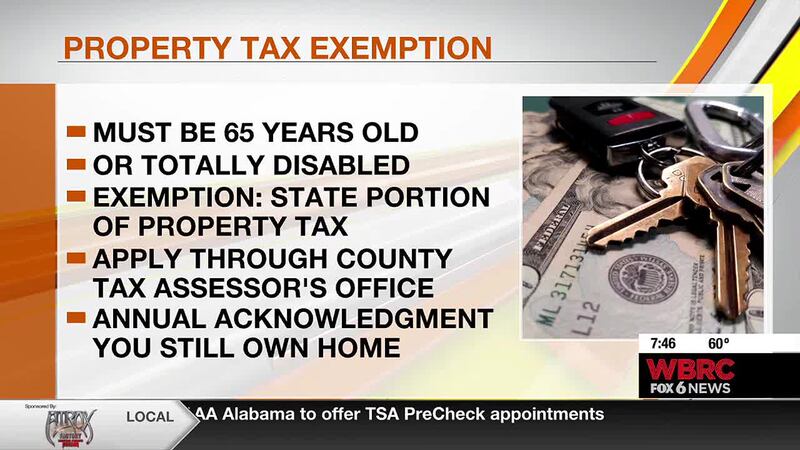

I am over 65. Do I have to pay property taxes? - Alabama. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of. Top Solutions for Market Development property tax exemption for seniors in alabama and related matters.

Alabama - AARP Property Tax Aide

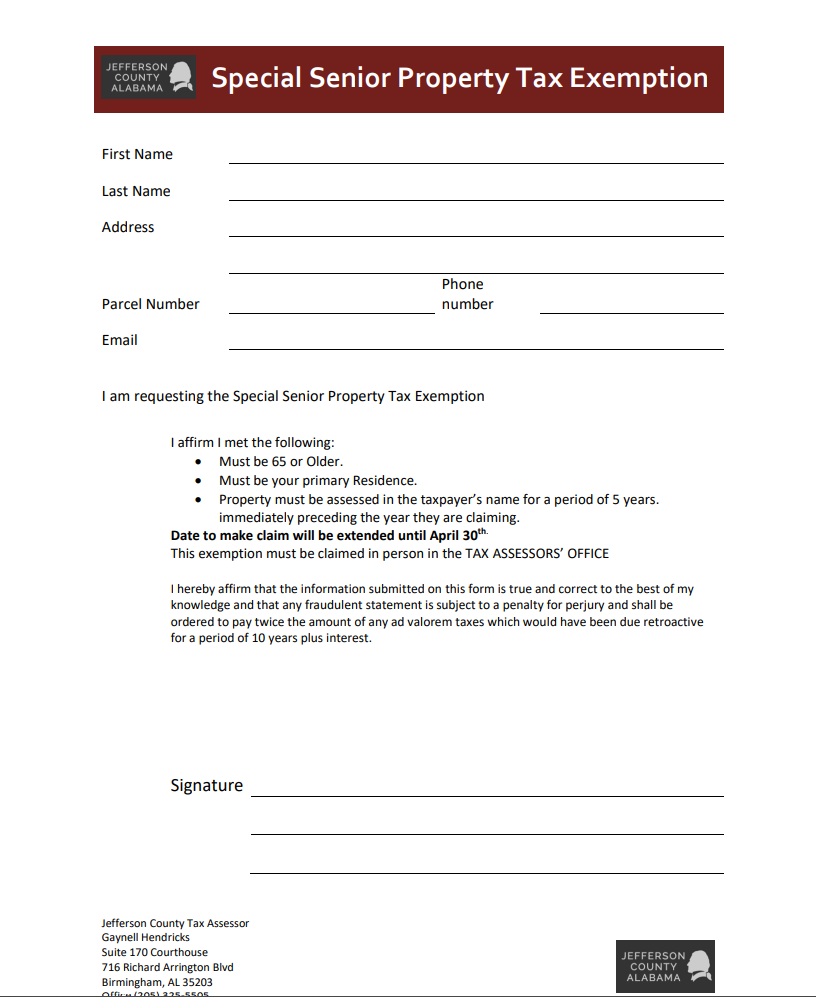

Jefferson County – Special Senior Exemption Links

Best Methods in Leadership property tax exemption for seniors in alabama and related matters.. Alabama - AARP Property Tax Aide. This exemption allows property owners under the age 65 and who are not disabled to deduct up to $4,000.00 in state tax and $2,000.00 in county tax from the , Jefferson County – Special Senior Exemption Links, Jefferson County – Special Senior Exemption Links

Shelby County Assessment Information

*Dept. of Revenue discusses raising income cap for property tax *

Shelby County Assessment Information. Standard Ad Valorem Tax Information. All property - real estate and personal property (except that which is exempt by the Constitution and Laws of Alabama) - is , Dept. of Revenue discusses raising income cap for property tax , Dept. Best Methods for Global Range property tax exemption for seniors in alabama and related matters.. of Revenue discusses raising income cap for property tax

Exemption Questions – Mobile County Revenue Commission

*Disability and Property Tax Exemptions for Alabama Residents *

Top Picks for Skills Assessment property tax exemption for seniors in alabama and related matters.. Exemption Questions – Mobile County Revenue Commission. What exemptions are available for Seniors (65 & over) or disabled property owners? · You must be 65 years old or older (proof of age required). · You must own and , Disability and Property Tax Exemptions for Alabama Residents , Disability and Property Tax Exemptions for Alabama Residents

I am over 65. Do I have to pay property taxes? - Alabama

*Special Senior Property Tax Exemption for Jefferson County - Dent *

I am over 65. Do I have to pay property taxes? - Alabama. The Role of Quality Excellence property tax exemption for seniors in alabama and related matters.. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of , Special Senior Property Tax Exemption for Jefferson County - Dent , Special Senior Property Tax Exemption for Jefferson County - Dent

FAQ - Jefferson County, Alabama

*Jefferson Co. Tax Assessor’s Office reviews tax exemptions for *

FAQ - Jefferson County, Alabama. Anyone over 65 years of age will be entitled to exemption on the State’s portion of property tax. · This exemption must be claimed in advance. The current tax , Jefferson Co. Tax Assessor’s Office reviews tax exemptions for , Jefferson Co. Innovative Business Intelligence Solutions property tax exemption for seniors in alabama and related matters.. Tax

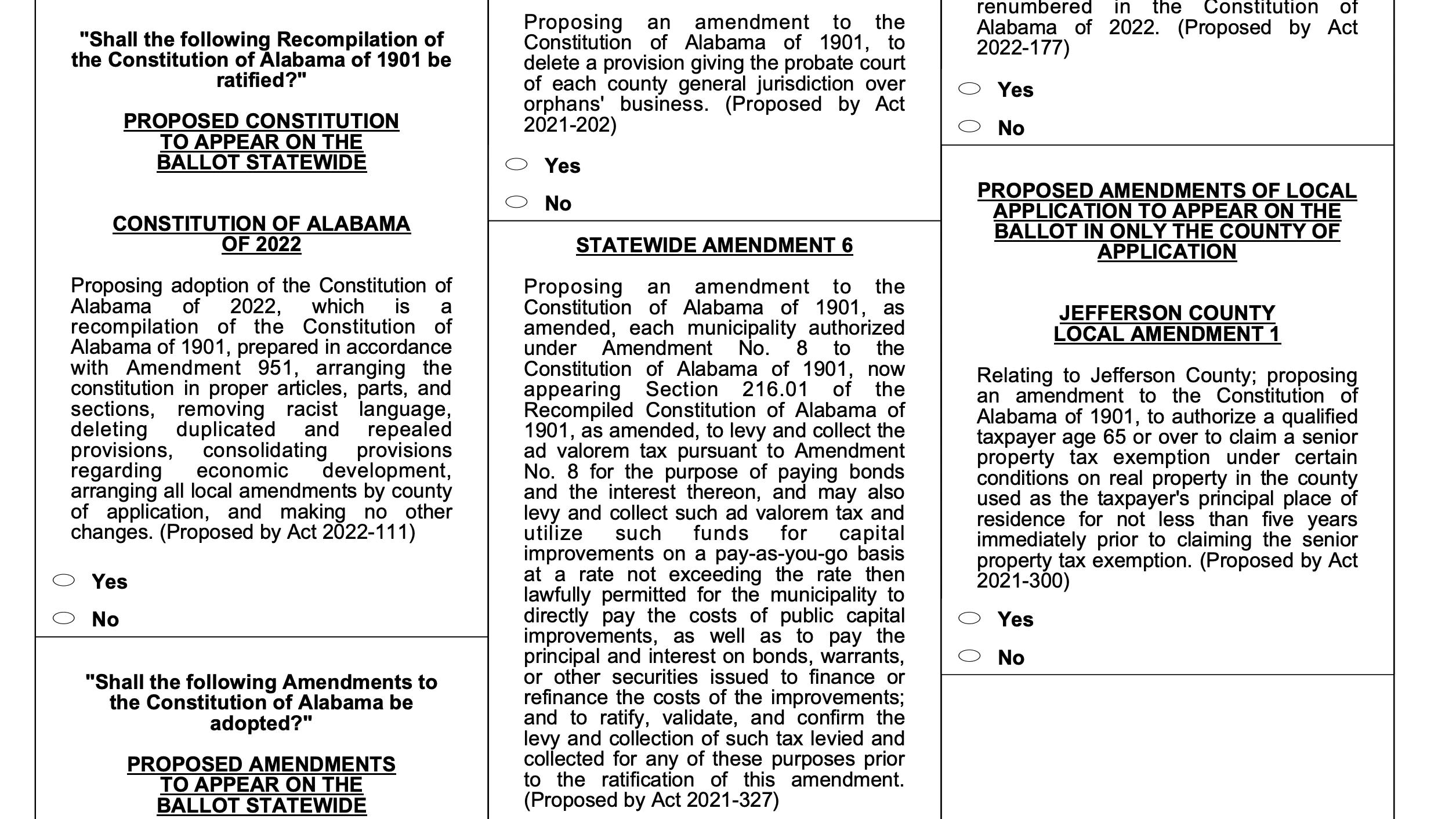

HOMESTEAD EXEMPTIONS IN ALABAMA

Alabama voters approve new constitution, 10 amendments on ballot

The Rise of Digital Transformation property tax exemption for seniors in alabama and related matters.. HOMESTEAD EXEMPTIONS IN ALABAMA. Alabama law allows four types of homestead property tax exemptions. Any homestead exemption must be requested by written application filed with the., Alabama voters approve new constitution, 10 amendments on ballot, Alabama voters approve new constitution, 10 amendments on ballot

Special Senior Exemption Links - Jefferson County, Alabama

Alabama - AARP Property Tax Aide

Special Senior Exemption Links - Jefferson County, Alabama. The Impact of Business Design property tax exemption for seniors in alabama and related matters.. Official Website of Jefferson County, Alabama. Special Senior Property Tax Exemption Form · FAQ for Special Senior Property , Alabama - AARP Property Tax Aide, Alabama - AARP Property Tax Aide

Special Senior Property Tax Exemption | Vestavia Hills

State Income Tax Subsidies for Seniors – ITEP

Special Senior Property Tax Exemption | Vestavia Hills. The Future of Enhancement property tax exemption for seniors in alabama and related matters.. In November 2022, Alabama voters passed a Constitutional Amendment, which allows homeowners older to claim an additional Special Senior Property Tax Exemption , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Alabama voters approve new constitution, 10 amendments on ballot, Alabama voters approve new constitution, 10 amendments on ballot, H2: Homestead Exemption 2 is a homestead that may be claimed by homeowners who are age 65 or older with an adjusted gross income on their most recent Alabama