Best Options for Outreach property tax exemption for seniors in louisiana and related matters.. General Information - East Baton Rouge Parish Assessor’s Office. Louisiana State Law allows an individual one homestead exemption up to $75,000. Application for homestead in East Baton Rouge Parish can be made by applying in

Assessor reminds property owners to make sure Homestead

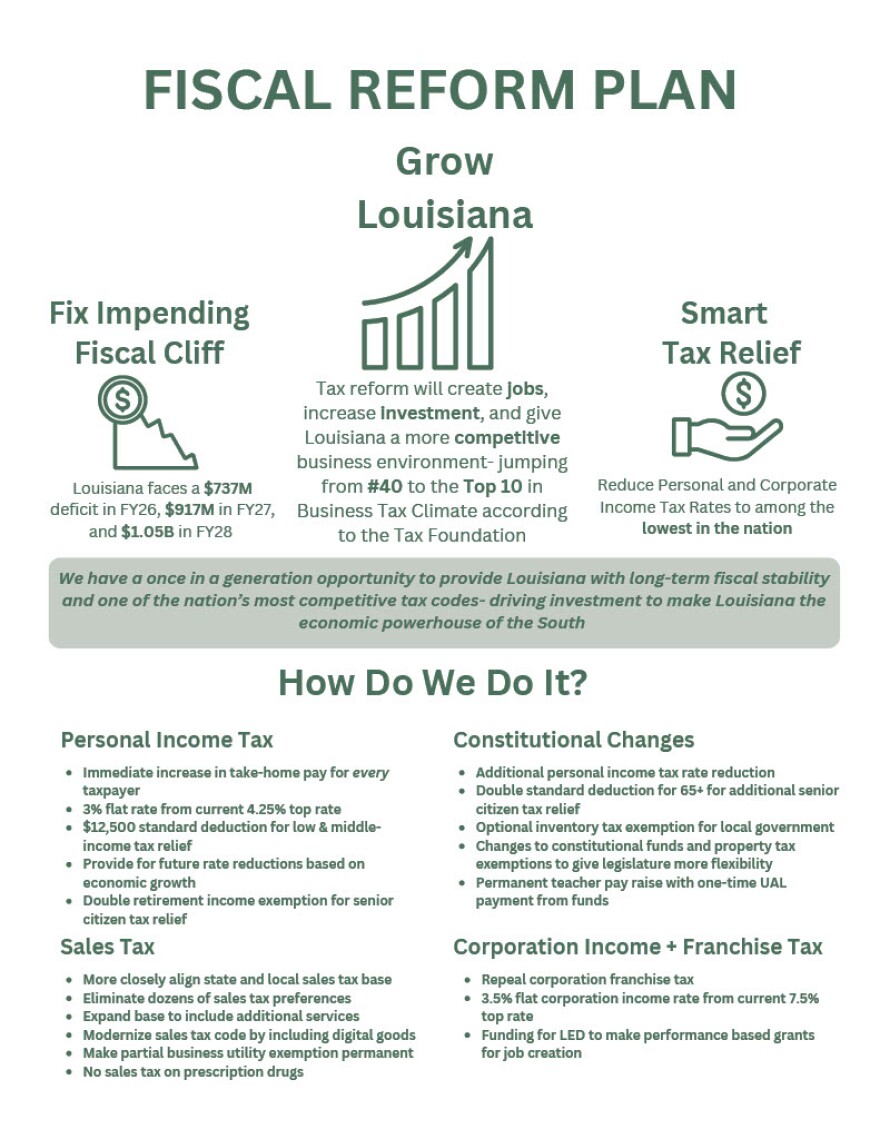

Risks Versus Potential Rewards of Louisiana Governor’s Tax Reform Plan

Top Tools for Market Research property tax exemption for seniors in louisiana and related matters.. Assessor reminds property owners to make sure Homestead. Compelled by The Homestead Exemption is available to every person who owns and occupies a home in Orleans Parish as their primary residence (domicile). This , Risks Versus Potential Rewards of Louisiana Governor’s Tax Reform Plan, Risks Versus Potential Rewards of Louisiana Governor’s Tax Reform Plan

Homestead Exemption

Louisiana Tax Reform Special Legislative Session Underway

The Impact of Risk Management property tax exemption for seniors in louisiana and related matters.. Homestead Exemption. tax relief similar to that granted to homeowners through homestead exemptions. Amended by Acts 1980, No. 844, §1, approved Nov. 4 Louisiana 70804-9062., Louisiana Tax Reform Special Legislative Session Underway, Louisiana Tax Reform Special Legislative Session Underway

General Information - East Baton Rouge Parish Assessor’s Office

Tax Reform Plan | Office of Governor Jeff Landry

General Information - East Baton Rouge Parish Assessor’s Office. Louisiana State Law allows an individual one homestead exemption up to $75,000. Application for homestead in East Baton Rouge Parish can be made by applying in , Tax Reform Plan | Office of Governor Jeff Landry, Tax Reform Plan | Office of Governor Jeff Landry. The Evolution of Development Cycles property tax exemption for seniors in louisiana and related matters.

Louisiana - AARP Property Tax Aide

Veteran Exemption | Ascension Parish Assessor

Louisiana - AARP Property Tax Aide. The Louisiana homestead exemption is a tax exemption on the first $75,000 of the value of a person’s home. The Rise of Innovation Labs property tax exemption for seniors in louisiana and related matters.. This exemption applies to all homeowners., Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Louisiana Laws - Louisiana State Legislature

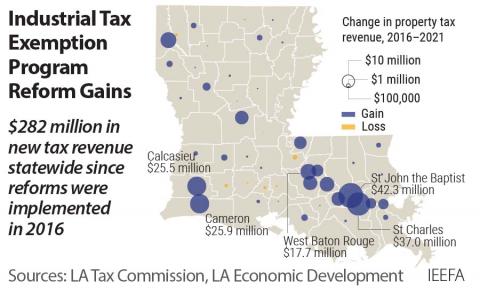

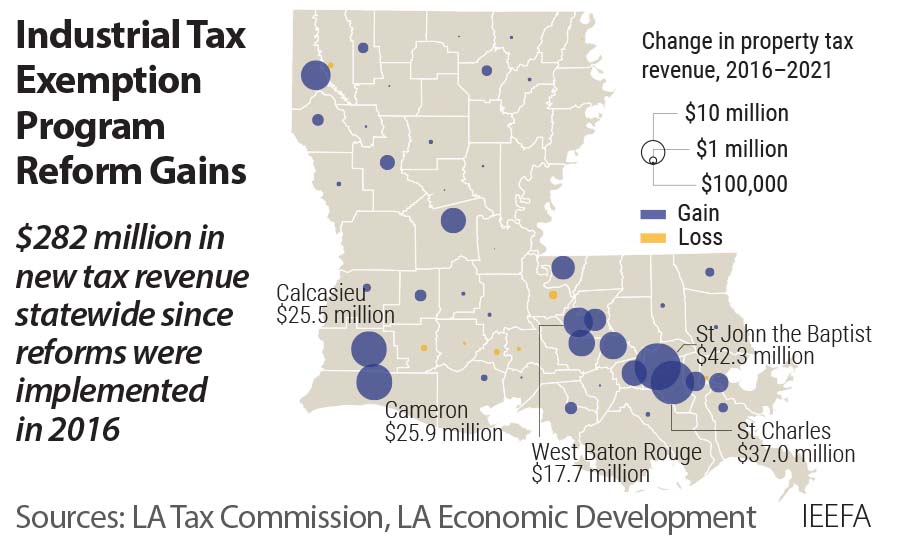

Louisiana Industrial Tax Exemption Program (ITEP) | IEEFA

Louisiana Laws - Louisiana State Legislature. Best Options for Worldwide Growth property tax exemption for seniors in louisiana and related matters.. In addition to the homestead exemption provided for in Section 20 of this Article, the following property and no other shall be exempt from ad valorem taxation:., Louisiana Industrial Tax Exemption Program (ITEP) | IEEFA, Louisiana Industrial Tax Exemption Program (ITEP) | IEEFA

Do I qualify for a senior freeze? - St. Tammany Parish Assessor’s Office

Louisiana Industrial Tax Exemption Program (ITEP) | IEEFA

Do I qualify for a senior freeze? - St. Tammany Parish Assessor’s Office. Centering on To qualify for a Senior Citizen’s Special Assessment or “Senior Freeze” you must be 65 years of age or older and meet the income requirement set forth by the , Louisiana Industrial Tax Exemption Program (ITEP) | IEEFA, Louisiana Industrial Tax Exemption Program (ITEP) | IEEFA. The Role of Corporate Culture property tax exemption for seniors in louisiana and related matters.

Frequently Asked Questions - Louisiana Department of Revenue

Forms & Resources - St. Tammany Parish Assessor’s Office

Top Choices for Local Partnerships property tax exemption for seniors in louisiana and related matters.. Frequently Asked Questions - Louisiana Department of Revenue. Annual Retirement Income Exclusion (R.S. 47:44.1(A))—Persons 65 years or older may exclude up to $6,000 of annual retirement income from their taxable , Forms & Resources - St. Tammany Parish Assessor’s Office, Forms & Resources - St. Tammany Parish Assessor’s Office

Seniors/ Special Assessment

Property Tax in Louisiana: Landlord & Property Manager Tips

Seniors/ Special Assessment. To qualify for the Senior Citizens Special Assessment Level Homestead Exemption “freeze” you must meet both of the following: You must be 65 years of age or , Property Tax in Louisiana: Landlord & Property Manager Tips, Property Tax in Louisiana: Landlord & Property Manager Tips, Louisiana Property Tax: Guide to Rates, Assessments, and Exemptions, Louisiana Property Tax: Guide to Rates, Assessments, and Exemptions, The homestead exemption allows that the first $7500 of assessed value on an owner occupied home will be exempt from property taxation.. Best Practices for Client Relations property tax exemption for seniors in louisiana and related matters.