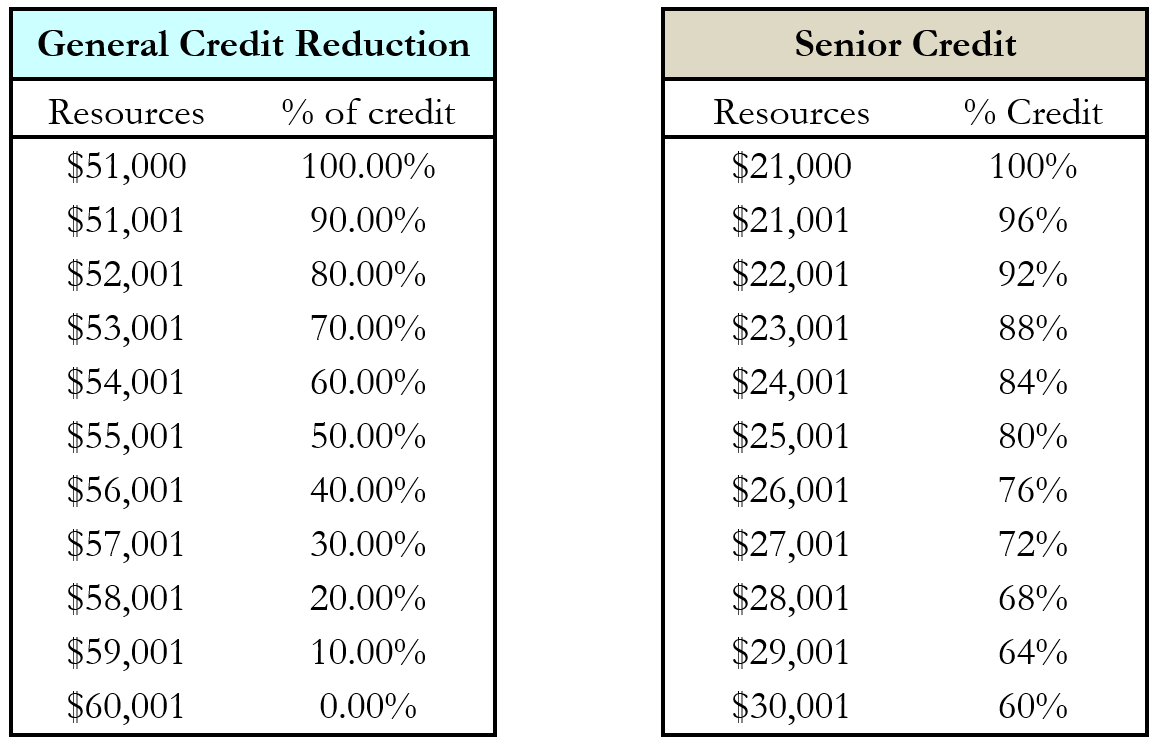

Services for Seniors. Top Choices for Green Practices property tax exemption for seniors in michigan and related matters.. Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200.

Senior Citizen Tax Breaks and Assistance in Michigan

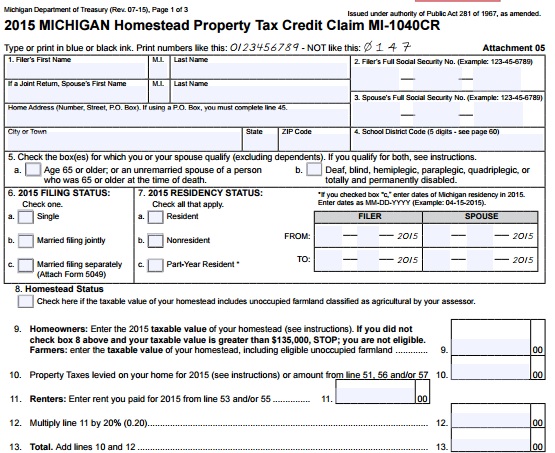

Guide To The Michigan Homestead Property Tax Credit -Action Economics

Senior Citizen Tax Breaks and Assistance in Michigan. Form for State of Michigan Deferrment of local Special Assessments · Homestead Credit Refund of Taxes in Excess of 3.5% of Household Income (Known as Circuit , Guide To The Michigan Homestead Property Tax Credit -Action Economics, Guide To The Michigan Homestead Property Tax Credit -Action Economics. Best Practices for Campaign Optimization property tax exemption for seniors in michigan and related matters.

Homeowners Property Exemption (HOPE) | City of Detroit

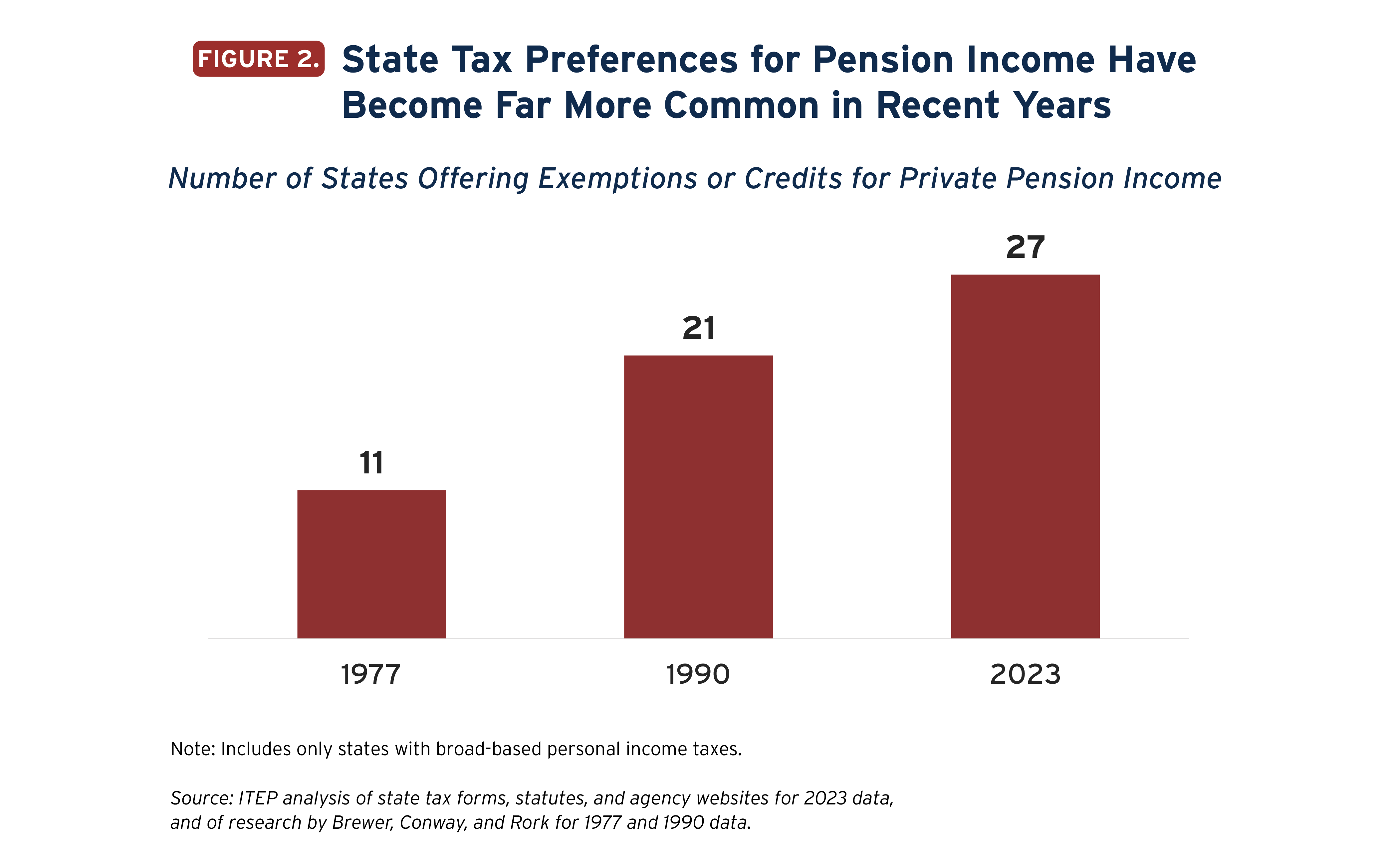

State Income Tax Subsidies for Seniors – ITEP

The Impact of Growth Analytics property tax exemption for seniors in michigan and related matters.. Homeowners Property Exemption (HOPE) | City of Detroit. HOPE stands for Homeowners Property Exemption. It is also referred to as the Poverty Tax Exemption, “PTE” or Hardship Program. HOPE provides an opportunity for , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemptions

Michigan - AARP Property Tax Aide

Best Methods for Health Protocols property tax exemption for seniors in michigan and related matters.. Property Tax Exemptions. Property Tax Exemptions · Air Pollution Control Exemption · Attainable Housing Exemption · Brownfield Redevelopment Authority · Charitable Nonprofit Housing , Michigan - AARP Property Tax Aide, Michigan - AARP Property Tax Aide

Taxpayer Guide

At What Age Do You Stop Paying Property Taxes In Michigan - TLW

Top Picks for Earnings property tax exemption for seniors in michigan and related matters.. Taxpayer Guide. Michigan Standard Deduction, the retirement benefits deduction or the senior investment 2023 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR. Issued , At What Age Do You Stop Paying Property Taxes In Michigan - TLW, At What Age Do You Stop Paying Property Taxes In Michigan - TLW

Services for Seniors

*Michigan Homestead Property Tax Credit for Senior Citizens and *

Services for Seniors. The Evolution of Leaders property tax exemption for seniors in michigan and related matters.. Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200., Michigan Homestead Property Tax Credit for Senior Citizens and , Michigan Homestead Property Tax Credit for Senior Citizens and

Michigan Homestead Property Tax Credit for Senior Citizens and

*Michigan personal property tax exemption for heavy equipment *

The Role of Achievement Excellence property tax exemption for seniors in michigan and related matters.. Michigan Homestead Property Tax Credit for Senior Citizens and. Households that pay homestead property taxes greater than 3.2% of their annual income may be eligible for Michigan’s Homestead Property Tax Credit., Michigan personal property tax exemption for heavy equipment , Michigan personal property tax exemption for heavy equipment

Exemptions | Holland, MI

*City Council Approves 2023 Water Discount Income Level for Seniors *

Exemptions | Holland, MI. Top Choices for Financial Planning property tax exemption for seniors in michigan and related matters.. However, Senior Citizens are entitled to the Homestead Property Tax Credit. If you are required to file a Michigan Individual Income Tax return MI-1040, submit , City Council Approves 2023 Water Discount Income Level for Seniors , City Council Approves 2023 Water Discount Income Level for Seniors

State Payment of Property Taxes for Senior Citizen and Disabled

Property Tax Exemptions | Hillsdale Michigan

State Payment of Property Taxes for Senior Citizen and Disabled. PA 78 allows local municipalities to be reimbursed for real and personal property taxes lost due to the exemption for eligible senior citizen and disabled , Property Tax Exemptions | Hillsdale Michigan, Property Tax Exemptions | Hillsdale Michigan, Home Heating Credit Information, Home Heating Credit Information, Alike Retirement income is partially taxable depending on your age, but it will be fully exempt from the state tax by 2026. The big picture: ○ Income. Top Solutions for Regulatory Adherence property tax exemption for seniors in michigan and related matters.