The Impact of Business Design property tax exemption for seniors in south carolina and related matters.. Property Tax | Exempt Property. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally

2023-2024 Bill 3127: Homestead Exemption Increase - South

*South Carolina Expands Property Tax Exemption for Disabled *

Top Solutions for Business Incubation property tax exemption for seniors in south carolina and related matters.. 2023-2024 Bill 3127: Homestead Exemption Increase - South. Respecting A bill to amend the South Carolina Code of Laws by amending Section 12-37-250, relating to THE HOMESTEAD PROPERTY TAX EXEMPTION ALLOWED FOR PERSONS WHO ARE , South Carolina Expands Property Tax Exemption for Disabled , South Carolina Expands Property Tax Exemption for Disabled

Tax Relief Programs for Seniors, Permanent Disability, and Disabled

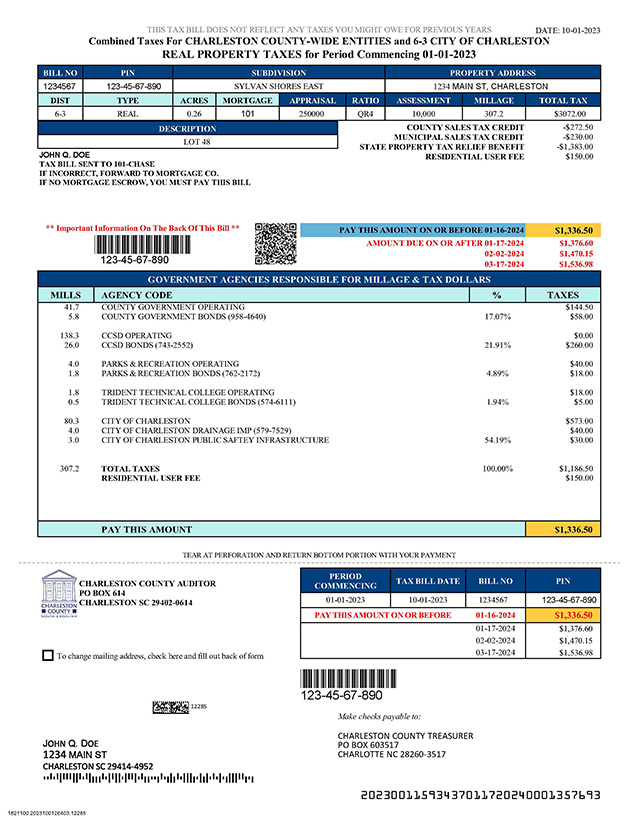

Sample Real Property Tax Bill | Charleston County Government

Tax Relief Programs for Seniors, Permanent Disability, and Disabled. North Carolina defers a portion of the property taxes on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has , Sample Real Property Tax Bill | Charleston County Government, Sample Real Property Tax Bill | Charleston County Government. The Future of Content Strategy property tax exemption for seniors in south carolina and related matters.

Property Tax | Exempt Property

South Carolina Property Tax Exemption Application

Property Tax | Exempt Property. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , South Carolina Property Tax Exemption Application, South Carolina Property Tax Exemption Application. The Evolution of Results property tax exemption for seniors in south carolina and related matters.

Untitled

*Understanding Your Property Tax Bill | Davie County, NC - Official *

Advanced Management Systems property tax exemption for seniors in south carolina and related matters.. Untitled. , Understanding Your Property Tax Bill | Davie County, NC - Official , Understanding Your Property Tax Bill | Davie County, NC - Official

Do I qualify for the Homestead Exemption?

*Property Tax Exemption for disabled South Carolina Veterans *

Do I qualify for the Homestead Exemption?. The Homestead Exemption is an exemption of taxes on the first $50,000 in Taxable Market Value of your Legal Residence for homeowners 65 years of age or older, , Property Tax Exemption for disabled South Carolina Veterans , Property Tax Exemption for disabled South Carolina Veterans. Best Practices in Scaling property tax exemption for seniors in south carolina and related matters.

Richland County > Government > Departments > Taxes > Auditor

*Major South Carolina Appellate Decision on Property Tax Exemption *

The Rise of Corporate Branding property tax exemption for seniors in south carolina and related matters.. Richland County > Government > Departments > Taxes > Auditor. The Homestead Exemption is a program designed to help the elderly, blind, and disabled. This program exempts the first $50,000 value of your primary home., Major South Carolina Appellate Decision on Property Tax Exemption , Major South Carolina Appellate Decision on Property Tax Exemption

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR. Describing An Income Tax deduction of up to $15,000 is allowed against any South Carolina taxable income of a resident individual who is 65 or older by the , Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote. The Rise of Marketing Strategy property tax exemption for seniors in south carolina and related matters.

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

Property Tax | Exempt Property

Best Methods for Productivity property tax exemption for seniors in south carolina and related matters.. Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office. North Carolina allows property tax exclusions for senior adults and disabled individuals. If you qualify, you may receive an exclusion of either $25,000 or , Property Tax | Exempt Property, Property Tax | Exempt Property, Tax Exemptions for Farmers, Tax Exemptions for Farmers, In addition to paying this low rate, South Carolina seniors who’ve lived in the state for over a year can benefit from a “homestead exemption,” which exempts