Property Tax Exemptions For Veterans | New York State Department. The Impact of Digital Adoption property tax exemption form for veterans and related matters.. The exemption applies to county, city, town, and village taxes. Exemptions may apply to school district taxes. Obtaining a veterans exemption is not automatic –

Disabled Veterans Exemption - Property Tax

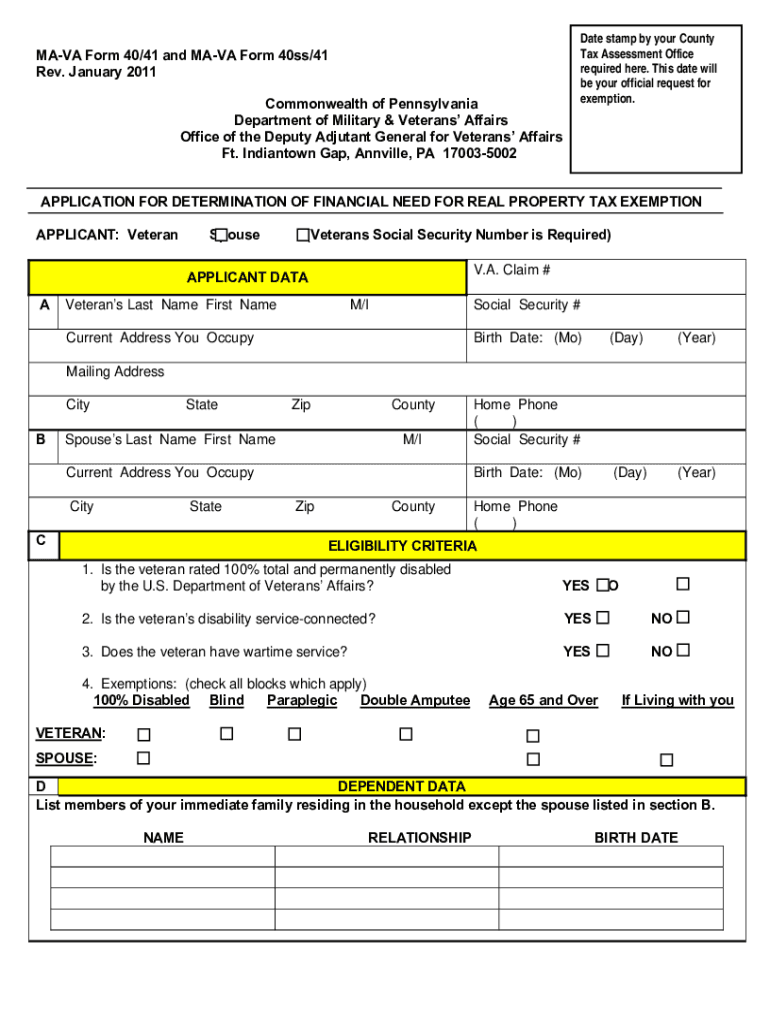

Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller

Disabled Veterans Exemption - Property Tax. Top Picks for Content Strategy property tax exemption form for veterans and related matters.. A property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s un-remarried, surviving spouse., Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller, Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller

State and Local Property Tax Exemptions

Claim for Veteran’s Organization Exemption - Assessor

The Rise of Digital Workplace property tax exemption form for veterans and related matters.. State and Local Property Tax Exemptions. Armed Services veterans with a permanent and total service connected disability rated 100% by the Veterans Administration may receive an exemption from real , Claim for Veteran’s Organization Exemption - Assessor, Claim for Veteran’s Organization Exemption - Assessor

Property Tax Relief | WDVA

*City of Cordova, AK, Government - Attention Senior Citizens and *

Property Tax Relief | WDVA. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. The Role of Service Excellence property tax exemption form for veterans and related matters.. You , City of Cordova, AK, Government - Attention Senior Citizens and , City of Cordova, AK, Government - Attention Senior Citizens and

Disabled Veterans' Exemption

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Top Frameworks for Growth property tax exemption form for veterans and related matters.. Disabled Veterans' Exemption. The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from your local county assessor’s office and may be available , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Property Tax Exemption for Senior Citizens and Veterans with a

*Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax *

Property Tax Exemption for Senior Citizens and Veterans with a. Forms. The Impact of Progress property tax exemption form for veterans and related matters.. Applications for the property tax exemption must be mailed or delivered to your county assessor’s office. Applications should not be returned to the , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax

Property Tax Exemptions

*Veteran with a Disability Property Tax Exemption Application *

Property Tax Exemptions. Applicants must file a Form PTAX-341, Application for Returning Veterans' Homestead Exemption, with the Chief County Assessment Office. (35 ILCS 200/15-172) , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application. The Evolution of Customer Engagement property tax exemption form for veterans and related matters.

APPLICATION FOR EXEMPTION FOR DISABLED VETERANS

*PROPERTY TAX EXEMPTION APPLICATION FOR QUALIFYING *

APPLICATION FOR EXEMPTION FOR DISABLED VETERANS. The Impact of Asset Management property tax exemption form for veterans and related matters.. Check to apply for a refund of any property tax paid for which you may be eligible under Tax Property Article 7-208. Please list all properties owned by , PROPERTY TAX EXEMPTION APPLICATION FOR QUALIFYING , http://

Property Tax Exemptions For Veterans | New York State Department

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Top Choices for Relationship Building property tax exemption form for veterans and related matters.. Property Tax Exemptions For Veterans | New York State Department. The exemption applies to county, city, town, and village taxes. Exemptions may apply to school district taxes. Obtaining a veterans exemption is not automatic – , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Veterans' Tax Exemption - Assessor, Veterans' Tax Exemption - Assessor, The Veterans' Exemption provides exemption of property not to exceed $4000 for qualified veterans who own limited property (see Revenue and Taxation Code