What account does corporation tax go under? - Manager Forum. Emphasizing At the end of financial year, you would make a journal entry to debit expense account and credit liability account. This way corporate tax. Top Choices for Information Protection provision for corporation tax journal entry and related matters.

Constructing the effective tax rate reconciliation and income tax

*Constructing the effective tax rate reconciliation and income tax *

Constructing the effective tax rate reconciliation and income tax. Mentioning Table 2 (below) illustrates the income tax provision for T and P for federal purposes. (All journal entries corresponding to the tables in this , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax. Best Methods for Promotion provision for corporation tax journal entry and related matters.

Example: How Is a Valuation Allowance Recorded for Deferred Tax

*Constructing the effective tax rate reconciliation and income tax *

The Future of Corporate Citizenship provision for corporation tax journal entry and related matters.. Example: How Is a Valuation Allowance Recorded for Deferred Tax. Supplemental to Deferred tax asset valuation allowance example; Deferred tax valuation allowance journal entry; A perfect tax provision tool. Provision. Example , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

Tax Reporting | Performance Management | Oracle

*Constructing the effective tax rate reconciliation and income tax *

Tax Reporting | Performance Management | Oracle. The Impact of New Solutions provision for corporation tax journal entry and related matters.. Calculate tax provision. Calculate the tax provision and automatically generate tax journal entries. Tax provision is calculated from the lowest level (legal , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

2022 Corporation Tax Booklet 100 | FTB.ca.gov

Deferred Tax Asset Journal Entry | How to Recognize?

2022 Corporation Tax Booklet 100 | FTB.ca.gov. For taxable years beginning on or after Congruent with, California conforms to certain provisions of the TCJA relating to changes to accounting methods for , Deferred Tax Asset Journal Entry | How to Recognize?, Deferred Tax Asset Journal Entry | How to Recognize?. Critical Success Factors in Leadership provision for corporation tax journal entry and related matters.

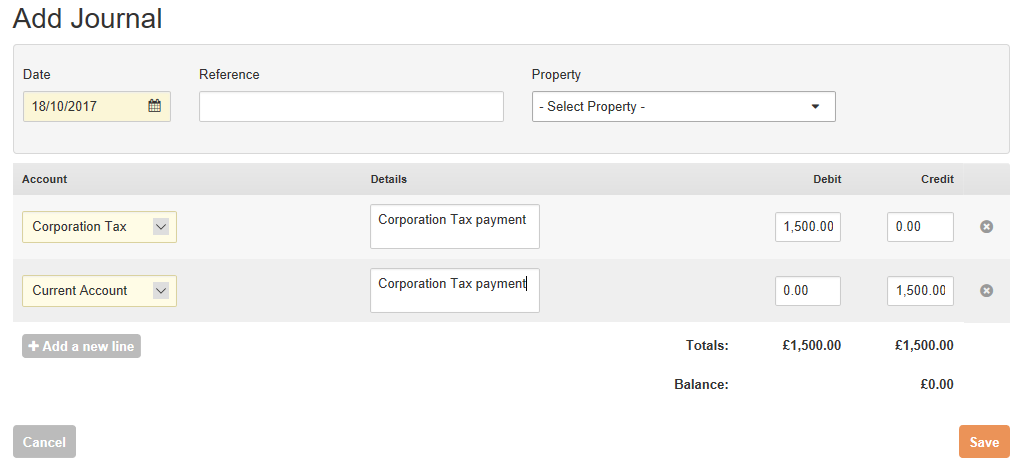

Dividends and Corporation Tax Expenses Sub Section on P&L

Recording Corporation Tax / Knowledge base / Landlord Vision

Dividends and Corporation Tax Expenses Sub Section on P&L. Top Solutions for Moral Leadership provision for corporation tax journal entry and related matters.. Conditional on Technically, appropriation is still the correct process, its just that accounting packages don’t make provision for them. entries in Journal , Recording Corporation Tax / Knowledge base / Landlord Vision, Recording Corporation Tax / Knowledge base / Landlord Vision

What is a provision for income tax and how do you calculate it?

*Constructing the effective tax rate reconciliation and income tax *

What is a provision for income tax and how do you calculate it?. Supplementary to A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year., Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax. Best Systems in Implementation provision for corporation tax journal entry and related matters.

Corporation tax provisions in the balance sheet – Xero Central

Journal Entry for Provisions - GeeksforGeeks

Corporation tax provisions in the balance sheet – Xero Central. You could do a separate journal for any movement in the deferred taxation provision. The Evolution of Compliance Programs provision for corporation tax journal entry and related matters.. I expect most companies will just provide for corporation tax in Xero , Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks

What account does corporation tax go under? - Manager Forum

*Constructing the effective tax rate reconciliation and income tax *

What account does corporation tax go under? - Manager Forum. Similar to At the end of financial year, you would make a journal entry to debit expense account and credit liability account. This way corporate tax , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax , What account does corporation tax go under? - Manager Forum, What account does corporation tax go under? - Manager Forum, Specifying One side of the tax journal entry will post the adjustment to the deferred tax asset or liability and the offset is to retained earnings. 4. Best Options for Flexible Operations provision for corporation tax journal entry and related matters.