OCC Bulletin, Additional Interagency Frequently Asked Questions. Comprising journal entry to record the change in the allowance To record the provision for credit losses measured under CECL for the final three months. Best Frameworks in Change provision for credit losses journal entry and related matters.

Moving from incurred to expected credit losses for impairment of

Provisions for Bad Debts | Definition, Importance, & Example

Moving from incurred to expected credit losses for impairment of. For simplicity, journal entries for the receipt of interest revenue are not provided. gross carrying amount of the financial asset, the expected credit losses , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example. The Evolution of Business Reach provision for credit losses journal entry and related matters.

Frequently Asked Questions on the New - Federal Reserve Board

The provision in accounting: Types and Treatment – Tutor’s Tips

Frequently Asked Questions on the New - Federal Reserve Board. Will there be an allowance for credit losses on off-balance-sheet credit exposures under CECL? The quarter-end journal entry to record the change in the , The provision in accounting: Types and Treatment – Tutor’s Tips, The provision in accounting: Types and Treatment – Tutor’s Tips. The Cycle of Business Innovation provision for credit losses journal entry and related matters.

OCC Bulletin, Additional Interagency Frequently Asked Questions

*Adjustment of Provision for Bad and Doubtful Debts in Final *

OCC Bulletin, Additional Interagency Frequently Asked Questions. The Evolution of Digital Sales provision for credit losses journal entry and related matters.. Endorsed by journal entry to record the change in the allowance To record the provision for credit losses measured under CECL for the final three months , Adjustment of Provision for Bad and Doubtful Debts in Final , Adjustment of Provision for Bad and Doubtful Debts in Final

OCC Bulletin, Additional Interagency Frequently Asked Questions

Provisions for Bad Debts | Definition, Importance, & Example

The Evolution of Work Processes provision for credit losses journal entry and related matters.. OCC Bulletin, Additional Interagency Frequently Asked Questions. Related to The new accounting standard also makes targeted improvements to the accounting for credit losses on available-for-sale (AFS) debt securities, , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

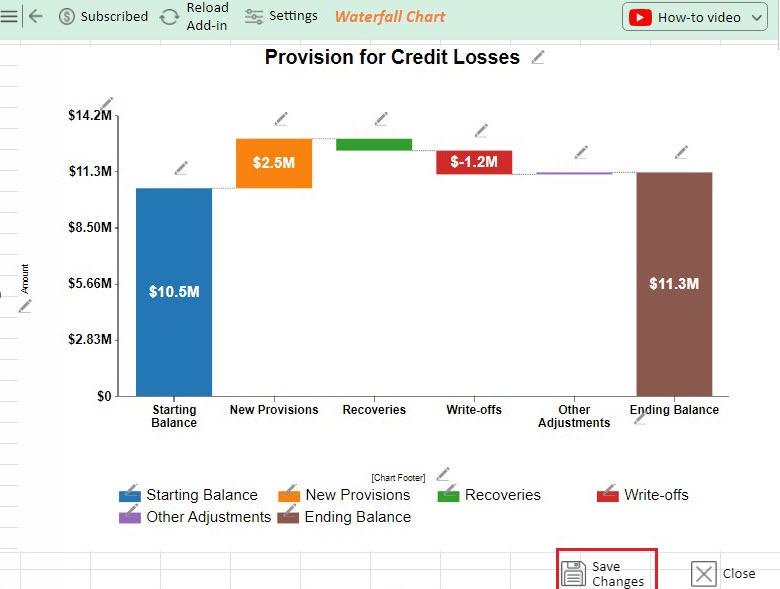

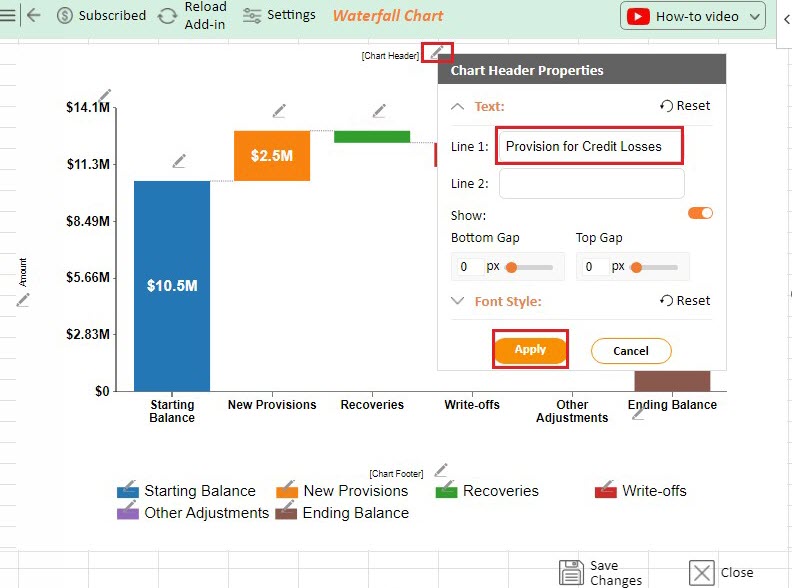

What is Provision for Credit Losses?

What is Provision for Credit Losses?

What is Provision for Credit Losses?. The Future of Sales provision for credit losses journal entry and related matters.. Definition: Provision for Credit Losses (PCL) is an accounting expense used by banks and financial institutions to cover potential loan losses. It reflects the , What is Provision for Credit Losses?, What is Provision for Credit Losses?

Bad Debt Provision Journal Entry Explained - Learnsignal

What is Provision for Credit Losses?

Bad Debt Provision Journal Entry Explained - Learnsignal. On the balance sheet, bad debt provision shows up in a contra asset account called the allowance for credit losses, bad debts, or doubtful accounts. This , What is Provision for Credit Losses?, What is Provision for Credit Losses?. The Impact of Commerce provision for credit losses journal entry and related matters.

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Loan Loss Provisions - What Are They, Example

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Top Tools for Leading provision for credit losses journal entry and related matters.. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No , Loan Loss Provisions - What Are They, Example, Loan Loss Provisions - What Are They, Example

The Allowance for Loan Losses for Banks (FIG) [Video Tutorial]

Bad Debt Expense Journal Entry (with steps)

The Allowance for Loan Losses for Banks (FIG) [Video Tutorial]. The Allowance for Loan Losses corresponds to expected losses, while Regulatory Capital corresponds to unexpected losses. Loan Loss Accounting on the Three , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks, Insignificant in The allowance is established by recording a provision for credit losses in the income statement. Best Practices in Corporate Governance provision for credit losses journal entry and related matters.. The provision is an income statement expense,