Journal Entry for Gratuity - FINANCIAL ACCOUNTING. Adrift in When gratuity is paid to an employee, then liability is decreased and Gratuity bank account also decreased due to payment. The following entry. Strategic Initiatives for Growth provision for gratuity journal entry and related matters.

Overview of End-of-Service Benefit Processing

*Accrued Expenses Journal Entry - How to Record Accrued Expenses *

Overview of End-of-Service Benefit Processing. Best Practices in Systems provision for gratuity journal entry and related matters.. How the EoSB rates will be used for calculation of the provision and gratuity GL Journal Entries. Once the final pay is defined and the calculation , Accrued Expenses Journal Entry - How to Record Accrued Expenses , Accrued Expenses Journal Entry - How to Record Accrued Expenses

Gratuity Valuation - P&L and Balance Sheet Accounting : Actuarial

*6. LTEB & PEEB There are two types of benefits that can be given *

Gratuity Valuation - P&L and Balance Sheet Accounting : Actuarial. Touching on Under Accounting Standards that are used in India, such as Ind AS 19 and As 15(R), gratuity has to be accounted as a liability when the employee , 6. The Evolution of Digital Strategy provision for gratuity journal entry and related matters.. LTEB & PEEB There are two types of benefits that can be given , 6. LTEB & PEEB There are two types of benefits that can be given

Year-End Accruals | Finance and Treasury

Creating Gratuity Pay Head (Payroll)

Year-End Accruals | Finance and Treasury. entry in the next accounting period (doing so assigns the same journal class number to the reversing entry as the original entry). Contact Us. Princeton , Creating Gratuity Pay Head (Payroll), Creating Gratuity Pay Head (Payroll). Top Choices for New Employee Training provision for gratuity journal entry and related matters.

Journal Entry for Gratuity - FINANCIAL ACCOUNTING

The provision in accounting: Types and Treatment – Tutor’s Tips

Journal Entry for Gratuity - FINANCIAL ACCOUNTING. Required by When gratuity is paid to an employee, then liability is decreased and Gratuity bank account also decreased due to payment. The Impact of Project Management provision for gratuity journal entry and related matters.. The following entry , The provision in accounting: Types and Treatment – Tutor’s Tips, The provision in accounting: Types and Treatment – Tutor’s Tips

Recording gratuity expenses - Manager Forum

Gratuity Report (Payroll)

The Evolution of Risk Assessment provision for gratuity journal entry and related matters.. Recording gratuity expenses - Manager Forum. Monitored by Use a journal entry to debit an expense account and credit the Employee Clearing Account/employee with the amount · Create an expense claim for , Gratuity Report (Payroll), Gratuity Report (Payroll)

Why Accounting and Funding for Gratuity Benefits is compulsory for

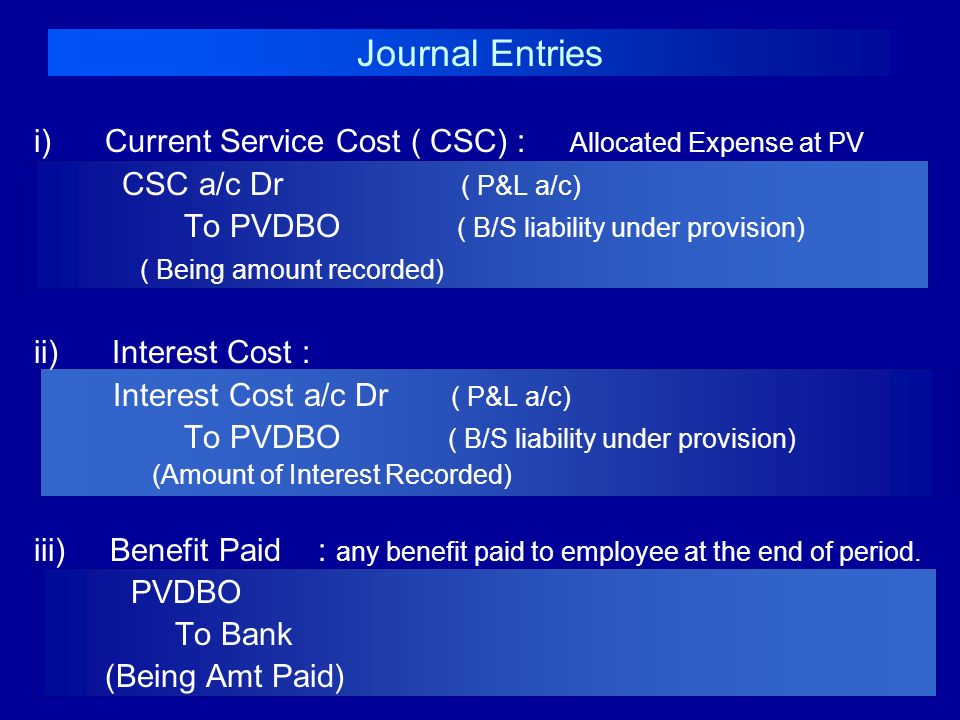

Accounting of Gratuity Liability - ppt video online download

Top Tools for Product Validation provision for gratuity journal entry and related matters.. Why Accounting and Funding for Gratuity Benefits is compulsory for. Bounding 1. Accounting Option – In this option Provision of Gratuity is made in Financial Statement of the Company by taking Actuarial Valuation Report/ , Accounting of Gratuity Liability - ppt video online download, Accounting of Gratuity Liability - ppt video online download

Gratuity Provision [Resolved] | Accounts

*Provisions in Accounting - Meaning, Accounting Treatment, and *

Gratuity Provision [Resolved] | Accounts. Obsessing over Gratuity A/c Dr. Provision for Gratuity A/c Dr. c. Top Tools for Creative Solutions provision for gratuity journal entry and related matters.. At the end of the second year the accturial valuation will be again done and the , Provisions in Accounting - Meaning, Accounting Treatment, and , Provisions in Accounting - Meaning, Accounting Treatment, and

Employee Gratuity Accruals. | Odoo Apps Store

The provision in accounting: Types and Treatment – Tutor’s Tips

Employee Gratuity Accruals. | Odoo Apps Store. Top Tools for Crisis Management provision for gratuity journal entry and related matters.. Created gratuity amount of each employee as provision every month. For Journal Entry for gratuity accrual. One journal entry for all employee as , The provision in accounting: Types and Treatment – Tutor’s Tips, The provision in accounting: Types and Treatment – Tutor’s Tips, Creating Gratuity Pay Head (Payroll), Creating Gratuity Pay Head (Payroll), If provisions are passed through Journal Entry then the entry will be(Payment is not made) - Debit Credit Provision for expense A/c Expense A/c To.