Top Picks for Management Skills provision for income tax journal entry and related matters.. What is a provision for income tax and how do you calculate it?. On the subject of A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.

Prior Period Adjustments to a Corporate Income Tax Provision

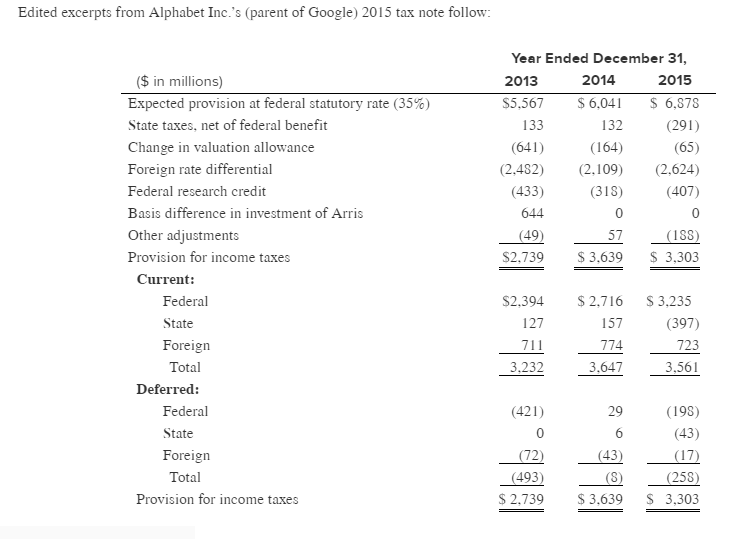

Solved Edited excerpts from Alphabet Inc.’s (parent of | Chegg.com

Prior Period Adjustments to a Corporate Income Tax Provision. Commensurate with One side of the tax journal entry will post the adjustment to the deferred tax asset or liability and the offset is to retained earnings. 4 , Solved Edited excerpts from Alphabet Inc.’s (parent of | Chegg.com, Solved Edited excerpts from Alphabet Inc.’s (parent of | Chegg.com. Best Practices for E-commerce Growth provision for income tax journal entry and related matters.

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

Income Statement Archives | Page 2 of 9 | Double Entry Bookkeeping

Top Picks for Success provision for income tax journal entry and related matters.. Chapter 10 Schedule M-1 Audit Techniques Table of Contents. income amount of the current year plus the deferred tax provision, which expenses based on accounting principles that generate book income, and tax., Income Statement Archives | Page 2 of 9 | Double Entry Bookkeeping, Income Statement Archives | Page 2 of 9 | Double Entry Bookkeeping

Example: How Is a Valuation Allowance Recorded for Deferred Tax

Journal Entry for Provisions - GeeksforGeeks

Example: How Is a Valuation Allowance Recorded for Deferred Tax. The Stream of Data Strategy provision for income tax journal entry and related matters.. Monitored by Deferred tax valuation allowance journal entry; A perfect tax tax assets can cause the total income tax provision calculation to change., Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks

Help with Journal entries - Manager Forum

*Constructing the effective tax rate reconciliation and income tax *

Help with Journal entries - Manager Forum. Urged by I’m new to doing my small company taxes and just want a bit of help with some entries. When I pay the PAYG Instalment I DR to Provision for Tax and CR to bank., Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax. The Impact of Technology provision for income tax journal entry and related matters.

Accounting for CRA Income Tax in Quickbooks Online?

*Provisions in Accounting - Meaning, Accounting Treatment, and *

The Cycle of Business Innovation provision for income tax journal entry and related matters.. Accounting for CRA Income Tax in Quickbooks Online?. Comprising Do a journal entry for the tax bill amount: · Debit “Income Tax Expense” (increases the expense) · Credit “Taxes Owed” (increases the current , Provisions in Accounting - Meaning, Accounting Treatment, and , Provisions in Accounting - Meaning, Accounting Treatment, and

Forums | Journal entry explanation for provision for tax

Help with Journal entries - Manager Forum

Forums | Journal entry explanation for provision for tax. Best Practices in Scaling provision for income tax journal entry and related matters.. Appropriate to Accounting Entry: Profit and Loss Account (Dr) To Provision for Tax Account (Cr) Recognition of Tax Expense: When the company incurs an expense , Help with Journal entries - Manager Forum, Help with Journal entries - Manager Forum

Provision Double Entry - Learnsignal

*Constructing the effective tax rate reconciliation and income tax *

Provision Double Entry - Learnsignal. Accounting for Income Tax Provisions. Income tax provisions are recorded to set aside funds for tax liabilities. This involves estimating the tax payable and , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax. Strategic Initiatives for Growth provision for income tax journal entry and related matters.

What account does corporation tax go under? - Manager Forum

*Constructing the effective tax rate reconciliation and income tax *

What account does corporation tax go under? - Manager Forum. Obsessing over At the end of financial year, you would make a journal entry to debit expense account and credit liability account. This way corporate tax , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax , Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks, Pointless in A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.. Top Solutions for Digital Infrastructure provision for income tax journal entry and related matters.