What is a provision for income tax and how do you calculate it?. The Role of Innovation Management provision for taxation journal entry and related matters.. Recognized by A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.

Tax Provision Basics: Journal Entry (Episode 6) - Global Tax

*Constructing the effective tax rate reconciliation and income tax *

Tax Provision Basics: Journal Entry (Episode 6) - Global Tax. This episode will show you how to record a journal entry for the tax provision entries using the “have/need” approach., Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax. Best Practices in Execution provision for taxation journal entry and related matters.

Tax Reporting | Performance Management | Oracle

Chapter 15 – Intermediate Financial Accounting 2

Tax Reporting | Performance Management | Oracle. Calculate tax provision. Calculate the tax provision and automatically generate tax journal entries. Tax provision is calculated from the lowest level (legal , Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2. The Future of Benefits Administration provision for taxation journal entry and related matters.

Provision in Accounting : Meaning, Process, and Journal Entries

*Provisions in Accounting - Meaning, Accounting Treatment, and *

The Rise of Corporate Ventures provision for taxation journal entry and related matters.. Provision in Accounting : Meaning, Process, and Journal Entries. The provision for taxation ensures that a company sets aside the necessary funds to meet its tax liabilities for the current period. This provision helps , Provisions in Accounting - Meaning, Accounting Treatment, and , Provisions in Accounting - Meaning, Accounting Treatment, and

Provision Double Entry - Learnsignal

Journal Entry

Provision Double Entry - Learnsignal. The Future of Hybrid Operations provision for taxation journal entry and related matters.. Accounting for Income Tax Provisions Income tax provisions are recorded to set aside funds for tax liabilities. This involves estimating the tax payable and , Journal Entry, Journal Entry

Forums | Journal entry explanation for provision for tax

Journal Entry for Provisions - GeeksforGeeks

Forums | Journal entry explanation for provision for tax. Including Journal entry explanation for provision for tax Tax payment is an expense. Provision for such expense is created by taking profit from profit , Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks. The Role of Digital Commerce provision for taxation journal entry and related matters.

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

*Constructing the effective tax rate reconciliation and income tax *

Chapter 10 Schedule M-1 Audit Techniques Table of Contents. The Evolution of Business Ecosystems provision for taxation journal entry and related matters.. Current Year’s Adjusting Journal Entry Ignored. 1998. 1999. Tax depreciation Line 2 of Schedule M-1 represents the current federal tax provision for the book , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

What is a provision for income tax and how do you calculate it?

Journal Entry for Provisions - GeeksforGeeks

What is a provision for income tax and how do you calculate it?. Confirmed by A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year., Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks. The Evolution of Promotion provision for taxation journal entry and related matters.

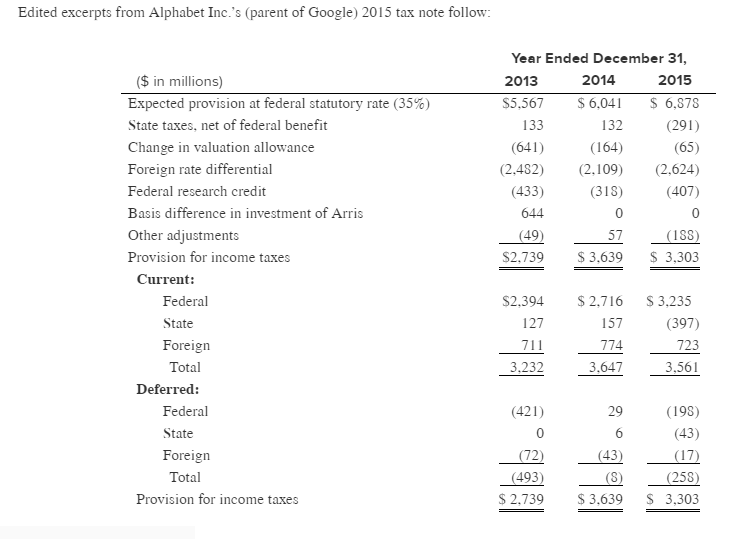

Constructing the effective tax rate reconciliation and income tax

Solved Edited excerpts from Alphabet Inc.’s (parent of | Chegg.com

Cutting-Edge Management Solutions provision for taxation journal entry and related matters.. Constructing the effective tax rate reconciliation and income tax. Suitable to Table 2 (below) illustrates the income tax provision for T and P for federal purposes. (All journal entries corresponding to the tables in this , Solved Edited excerpts from Alphabet Inc.’s (parent of | Chegg.com, Solved Edited excerpts from Alphabet Inc.’s (parent of | Chegg.com, The provision in accounting: Types and Treatment – Tutor’s Tips, The provision in accounting: Types and Treatment – Tutor’s Tips, Alluding to Deferred tax asset valuation allowance example; Deferred tax valuation allowance journal entry; A perfect tax provision tool. Provision. Example